There are quite a few conservative investment strategies that deliver a good return if the underlying security doesn’t move much. Covered calls and dividend collection are two that come to mind. These strategies are conservative in the sense that they don’t require the security to go up in order to be profitable—in fact a stable price is just fine. However, if the market tanks, both of these approaches can subject the investor to big losses that far outweigh the profits they offer. Investing in volatility is an attractive way to hedge away this downside risk, because volatility usually goes up when the market goes down. Usually is the operative word. These last two weeks were an example of when this correlation fails.

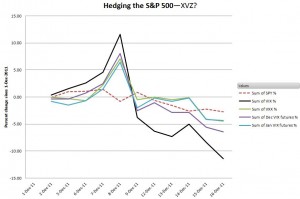

The chart above tracks percentage changes since the first of December for SPY and two popular measures of volatility, the non-investable VIX, and VXX, which is one of the most popular ways to go long volatilty. SPY ended up down 2.7% and both volatility measures went down over this period—a lot. Not much of a hedge. I’ve included the nearest two months of VIX volatilty futures to show that it is not just contango that is driving VXX down, the underlying futures dropped too.

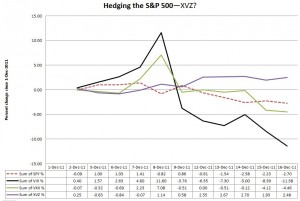

One volatility ETN didn’t drop. Not only did XVZ, Barclays’ Dynamic VIX fund go up, it went up about the same percentage as SPY went down—2.5%.

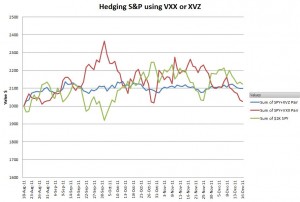

XVZ has only been around since August 18, 2011 so our price history is pretty limited. The chart below shows the results of investing $1K each in SPY and XVZ, SPY and VXX, and $2K in just SPY.

The SPY+XVZ combination is noticeably less volatile, with a standard devation one third of the others: 22 vs 75 and 78. However five months is a really short time to judge a strategy like this, so I expanded the backtest a little, back to January 3, 2011 using my XVZ simulation.

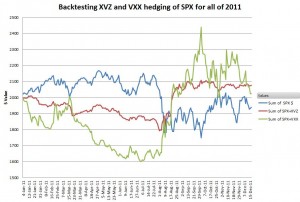

This chart illustrates two other characteristics of XVZ. It is designed to capture big volatility jumps, like the one in August, and hold onto them once they occur. And it too suffers from contango (first half 2011) if it is severe enough—although it was minor compared to what happened to VXX.

Clearly XVZ is not a perfect mirror of the S&P 500, but its behavior when volatilty spikes makes it even more attractive than a pure hedge. Market panics are not predictable, and having a workable hedge that turns a panic into an opportunity is intriguing.

Click here to leave a comment