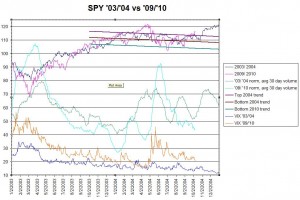

SPY’s 2010 price path for the 8th of October is about 3 points higher that the 2004 trend top line, but that is consistent with 2010’s considerably higher volatility. Recently there have been articles noting relatively low trading volumes, but compared to the normalized volume in 2004 (which at an absolute level was about 3.5x lower) volumes don’t look out of line.

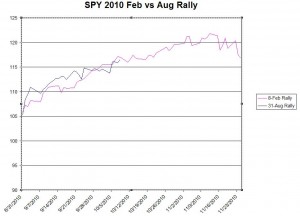

The rally that we are currently in started around the 31st of August. To me it has felt similar to the long rally we had starting in February 2010. No wonder. Both rallies started with SPY in the 105 to 106 range, and have tracked closely since then on a day by day basis–see below.

If these rallies stay in sync then we would expect the next bear cycle to start right before Thanksgiving.

.

Click here to leave a comment