Covered calls are an example of positions that are short volatility. I hadn’t thought of it that way until Sheldon Natenburg, the author of Option Volatility & Pricing pointed that out in a fascinating interview in Expiring Monthly. A covered call position is profitable if the underlying equity stays the same or goes up, but in a big market downswing, when volatility spikes up, the modest potential profits from a covered call are more than wiped out by the losses in the underlying.

Unfortunately it is usually expensive to hedge a short volatility position. The two most common strategies have problems: VXX typically has roll yield losses, and VIX/VXX options have significant time decay. Recently I started looking at Barclays’ VQT ETN, a fund that is intended to be long volatility. The chart below compares $1000 invested in SPY and VQT starting in September 3rd, 2010—VQT inception date.

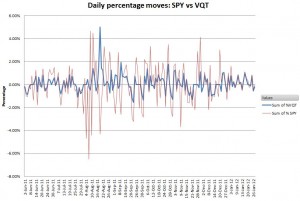

$1k investment in SPY and VQT in bull market phases VQT underperformed the S&P 500 by about 50%, but during the -19.5% drawdown in August 2011 VQT only dropped 3% before going on a short term volatility fueled binge that lifted it 20%. The next chart shows the day-to-day percentage moves of VQT vs SPY since June 2011.

When times are volatile, VQT shifts its investments to include more short term volatility—which lowers its correlation to the S&P 500 to about 50% or 60%. In very quiet times, like the end of December/January VQT shifts to a almost pure S&P play—giving it the nearly 100% correlation you see at the right side of the chart. The next chart is from the VQT prospectus, showing the backtested, theoretical performance of VQT since 2005

VQT vs S&P500 backtest to 2005 VQT looks almost tailor-made for covered call writing. Its low drawdown behavior limits capital risk while its volatility is similar to the S&P 500. Unfortunately, there are no liquid options available on VQT, so we’ll have to get creative in developing a covered call style position. Since much of VQT’s composition is direct exposure to the S&P 500 I will use SPY options as logical building blocks. A covered call is a short call position hedged with a long equity position. Since brokers won’t accept a long VQT position as a hedge for a short SPY call and I don’t want to have naked calls, I’ll protect my short call position with long out-of-the-money calls—creating a call spread. I’m not too concerned about losses on these credit spreads, because VQT is a natural hedge for the position, so I’m comfortable with a $2 spread in the option strike prices.

Profitability analysis:

| Market Action | VQT action | SPY call credit spread action | Overall Profit |

| S&P 500 strongly up | Up, but not as much as S&P | Worst case loss. Loss is premium received at creation minus $2/ option pair | Neutral to small loss |

| S&P 500 up | Up, but not as much as S&P | Neutral to profitable, with profit equal to premium received at creation minus any in-the-money intrinsic value. | Modest profit |

| S&P 500 down | Down, but not as much as S&P | Profitable, keep full premium received at creation | Neutral to small loss |

| S&P 500 strongly down | Strongly up as volatility portion kicks in | Profitable, keep full premium received at creation | Very Profitable |

The spreadsheet that provides the VQT backtest data from March 2004, including all formulas is available here.

Vance, any thoughts on a ATM or DITM covered call strategy on SVXY?

Thank You Vance

You were 100% correct once again. I would have been called out of my shares on SVXY as it has skyrocketed the past few weeks.

Thanks for all your help

Hi Vance

Thanks for your feed back. I paper tested my theory with uvxy and you were 100% correct I would have been able to sell the calls on uvxy for only 2 weeks before it dropped well below 11 and would have resulted in a loss. My question is what if I applied the same theory to Svxy. Buy 100 Shares at 56.50 using todays price buy 1 long term put say jan 2017 55 for about 9.50 then sell weekly calls 2 dollars above my purchase price so if I get called out I can repurchase and repeat the following week. the only problem I see is if it has a huge spike up like it had recently in which case I might have to buy a long call also increasing my cost.

Hi Greg,

Obviously if SVXY tanks you’ll lose a considerable percentage. If SVXY skyrockets you’ll end up buying SVXY at higher and higher prices and your Put less and less effective at protecting your investment. Sideways action is always best for covered call type configurations.

Hi Vance

Thanks for your feed back I think I solved part of my problem with my example below if I sold the calls at 20 strike price instead of 16 that would cover me if my shares get called away so I only have to worry about uvxy falling below 11 and once I cover the 650 break even it wouldn’t matter if my shares get called away because I have the puts. Is that correct? Also since this fund loses 60% a year how do you short it do you just buy the puts and wait for it to drop or is there a better way.

Thank You

Greg

Hi Greg,

As always options offer painful trade-offs. The S20 calls help your worse case scenarios, but you give up a lot of premium–and earning premium is the key attraction of this setup.

Be very careful with shorting these funds. You must assume at least a 4X increase in price if volatility spikes, 6X is probably a better assumptions. Tough to have enough margin in place to ride through spikes like that. Timing obviously helps, but the successful players keep their positions small. Don’t assume expiring ITM will easily get you short positions. At the very least you’ll probably have to pay significant fees (e.,g 7% / year) and some brokers aren’t particularly interested or good at getting “hard to borrow” shares for you.

Best Regards,

Vance

Hi Vance

I just came across your site and I love it. I’m new to investing and was wondering if you could tell me what the risk to capital would be if for example

I purchase 100 uvxy at 13 I Purchase jan 2017 11 put for 450 and then I sell weekly 1 weekly 16 call for 32 dollars and repeat this every week. I think I’m missing something and your input would be a big help. the numbers I’m using are approximation from Friday.

Thank You

Greg

Hi Greg,

You have an initial debit of $1300+450 = $1750, A guaranteed credit of $1100 even if UVXY goes below $11, so you need to earn $650 before you are at breakeven. If you can earn $32 on your call each week you’re there quickly. Risk– big spike in UVXY has the call in the money, you collect the premium just once, or twice. If UVXY falls too much you won’t get much call premium for strikes above $11.

— Vance

Very nice set-up.

Any other options work-arounds for VQT or even GASZ would be greatly appreciated.

Thanks!

Hi Arnold, The possibility of options on VQT is getting brighter. Its volume is increasing and it has taken in $370 million in assets this year to climb to $572 million. ProShares UVXY and SVXY now have options which might strengthen the case for VQT. GASZ is still tiny at $12.7 million. It has climbed over 25% in 9 months, it’s surprising that hasn’t gotten much notice. No ideas on options on this one yet, interesting idea…

— Vance

Hi Vance, is there any terms of termination for VQT? If yes, what is it?

Because as far as I know, there’re term of termination for ETNs

Hi Hendra, VQT does have a termination event, but it does not kill the fund–it just puts it into cash for up to 5 days. The trigger for the termination is if the fund after 5 days shows more than a 2% loss. This termination is different from funds like XIV or IVOP that terminate at a certain price. Since both components of VQT are long (S&P 500 and VXX effectively) they can’t go negative like inverse funds and with the 60% or more S&P component and a long volatility position VQT is very unlikely to have a huge negative downware move.

— Vance

thanks Vance for your answer. This article is a very useful knowledge for me. Keep up the good work!