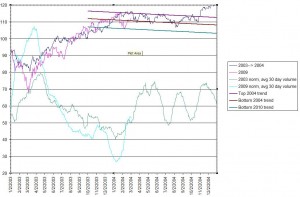

The surprising date / value / normalized volume correlation on the S&P 500 between 2004 and 2010 continues, with the 3rd of March SPY closings only differing by 3%. If 2010 continues to track 2004 then we should see an ongoing ramp in trading volume, with a 30 day moving average of around 300 million shares per day on SPY, compared to the current run rate of about 220 million. After spiking up to almost 500 million shares on the recent bottom on Feb 9th things have quieted down. People are understandably nervous, with only the most optimistic forecasting a continued strong bull market.

My gut is telling me that we are approaching the 2010 top trend line–but the bulls are in control right now, at least until tomorrow…

Click here to leave a comment