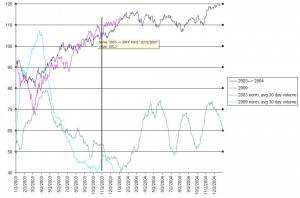

Last November I posted regarding the interesting correlation (at the day of the month level) between SPY prices in 2003 and 2009. I updated that analysis with the last 44 days of data and things still line up surprisingly well. Six years later to the day, the SPY closing values are just slightly over a percent from each other (112.93 vs 114.19). The normalized volumes are still tracking, and visually at least it looks like the recent decrease in real volatility is mirroring what happened in January 2004. If this correlation keeps up we won’t see real volatility kick up for another 3 weeks. The black vertical line marks where my data stopped on my 1-Nov-09 post.

Click here to leave a comment