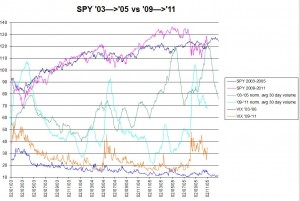

The prices of SPY from this year and the same date 6 years ago continue their intertwining. For the last two years, just using the old SPY chart has been a better predictor than any number of CNBC commentators—too bad I haven’t been able to convince myself to use this as my market strategy.

Today’s closing price of $122, was only $1.5 different from the $120.49 close on November 1st, 2006.

Volatility on the other hand is much higher this time around. The availability of volatility based products, starting with futures in 2004 certainly doesn’t appear to be dampening market volatility.

Hi, I know it deosn’t concern SPY directly but could please run a check on the spread between short vxx and xiv at the same time? it looks like the big volatility causing them both to decay in the long run so taking hedged position between the two meaning the direction of the market doesnt concern you any more and you only care about decay. It would mean a lot to me if you could show us a chart of such a position (short vxx & short xiv at the same time)

Hi Jones,

I’ll take a look at this in a couple of days…. Off hand I would expect this strategy to have a lot of path dependence, because the order of percentage moves would make a big difference in the performance of XIV.

— Vance