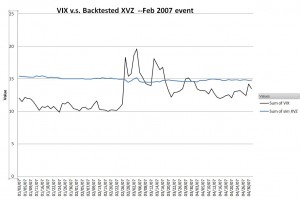

February 27, 2007, currently holds the biggest daily percentage jump record in the VIX index’s history (the VIX didn’t come out until after the 1987 crash). The VIX jumped from a 11.15 close the previous day to 18.31 —a 59% jump.

Normally I would expect a volatility strategy fund like XVZ or, VQTto perform very well during a volatility spike of this magnitude. None of these funds existed back then, but my backtest of XVZ shows XVZ would have stayed flat, and I doubt the others would have done well either.

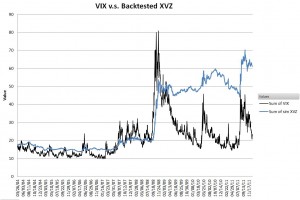

The chart below (click to enlarge) shows XVZ’s backtested performance since 2004 compared to VIX. In general, it has very good performance during volatility spikes.

The February 2007 spike was different. The chart below shows a close-up of VIX and a simulated XVZ in that time period.

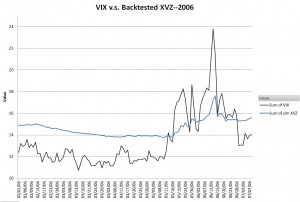

VIX vs XVZ February 2007 Unlike most volatility spikes there was no forewarning on this one—things were quiet, then a big one day jump. The chart below shows a more typical run-up that happened in 2006, where XVZ would have gained about 9% overall by the time the spike was over.

Unlike most volatility spikes there was no forewarning on this one—things were quiet, then a big one day jump. The chart below shows a more typical run-up that happened in 2006, where XVZ would have gained about 9% overall by the time the spike was over.

When I was generating the backtest for XVZ I noticed this anomaly. A closer look revealed that XVZ wouldn’t have caught this spike because its asset allocation strategies on any given day are based on the closing value of the VIX to VXV ratio two days before. When the spike occurred XVZ would have still been in its full contango fighting mode, short 30% short term rolling futures, and long 70% medium term futures—the moves in the two positions would have cancelled each other out. By the time XVZ adjusted the VIX was already into its mean reverting mode.

Inherent time delay in the triggers (e.g., SPX historic volatility, implied volatility) used by other volatility strategy funds like VQT and VSPY hobble them with the same inability to capitalize on fast volatility spikes. The spike in 2007 was triggered by a 9% blow-off in the Chinese stock market, but the scenarios that worry me more are no-warning events like natural disasters (earthquake/tsunami) or terrorist attacks. Generally, there is no forewarning on these events and they could have significant impacts on the market. None of the first generation volatility strategy funds address this gap, hopefully the second generation will.

I wonder how that 59% spike affect XIV had XIV existed that time.

Hi Tom,

Looking at my backtest data it looks like VXX would have gone up 25% that day, so XIV would have been down 25%.

— Vance

Not sure if that will be possible to find. What you are asking for is the vxx without the decay. No one would take the other side.