I continue to evaluate (and invest in) a hedge position created by going long both IEF, Barclays 7 to 10 year treasury ETF and DTYS, Barclays’ iPath® US Treasury 10-year Bear ETN. The net position, holding equal shares of both securities should yield around 1.7% annually, and since I’m willing to bet that interest rates won’t be going down anytime soon I’m boosting the overall yield by about another 3% by writing calls on my IEF position. For more information on this hedge see this post. This hedge seemed to perform well during the recent correction. When IEF climbs quickly DTYS lagged, but it eventually caught up.

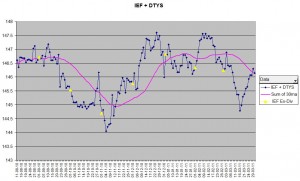

IEF is going ex-dividend this Friday, 1-April, so I thought I would take another look at the historical data to see if there was anything noticeable related to the IEF ex-dividend date.

The yellow triangles mark IEF’s ex-dividend dates. Visually there doesn’t seem to be any significant impact on the hedge.

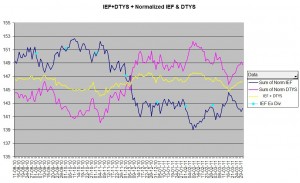

You might wonder if the IEF + DTYS combination is all that great a hedge reviewing this first chart. The next chart provides a better perspective by showing the normalized individual performance of IEF and DTYS. The standard deviation on IEF and DTYS is about 3% and 6.5% of their average values respectively (coefficient of variance). The equivalent number for the IEF + DTYS hedge is 0.5%. The second graph provides a visual representation.

Click here to leave a comment