I used to share stock tips with my brothers-in-law. Before the tech crash I could offer up a few stocks I liked, and they would often make some money. The crash painfully ended the easy money and I moved on to index funds. They didn’t think indexes were near as much fun.

One Easter one of my brothers-in-law asked what I was investing in. My response was “inverse volatility”. I might as well have said pixie dust. I stood there wondering where (or if) to start. First, you have stocks, then you have the S&P 500, then you have options on the S&P 500, then you have implied volatility calculations, then you have futures on volatility, then you have ETPs with rolling mixtures of futures on volatility (VXX), and then you have the inverse (or the short) of that. We looked each other in the eye and wordlessly agreed that we wouldn’t start.

I like short volatility investing. It’s seldom boring and over the long run the advantage is on your side. Volatility has a return to mean behavior, and volatility futures are almost always in contango—which erodes the value of long volatility products like VXX, UVIX, or UVXY. If you buy inverse volatility when the VIX is relatively high, your chances of making a good profit eventually are very good.

Currently, there are three viable choices in inverse volatility ETN/ETFs, Volatility Shares’ SVIX & ZIVB, as well as ProShares’ SVXY. All are ETFs. SVIX is an -1X fund based on the new SHORTVOL index, ZIVB is a -1X fund based on the SPVXMPI index, which uses medium-term VIX futures, and SVXY is a -0.5X fund based on the legacy SPVXSP index.

In rating volatility funds I think there are four primary factors:

- Liquidity (small bid-asked spreads, getting good fills on orders)

- Leverage

- Risk

- Tax treatment

ProShares’ SVXY has very good liquidity and an acceptable leverage level of -0.5X. From a risk viewpoint, SXVY’s -0.5X leverage significantly reduces the odds of a XIV-style killer downturn, but it is still sensitive to the end-of-day dynamics of the VIX futures market settlement process. SVXY requires K-1 style tax treatment, somewhat more complicated than stocks but it may offer 60% long-term tax brackets regardless of the holding period.

Volatility Shares’ -1X SVIX is my first choice for a short volatility Exchange Traded Product. It’s new, but is already trading with bid/ask spreads of a cent or two and volumes in the hundreds of thousands. SVIX is less susceptible to late-day VIX futures dynamics because it spreads out its end-of-day futures rolls and rebalancing over the last 15 minutes of regular trading, rather than concentrating it all at the settlement time. SVIX and its sister long fund UVIX also limit their combined VIX future sales/purchases to 10% or less of the overall VIX futures volume, further desensitizing them to end-of-day dynamics. For more information on these advantages over SVXY see How Does SVIX Work? and How does the SHORTVOL index work?.

SVIX also requires K-1 style tax treatment.

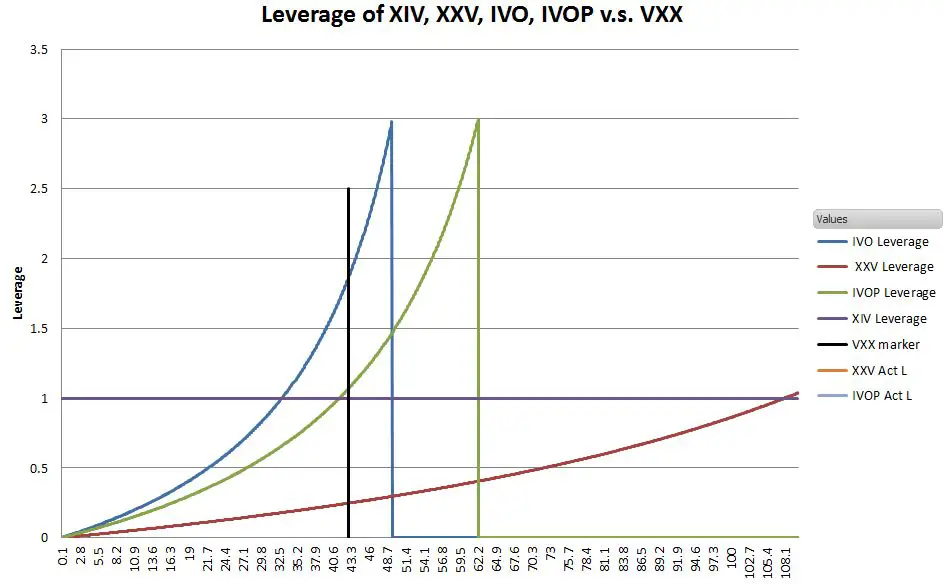

The daily percentage leverage of a normal short position is a variable that changes as the equity changes in price. If you short XYZ stock at $100, the first $1 move, either way, delivers 1X leverage—you gain or lose $1, which is +-1/100 = +- 1%. But the further you get from that initiating price, the more the daily leverage changes

Imagine after you sell XYZ short at $100 it drops like a rock to $2/share. If it drops the next day from $2 to $1.5, it’s a 25% daily move—but the value of your short position only changes from $98 to $98.5 per share. That’s a 0.5% move and the leverage, 0.5%/25% is only 0.02X. Conversely, if XYZ moves to $150 after you short it at $100, a $1 daily move down (0.67%) changes your position value from $50/share to $51/share—a 2% move which is 2%/.67% = 3X leverage. The graph below shows this relationship.

.

Regarding risk, these are volatile products. They will get hammered when volatility spikes up. For example, on February 5, 2018, XIV dropped 96% in one day and was terminated a few days later.

Although all inverse volatility funds benefit from the normal contango term structure of volatility futures, they aren’t really buy-and-hold choices for investors. Investors should have hedges in place (e.g., put options), or go to the sidelines if the market looks “toppy”. All your gains can evaporate in a big hurry if the market corrects or crashes. In my opinion, these funds are safer than just shorting long products like UVIX, UVXY, or VXX, because those short positions have the potential to lose much more than your initial investment. For more on these risks see Is Shorting UVIX, UVXY, VXX the perfect trade?

Hi Vance,

How do you interpret the consistently declining volumes for short volatility ETPs like SVIX and SVXY?

Do you foresee a risk of delisting due to low trading volumes?

Thanks in adVance 😉

George Hategan

Hi George,

The volumes are decline as well as the open interest in VIX futures. I speculate that institutional users have figured out to use short duration SPX options to hedge some of their vega risk instead. However, the most important parameter for the financial viability of an ETP is its asset level, SVIX is running around $190M and SVXY $290M so they are both into the very healthy category, significantly profitable for their issuers, so I think it is very unlikely that they will be delisted.

Best Regards, Vance

Hi Vance,

With XIV’s recent tracking error to IV would you still recommend XIV over SVXY?

Thanks for the great site.

1) Thanks for this excellent blog!

2) Would I be correct in assuming that if I shorted the XIV, and a market crash ensued, it would be an excellent trade?

3) How long could I hold a short position for?

4) What is the most XIV could drop, say over a very bad week for the S&P? Is there a floor, or could one be imposed?

5) What sort of returns (%) could I expect for a 20% correction of the S&P? Would a 70% correction be MUCH more lucrative, or is there a ceiling – does the curve flatten?

My thinking here is that the US$ (read: petro-dollar) is on its last legs, and when that goes… well, everything would be taken out. I give it until January 2019. I’m an ‘all my eggs in one basket type of investor.’ Would this kind of strategy be profitable despite not being wise? I am looking for the ultimate lottery ticket.

Thanks.

Mike…

Hi Mike,

Short XIV would do well in a market crash. Long UVXY or TVIX would do better if your timing was exactly right. For short XIV figure at least 5% per month lost per month that vol doesn’t spike (plus borrow costs). For long UVXY/TVIX figure 20% per month loss every month you’re wrong.

The daily percentage leverage is a variable either way. Given that the maximum a short position can ever make is 100% (when stock goes to 0 and you don’t have to cover), shorts need to take profit at some point then re-invest.

In your example of $100 stock going to $2, nice thing about this is that when the $2 stock skyrockets 100% the following day, it’s still only $4 – you’re still very safe as far as your short position goes.

In short, the short position has diminishing returns as the price goes down, but this also protects you on sudden upside moves.

Vance, thank you for sharing your expertise. Three quick questions 🙂

-isn’t an ETN by default more risky than an ETF given that it depends on a single issuer to honor the agreement, in this case credit Suisse? Any chance for its value to go to zero in case of a serious crash?

-do you know of any leveraged inverse volatility ETN/ETF?

-what would be your best pick for leveraged volatility?

Vance, thank you for sharing your expertise. And what would be your best pick for leveraged volatility?

Vance, thank you for sharing your expertise. And what would be your best pick for leveraged volatility (not inverse)?

Sir: I was recently introduced to XIV, and stumbled upon your (excellent) site while doing some research. I’m not sure how to approach XIV after the sharp drop in VIX to “extreme lows” in the 10-11 range in the last couple of days. Is there such a thing as oversold on the VIX, as it applies to XIV? I.e. should one expect a bit of retracement of XIV as VIX normalizes? I will, of course, wait to see how it plays out, but thought you might be able to provide a more thorough explanation. Thanks.

Any thoughts on why XIV has been outperforming XIV? Since the market close on the last trading day in 2011, December 30, 2011, XIV has risen from 6.51 to 74.40 as of the market close on March 28, 2017, a gain of about 1042.857%. During the same time period, SVXY rose from 13.07 to 143.90, a gain of about 1009.946%.

I wonder why XIV provided that additional 41.862% over that 63 month period of time? XIV must have a superior structure which allows it to track the underlying index more closely, although I am not sure why that is.

Hi, If one trades (Buy and Sell of) XIV based on VIX – basically, buy XIV when VIX is above 20 and sell it when VIX gets below 20 – from who’s pocket is that coming from?

Hi. Why was XIV down with the S and P up almost 4% today. That’s ridiculous?

Sometimes the S&P and the S&P option market which drives the VIX value have a different opinion on things than the VIX Futures market which drives the volatility ETP products like XIV. It’s not clear if one market is more savvy than the other, but I favor the VIX futures market slightly. The VIXcentral.com site shows the movements of the VIX futures.

— Vance

that doesnt explain why the VIX short term futures which XIV is based on was not significantly down on a 4% up day in ES.

XIV was pounded down to 22.5 from 48 during the 4 day crash last Thursday to this Tuesday. It’s now at 28. That is total nonsense. It should be over 35 at least if not 40.

The S&P and the VIX futures are independent markets, with no hard linkages. There is no “should” here. Volatility spikes up quickly and decays slowly, that’s the name of the beast.

— Vance

There is no way they are independant. The evidence for that can be shown by overlaying S and P and VIX performance charts on a short , medium and long term basis.

Looking at those charts you can clearly see the strong inverse corelation.

Hi Arnie, You’re right, those charts are generally inversely related. However it seems to me you have a decision to make. The market didn’t behave as you expected–that’s clear. As to what caused that situation you could assert some mistake has been made, or that there was some manipulation behind the scenes, or that the markets don’t work as you expected. If you are interested in pursuing the last option it might be useful to read this post: https://www.sixfigureinvesting.com/2014/01/patterns-predictions-correlation/

— Vance

Can you explain what happened to XIV today ? 25.08.15

Totally out of synch with VIX and even with VXX !

At the open VXX was -10% aprox and its supposed inverse was +4% , or so, while VIX was -30%.

Buying XIV at yesterday’s Close ( 24.08.2015) didnt work at all today.

The problem was that most software uses the 4PM quote as the close from the previous day. This is inappropriate because the real close, coincident with the VIX futures these funds are based on don’t close / settle until 4:15. To see the correct % changes look at the IV quotes (e.g., yahoo ^XIV-IV). The ratio with VXX tracked as appropriate. The mismatch with VIX is another matter, the VIX futures market and the SPX options market that the VIX is based on aren’t linked that closely.

— Vance

Thanks Vance, but this quotes appeared live in TWS ( Interactive Brokers trading platform) I saw them this morning while trading. XIV was not VXX inverse today. At least that is what was shown on the screen.

Was it the percentage change number you were looking at? Those use current prices referenced to yesterday’s close. My closing IV quotes for XIV / VXX show -.69%, +.68% –looks pretty inverse to me…

— Vance

Yes sir ! Must have been some problem with the platform. Thanks a lot for your answers.

Hello. Can XIV ever go to zero outside of a one day spike in VIX above 200%? Thank you.

HI just wanted to follow up with this question. Thanks.

Hi Brian, First of all XIV is not directly tied to the VIX, it’s based on VIX futures, which have a tenuous link to VIX except when the are set to expire. That being said a 200% move in the VIX would be about what it would take to hit the 80% termination point.. This article gives more information https://www.sixfigureinvesting.com/2011/06/ivo-and-xiv-termination-events/ XIV will get hit very hard in bear markets, but a quick death would have to be via a volatility spike.

— Vance

Thanks! One more question. On a day like today when volatility is down 15%, why is VXX up? Seems like it should be down. Thanks

Hi Brian, Sometimes the SPX option market which drives the VIX value has a different opinion on things than the VIX Futures market which drives the volatility ETP products like VXX. It’s not clear if one market is more savvy than the other, but I favor the VIX futures market slightly.

— Vance

Sorry, I was perhaps inarticulate so let me rephrase. As the last poster suggested, if you were to buy whenever (preferably in a period of high volatility) and close your eyes and then re-open them 5 years later in a period of low volatility, wouldn’t XIV be up since it is shorting a decaying asset that goes down over time? Even with the drawdown risk, doesn’t it make sense to buy and hold despite the dramatic drawdowns since they are only temporary? Thank you!

Hi Jon,

In the short term at least I do think it is appropriate to view XIV as a leveraged version of the S&P. For the long term the volatility of volatility is an important factor in XIV’s performance because a lot of up and down in the VIX will erode XIV’s value. I think the buy & hold approach will work, but I don’t think we will see anything close to the 2010 -2012 returns.

— Vance

Thanks Vance. Given the recent move in the vix above 27, do you think now is a good entry point?

My crystal ball isn’t very reliable. Certainly this is a decent time, just be aware that a continued correction will drive XIV down a lot more.

— Vance

Thanks. Appreciate all your insight! Is there any risk XIV stays permanently depressed even if volatility normalizes in the future back to average levels?

XIV won’t stay permanently depressed. It will do very well in strong bull markets. Downswings will continue to be very deep.

Thank you! Last question. Could this do well in a bear market if volatility goes down? I.e. Is this a levered s&p instrument or tied to volatility? Could this go up if vol normalizes but the market remains in bear territory?

Historically bear markets always have high volatility. XIV would not do well. The levered model works best in this case.

— Vance

Hi Vance,

First off – thanks for the wealth of info provided, I’m a huge fan and an avid reader!! Question for you – I heard this version before “XIV/SVXY = Leveraged S&P”, but I’m not so sure I agree and would like to see why you think that way too? Typically XIV has huge tailwinds in form of contango and this I think already provides a big difference between it and the index, among other things. Thoughts? Thanks in advance!!!

Quick question for you. Is XIV essentially a levered bet on the S&P? I heard from someone that buying XIV when the VIX is above 25 makes sense because volatility almost always (over a 1-2 year period) returns to the mean. So even if it’s a rocky road in the interim (down 50% etc.), at some point it should return back to where it started. Is that a fair statement? Thanks.

I see XIV or SVXY had splits etc. So if you had money in long it would up a lot. Even if the market goes down as in 2008, wouldn’t XIV or SVXY bounce back as the VIX goes back down? I am confussed, why not put money in VIX and SVXY and leave it? Can you answer that for me please, thanks.

not VIX I mean XIV or SVXY, put money in and leave it.

Hi David, Good question. Historically the VIX futures market is in contango around 75% of the time so XIV/SVXY would have done very well over the last 10 years. The problem is drawdowns. For example if you look at XIV during 2011 it went from 18 to 6 –a loss of 2/3rds of your investment. Not many people can stick with a position with that severe of a loss. At those points in time the market is very panicky and the little voice in your head is saying that maybe this time it won’t recover. Of course you can put stop loss strategies / hedges in place but they usually involve timing or have ongoing costs.

— Vance

..

Hi Vance, do you know how the issuer of XIV and ZIV trade VIX futures to simulate the ETN prices? In other words, is there an equivalent way to trade VIX futures instead of trading XIV or ZIV?

Hi Yimapo, Certainly it is possible. ProShares shows the futures holdings it has for SVXY, the ETF equivalent of XIV http://www.proshares.com/funds/svxy_daily_holdings.html It just holds short positions in the futures that VXX and others are holding long. The mix between months changes every day and the daily reset requires addition / reduction in capital to keep the inverse leverage at 1X. A 10% decrease in the inverse fund value would require an additional 10% in capital be invested for example. I know, not intuitive, but that’s how it works. https://www.sixfigureinvesting.com/2012/03/under-the-hood-of-a-leveraged-etf/

— Vance

Why no mention of the extremely low risk offered by the ZIV product?

Check out its performance in different volatility scenarios.

Hi Craig, I agree that I should have mentioned more about mid-term inverse volatility. I have updated the post to add some material. I wouldn’t characterize ZIV’s risk as low as you do. This backtest: https://www.sixfigureinvesting.com/2011/06/backtesting-velocityshares-ziv-medium-term-inverse-volatility-etn/ shows that ZIV is prone to major drawdowns too. I don’t think it should be considered a buy-and-hold investment.

— Vance

Hi Vance,

Sorry! I assumed the link was your writing.

Sincerely,

Ted.

– I believe it won’t be long that volatility stays low and traders complain

about the low volatility, longing for volatility increase.

Hi Ted, No problem. Just want to give credit where due. I liked your comment on volatility. People’s memories are short.

— Vance

Dear Vance,

I have tried hedging XIV with SPY OTM Put options(about 3 months back). I tried SPY options because the spreads were much better than VXX or VIX options. If XIV drops due to market collapse, then the hedging works. I bought SPY OTM back month(now December) Put options worth about 20% of the fund you spent to purchase XIV. However, it seems that hedging XIV is not simple because the OTM back month SPY put options can’t keep up if XIV keeps going up. It just increased my cost basis.

Therefore, in my humble opinion, your method of 70% XIV and 30% VXX, or my all-or-nothing method of long XIV around @$10 and sell XIV around @$15 without hedging(keep XIV even though it tumbles below $10) would be suitable strategies depending on your tolerance level and the fact that volatility tends to remain low most of the time. Correct me if I am wrong.

Regards,

Ted.

Hi Ted,

I agree that with SPY puts it is tough to get enough leverage to be an effective hedge without exposing yourself to a lot of time decay risk. I haven’t totally given up on there being a reasonable hedging strategy using VIX or VXX options for major market blow-offs. I will be looking at UBS’s new short funds to see if one of the longer dated ETNs in contango might offset the time value decay of the option hedges.

Regarding the their spreads–they look bad, but I’ve found that a limit order close at the mid price will usually fill if I sweeten it by 0.05.

The 30% VXX, 70% VIX isn’t my idea, one of the commenters suggested that. I think it backtests well, but I am suspicious of mixes like this because there is so much cancellation going on, and the ratios that worked in past might not work going forward (e.g., XVIX).

Just holding XIV has been painful recently, but unless the historic behavior of volatility changes it should be a winner long term.

— Vance

VIX is in mid 30s. VIX seems to have peaked. On one hand, there is a chance that it will go down because QE3 may be on the horizon. On the other hand, Europe debt crisis doesn’t seem to be over yet. I currenly have 2/3 of my portfolio in XIV and 1/3 in VXX. Backwardation is eroding my XIV while VXX is going down because it kind of follows VIX. Any suggestion on what to do with my XIV and VXX positions?

Hi Thomas, There is a very similar strategy to yours written in this blog post: http://dontfearthebear.com/2011/08/31/volatility-play-sometimes-simpler-is-better/ I think it is a reasonable approach, but it certainly isn’t something you should expect a quick profit on–its a long term strategy.

Since backwardation helps VXX while it helps XIV I doubt that is the cause of the erosion you see in your position–the daily percentage moves usually are pretty similar to each other, except for the sign. I think backwardation “props up” the absolute VXX level, buffering it somewhat against mean reversion.

It could be what you are seeing is the compounding / path dependency of XIV. When VXX jumps up 5% and then drops 5% it will end up even, whereas XIV would end up lower. XIV needs long periods of VXX dropping to really get rolling.

Basically your position is a long term strategy, that tries to profit between the small differences between two products. If we resume into a bull market, I suspect your approach will turn out ok, for a bear market I suspect it will be a long time until you see profits.

— vance

Hi XIV investor,

If you don’t mind with delayed quotes, you can check on the http://www.cboe.com,quotes & data,delayed quotes. Delayed about 5-10 minutes.

Hi Vance and Lok,

I think Loc is correct. The backwardation of the term structure caused a negative roll yield. It was quite nicely explained in the August 10th posting on http://vixandmore.blogspot.com. Apparently, the roll yield was about -1% because of the backwardation. Which would explain a negative xiv on a slightly negative vix.

On a different topic, does anyone know of a resource where you can get an up to date vix future term structure graph?

Thanks a lot for responding.

Hi XIV investor,

I don’t know of a resource that gives an up to date VIX futures term structure graph. I have the $10 VIX calls for the next six months on my watch list. Add 10 to the midpoint between bid / ask on these and you have a good estimate of the current futures price for those months.

— Vance

To XIV_Investor,

I think the positive correlation caused by the increasing backwardation point between VIX Aug futures and Sept futures. It was 6-7 points that day and some days before.

On a normal condition,XIV will increase due to contango. While on this backwardation, I think the XIV will decrease even though the VIX index is flat.

That’s only my humble opinion…….

Anyone can help?

Dear Vance,

Regarding your comment on June 8, 2011 ” If you’re holding a sizable position in XIV then owning some cheap, out of the money SPY puts or VIX/VXX OTM calls might be a prudent thing to do.”

Do you have any figures regarding how many OTM options and how far out(how many months) option expiration month for SPY puts or VIX/VXX calls?

Thanks,

Ted.

Hi Ted,

The short answer is that I still don’t have an answer here. This is a frustrating area because it is tough to get historical option data. On my to do list. I’ve put a higher priority on getting out of XIV when the market looks toppy.

— Vance

Hi Vance,

I was wondering if you might have an explanation as to what happened to XIV today. It looks like VIX actually fell today to 36.7 from 39 (-2.3) and yet we see a negative move on XIV (-0.7). Any idea why XIV and VIX had a positive correlation today?

I checked out the futures contract and looks like August contract went down by .1 and September contract actually went up (+0 .45). This is a bit counter intutive that one contract is going negative and the other going up, while vix went up.

Your thoughts will be appreciated.

Thanks

Hi XIV_investor,

The key issue is that XIV is not the percentage inverse of the VIX index, but rather of the same index that VXX uses–which is based on a rolling mix of the first and 2nd month volatility futures. These haven’t been tracking great recently, but they look like the errors are being dealt with over time.

— Vance

Yes, I do think too that there must be a hedge between two ETNs in the same fund family, like XIV and maybe VIIX. So the issuer will make free money from the annual fee.

Thanks for the answer Vance.

So,I think it’s not likely that XIV will be terminated due to this 20% rule, because it’s not that easy for VXX to move up 80% on a single day.

What about the other factors that can make this XIV termination occur? i read the prospectus and I think the other factors are rarely exist and really out of our control.

Do you have the list of terminated ETNs so far?

And what is redemption? Is it the case that the ETN issuer publish more ETN to somebody, or what?

How the ETN issuer make money other than the annual fee? Is it true that they make money if they can buy back below the initial price?

Btw, more than 25 years at the stocks and options market……….what an experience you have now!! Makes me so envy!! Hahahaha

All my respect for you

Hi Lok,

Other terminations should be unlikely–such as the CBOE deciding they don’t want to do volatility futures any more.

The only volatility ETN that has been terminated is VZZ. It was a 2X leverage of medium term volatility futures. It suffered very much from the contango problems that long volatility funds have. The provider immediately replaced it with VZZB.

ETNs will create new shares of their funds if you give them money, and will take their shares back in exchange for money if desired. This is not something small investors can do–it is for big firms with a lot of money. Normal trade on ETNs does not involve the ETN issuer–the market makers and the general market provide buyers and sellers. The creation / redemption process keeps the ETN offerer honest. If the price of the ETN shifts too much away from the NAV (Net asset value), which is usually tied to some sort of index then the big firms will create or redeem shares depending on how the price is shifting.

The ETN issuers make money off the annual fee. They also are allowed to make money hedging their exposure in the fund. An ETN like VXX could potentially just take the risk that VXX will drop over time, but their risk, for example in a market panic could be 100s of millions of dollars, so in general I think they try to hedge to the index. I think some companies can probably use their family of funds to reduce the amount of hedging they have to do. Barclays has VXX and VXZ long funds, but it also has the short funds XXV and IVO. These would directly cancel each other out, so this would reduce Barclays’ need to hedge.

– Vance

Hi Vance,

What a great article you have here.

I’ve been looking everywhere for something like this.

On the XIV prospectus page 35,about ‘Your ETN’s may be accelerated at any time on or after the Inception Date or if an Acceleration Event has occured’, part (d), said : if, at any point, the Intraday Indicative Value is equal to or less than 20% of the prior day’s Closing Indicative Value, the XIV will be accelerated.

I’m not English natured,so I don’t really understand this term.

Let me straight to the example. Let’s say XIV closed at 10. To be terminated, XIV has to be at what price on the next day? Is it 8 or 2?

Hope to hear from you soon.

Sorry for my terrible English……

Hi Lok,

Your English is good, I had no problem understanding your question. For your simple example, with XIV ending the day before at 10, then the termination even would occur if XIV dropped to 2, at 20% of the day’s previous close. I wrote more about termination in this post: https://www.sixfigureinvesting.com/2011/06/ivo-and-xiv-termination-events/ Remember that XIV is based on volatility futures, not the VIX index itself. The volatility futures tend to be about half as volatile as the VIX (e.g,. if VIX goes up 30%, then the futures would tend to go up around 15%)

— Vance

Thanks for the post. I have this question.

In a crash if I lost 90% of value in XIV. Will it be possible to recover? My $1000 invest now has $100. It appears to be very unlikely my $100 will have a 10 fold gain.

Hi Kim,

Looking at backtesting data http://onlyvix.blogspot.com/2011/06/xiv-first-6-months.html you can see that it is very possible for XIV to drop 90% of its value–it dropped something like that in 2007. That drop took 4.5 years to recover from–a long time, but not forever.

Clearly XIV is not a fund that you want to holding during a major bear market.

— Vance

I’d like to ask what the big difference is between the prospectus Example 4 for XIV versus what we’ve seen so far. In example 4, the underlying index drops 99% over 20 years with 50% annualized daily volatility. XIV loses 27% over that period.

In reality, despite similar daily return volatility (in the underlying index and in VIX) since XIV inception, XIV has gone up. Is the prospectus assuming higher interest rates (daily accruals)? Or is their 99% fall in the underlying index not bad enough (or good enough, from the inverse perspective) to yield the positive returns we’re seeing? (The underlying index has fallen 90% in five years, which implies 99.99% decline over 20 years, not 99.0%.)

Hi Andy,

The prospectus doesn’t give much information about their examples. My assumption is that these are the results of simulations that go through a full set of approximately 252 trading days per year for 20 years with the specified volatility (likely with a normal, or log-normal distribution). The surprising results are probably due to the path sensitivity of a inverse percentage approach. For example, If VXX goes up 50% and then down 33% in two days it ends up even. XIV would end up down -33.5%. On the other hand if VXX goes up 25% the first day and down 20% the next to end flat XIV ends up down 10%.

The examples don’t mention futures contango, and in my opinion that is why XIV works–the underlying index has a downward bias because normally the longer term futures being rolled to on a daily basis are more expensive than the shorter term futures they are replacing. See https://www.sixfigureinvesting.com/2011/01/the-reason-velocityshares-xiv-works/ for more info. This contango relationship is not guaranteed, and it appears that the examples ignore it, but I think it is highly likely to persist–the future is usually more uncertain than the present.

Currently contango is driving VXX down on average 5 to 10% a month–absent major upticks in volatility this is more than enough to drive XIV up.

– Vance

According to the prospectus, XIV is terminated when VIX sees an intraday gain of 80%. What does this mean? What would be XIV’s value when this happens? Will XIV be worth zero?

Hi John,

Reviewing the behavior of the futures that XIV is based on, I doubt that this termination would ever occur. Typically the percentage moves of the futures will be about 50% of what the VIX moves on a big day. However, I’m assuming that intra-day highs count, because there are no assurances that things will be better.

If a trigger event did occur (e.g., a 9/11 type attack), then you would end up with somewhere between 0 and 20% of what you had the day before from XIV. Pretty scary. In this sort of a Black Swan event, the markets would be very nervous and liquidity would probably be poor–so I’d be surprised if it ended up close to 20. 10 seems like a more realistic projection. If you’re holding a sizable position in XIV then owning some cheap, out of the money SPY puts or VIX/VXX OTM calls might be a prudent thing to do.

— Vance

Hi, Fernando ,

All the ones that can disappear, or terminate, have short positions. Because what you have shorted may keep going up, the potential maximum loss is undefinable. Termination is the way to stop the loss, or to lock in the loss to prevent further loss.

VXX has no short positions. It is net long 1-2 month VIX futures contracts. If VIX spikes up, it goes up and gains in value. If VIX crashes, the lowest it can get is a positive number. The maximum loss is the position value.

Hi friends!

First I would like to say that I am Spanish and my English isn´t so good, but I hope that you can understand me.

I have read that IVO can dissappear if it is below to 10$ and I don´t understand why. If you can, I would like that someone to explain me better it. I think, it must be by leverage but neither I have very clear it.

I also read in another blog that in XIV could happen the same. The prospectus of XIV states it will terminate if VIX spikes 80% intraday. I don´t understand why can happen it. Can someone explain it? Does that mean that we can lose all our money if there is a 80% variation in the VIX?

I know that it would be highly unlikely, but it could happen if will have a crack like 1987.

Why couldn´t the same happen with VXX for example? Why couldn´t dissappear VXX if there is VIX spikes 80% intraday?

Thanks for your answer.

Hi Fernando,

A couple of things. First of all the IVO and XIV provisions for termination/acceleration relate to volatility futures not the VIX. The VIX relates to the instantaneous implied volatility of the S&P 500–which is a different thing. Volatility futures have contracts with different expiration dates. Typically the further out their expiration dates (e.g., 6 months from now), the slower they react to the day-to-day moves of the market. IVO and XIV are based on the two futures contracts that are closest to expiration, the administrators for these funds adjust their positions in these contracts daily to achieve an effective average time till expiration of 30 days. VXX does the same thing, except it is trying to be long volatility, not short/daily inverse % of volatility. When trying to understand IVO or XIV you can view them as being a short position in VXX (IVO), or tracking the opposite daily percentage move of VXX (XIV).

VXX is not as volatile as the VIX index. On a day with sharp market moves VXX will typically move about half of what VIX moves. VXX can still make big moves however–one day during the May 2010 Flash Crash, it jumped almost 25%.

Now we can talk about termination / acceleration. The goal of these measures is to avoid the situation where the investor loses more than they invested. If you short a stock, and the stock moves up enough, you can lose more than your initial position. For example, if you short 100 shares of XYZ at $10, you initially receive $1000, if XYZ climbs higher than $20 it will cost you more than $1000 additional to close out the position. IVO is essentially a short position in VXX, and Barclays doesn’t want you to ever owe more than you put into it, so they liquidate the fund if it drops below $10 on the market. This corresponds to a rough doubling in the price of VXX when IVO was created–which would be about $60.

With XIV it relates to the percentage moves. If VXX jumped more than 100% in a day, then if VelocityShares didn’t terminate XIV their customer’s positions would drop more than 100%, which would take them negative. They avoid this situation by terminating the fund if the daily move of VXX is 80% or more. Just to be clear, they aren’t tied directly to VXX, but rather the underlying futures contracts, but I believe VXX is a good proxy for the situation.

So the big risks with IVO and XIV are market crashes worse then the Flash crash. Two examples that come to mind are the 2009 crash and the October 1987 crash. VXX didn’t exist for either of these. I do have VIX data (or simulated data) since 1992–there were 20 days with VIX jumping over 30% (previous day close to intraday high) during that period. The highest percentage jump over that period was 70.5% on February 27, 2007. There were three days with VIX jumps over 30% in the 2008/2009 crash, and during the Flash Crash.

If VXX had existed during this time span, and held to its typical behavior of 50% of VIX’s move it looks like the XIV termination event would not have occurred, but obviously would have taken heavy losses on those days. In IVO’s case it would have mattered when the fund was initiated, because there were certainly times when VXX has more than doubled over a short time frame.

This response will probably raise more questions, but hopefully it is clearer why these termination events exist, and how they can happen. If you are investing significant amounts of money in these products it looks prudent to at least hold some VIX calls also. These would provide some insurance against these infrequent, but dramatic events.

— Vance

Is it better to short VXX or go long XIV with the same amount of dollars?

Does the answer change if using margin?

Great question. It is a complicated problem. From a leverage standpoint my guess is that XIV is probably better if the % move in VXX is greater than ~10%. However, as Yuman points out in the comments XIV has compounding/path sensitivity–these hurt if VXX goes up and help if VXX goes down. Obviously margin is required for short selling in general, and lots of margin is required if your plan is to sell & hold short VXX through VIX spikes. Buying XIV on margin would be less scary because you don’t get the leverage multiplying above 1X when VXX moves against you–still losses could pile up pretty quickly.

I’ve been doing a lot of short term trading XIV recently (playing 4 pt moves). I plan to evaluate those trades for short VXX positions instead. I expect short VXX would have performed 10 to 20% better for the trades that didn’t complete intraday (~40%), but I’m a lot more comfortable with XIV because I can’t sit and watch the action all day…

— Vance

Hi, Vance,

Thanks for the reply, and the great posts. I have to agree with you that XIV is probably the winner on balance. IVO would be the winner without the vertical descend cause by the “Automatic Termination” that guarantees an irreversible loss at the painful time. XXV/IVO can only take a hit of 50% surge in VXX at inception. The ideal thing would be a XIV2 that resets, not daily, but weekly or monthly. Or a new IVO each month that has no “Automatic Termination” . The closest to that, I figure, is shorting 2nd month futures. Since it requires 20% margin, you can short $10K worth of futures in a $10K account with 2K in margin. If the futures doubles against you, your margin goes up to 4K – you don’t have to trigger “Automatic Termination” .

I think the symbol ZIX should be ZIV. The daily inverse funds suffer from compounding decay. If VXX goes from 20 to 30, then comes back to 20, XIV and ZIV will not get back to the previous values when VXX was 20. For VXX, the moves are +50% then -33%. XIV would move -50% then +30%, (0.5*1.3=0.65), a 35% loss. That is, if VXX is flat, XIV loses.

Hi Yuman,

Thank you very much for your correction on ZIV. I have corrected the post.

Thanks for bringing up the compounding issue–that is certainly a major factor in the dynamics of VXX vs XIV. I agree that daily inverse funds suffer from compounding delay when the underlying is up. But since VXX will be down more than it is up due to contango–VXX will never be flat or positive for very long. I suspect the compounding will be in XIV’s favor most of the time. A true short of VXX avoids the compounding problem, but introduces the loss of leverage effect I mentioned in the post, plus the downside risk is higher.

— Vance

A good example would be comparison of XIV and SP500 results from Feb 14 to May 16. If you ride out the March storm and sit tight the whole time, you see that XIV goes up from 158 to 166.97 while SP500 falls from 1332.31 to 1329.47. This shows that although vol is much higher for XIV, if you have stomach to be a long term investor, it is very likely that you will make money in the end.