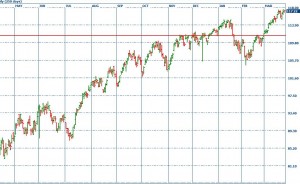

This bull run has been going on since the 8th of February. A very long time without a correction in these uncertain times. In watching the market action I have been surprised at the down days. In-spite of the late January scary correction and market shocks that I would expect to send the S&P 500 down a percent or two, the market has shown remarkable resilience.

In conversations with my friends, most of which are not active traders, I have noticed a pattern. Most of them are out of the market, expecting a double dip recessi0n. Perhaps this is the overall situation. Overall there are a lot of bulls remaining, but for the most part they are buy and hold types, not trying to time the market. Are the people that are likely to get scared after a long bull run-up and sell on scary days already be on the sidelines? If this is the case this market might have some upside left in it.

Click here to leave a comment