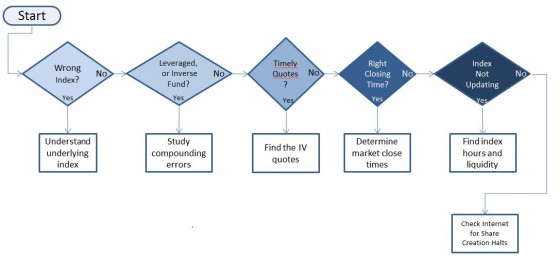

Frequently I see people complaining that their Exchange Traded Fund (ETF) or Exchange Traded Note (ETN) is broken. Occasionally they’re right, but most of the time they’re not. Before complaining, here are some things to look at:

- Are you looking at the right index?

- All Exchange Traded Products (ETPs) track an index, which is identified in their prospectus, and in the fund’s fact sheet. Don’t assume what the index is. For example, the index that VXX tracks is not the CBOE’s VIX®, and UVXY the 1.5X volatility fund is not designed to track 1.5X the VIX.

- None of the volatility funds track the VIX, they all use other indexes, because the VIX itself is not investable. Some funds (e.g., UVXY) do a semi-decent job of tracking the VIX in the short term, but nobody does a good job in the medium to long run. In fact, it’s a killing field.

- Investigate the index once you’ve determined what it is. It’s often not easy; sometimes even getting quotes on indexes is hard. But similar to the hunter’s credo of eating what they kill, investors should understand what they trade.

- Is the fund leveraged/geared (e.g., 2X, 3X), or an inverse fund?

- Leveraged or inverse funds typically do a good job of delivering their target performance on a daily basis, but usually fall far short with longer time frames. The reason is compounding error or path dependency. It erodes the value of these funds in choppy markets.

- For example if a non-leveraged fund (e.g., SPY) goes up 10% one day and down 9.09% the next it ends up even. However the 2X fund (SSO) and the inverse fund (SH) both end up down 1.8%

- 2X Fund: (10*(2*10%)=12, 12*(2*-9.09%) = 9.82

- -1X Fund: (10* (-10%) =9, 9 *(+9.09%) = 9.82

- In strongly trending markets compounding errors can boost the return of a leveraged / inverse fund beyond its multiplier. See Hat Trick For Leveraged / Inverse Funds.

- What are the timestamps of the quotes you are looking at?

- Unless your fund is very active the quote you’re using might be older than you think. For example, the fund’s closing value might reflect a trade that happened hours before market close. If you look at an intra-day chart of your fund including volume you should be able to see when the trades occurred and the quotes updated. Typically the intraday indicative value (“IV”) quote is a more accurate way of getting the actual fund value. It’s updated every 15 seconds during market hours.

- The IV quote tickers are not standardized. Yahoo finance uses a “^” prefix to get the IV value (e.g., ^VXX). For more on IV quote symbols see Trading ETFs Without Getting Fleeced.

- Are the markets you’re comparing closing at the same time?

- VIX futures markets at the CBOE Futures exchange trade for 15 minutes after the equities markets close. The volatility ETPs are based on volatility indexes that are based on futures settlement values. Eli from VIX Central points out that these settlement values can come out well after 4:15. The final IV update for the day appears to reflect these late settlements—giving us the real closing value for the volatility funds.

- Is the trading value of the funds diverging significantly from its index or IV value?

- If this is the case, your fund might be broken, but before we pursue that there are a couple things to check:

- Are the markets for the underlying assets closed (e.g., Asian or European stocks)? If so those indexes can’t update so some divergence during USA trading hours should be expected.

- Are the securities for the underlying assets illiquid or rarely traded (e.g., high yield corporate bonds)? If so the trading value might reflect the market’s estimation of what those assets are worth, rather than the last trade, or published bid/ask quotations.

- If this is the case, your fund might be broken, but before we pursue that there are a couple things to check:

If you’ve checked through all the items above and things still look wrong your fund may indeed be broken. Historically the only pathology for ETF/ETNs is to have their share creation process halted or somehow limited. Some of the stated reasons for doing this are:

- Market closures (e.g., the Egyptian stock market EGPT closed for 2 months in 2011)

- Regulatory hurdles, where permission to issue new shares is delayed UNG, UNL, DNO

- Issuer “internal limits on the size of ETNs”, TVIX

- Commodity position limits, where the exchanges won’t allow the funds to accumulate more contracts UNG

- Self-imposed market cap limits AMJ

In all these cases the share redemption process has been left intact. In practice, if share creation is stopped and redemption is working the ETP’s price can rise higher than the index, but not drop significantly lower than the index. Both UNG and TVIX were expensive object lessons for the people that didn’t understand this.

The NYSE has a good webpage that lists all the funds that currently have suspended or put limits on share creation. Unless these suspensions are temporary these funds should be avoided.

Hi Vance, do you have any speculation as to why Credit Suisse is cancelling their ETN’s? They say “to better align with product suite.” Maybe these ETN’s weren’t making any cash for them. I don’t own any of these, but how do you think these will trade? Can they get volatile without the underlying getting volatile?

https://www.credit-suisse.com/about-us-news/en/articles/media-releases/credit-suisse-ag-announces-its-intent-to-delist-and-suspend-further-issuances-of-its-velocitysharestm-etns-202006.html

thanks for sharing these information. Nice blog indeed

Hi Vance, thanks for this great website. Is TECL a deprecating asset? I’m trying to figure out why at $320/share I’m break even. Although my entry is at $310/share.

Never mind Vance, it is bc of wash sale. Oops!

Can you please explain three aspects of the VXX for me, Vance? First, even granted the overall degree of fear in the market now is less than it was a decade ago, why do VXX and VIX hover in the 8 to 40 point range instead of the 2500+ range the VXX had back then? The range for movement, and the level of movement overall, seem extremely constricted compared to prior times. If this a feature of contango, what sort of catastrophe would be required to fully counterbalance this relative inertia?

Second, what features of the market factor into the decision to reverse split any of the volatility related funds, who or what group inside Barclay’s are responsible for assessing the impact of these factors, and how do they arrive at their conclusions?

Third, in the days prior to Trump being elected, it was widely said an upset win by him would

provoke a market decline of 10 to 20 %. That did not occur, at least not at anywhere near the aforesaid level, and the large spike I, and others I’m sure also, had anticipated in the VXX did not materialize. Even so, such a political shift would seem to be a circumstance worthy of some considerable, even if brief, move in the volatility funds world. If analysts were predicting such a steep drop in the market following a presidential upset, how were the VXX and similar funds not more responsive to it?

Hi Marion,

I suggest we start with you reading the following posts and see if those answer any of your questions. Please feel free to repeat /add to your questions. VXX https://www.sixfigureinvesting.com/2013/04/how-does-vxx-work/ VXX’s losses https://www.sixfigureinvesting.com/2016/09/the-cost-of-contango-its-not-the-daily-roll/ VIX https://www.sixfigureinvesting.com/2014/07/how-does-the-vix-index-work/ VXX reverse split https://www.sixfigureinvesting.com/tag/vxx-reverse-split/

Best Regards, Vance

Excellent summation of possible pricing errors for these ETF’s. You are amazing Vance, where do you find the time to explain this stuff? Your help is much appreciated!

Hi Timothy, Thanks for the feedback. Much appreciated. This post, like a few others was partially to save time. I was getting a significant number of emails/comments about this or that ETP being broken, so I decided to summarize the common questions / mistakes in a post.

great summary of many mistakes I made in the past 🙂

thanks for the post

given the compounding issues of the -1x ETP’s whats a better way to play short vol and contango then? short VXX?, long deep in the money VXX puts? (whats VXX borrow – now and if vol spikes?) Just short the futures yourself (to be able to roll ~1/20th of your position a day you need a sizable account though (20+ VIX futures will take over $200k USD margin)) …. better ways?

Hi Marco, Because of the persistent contango with VIX the compound issues of -1X are not a particularly big problem for vol funds–in fact the compounding sometimes boosts their performance. All the other things you suggested have issues too. For my level of sophistication anyway the inverse vol ETPs look like the best choose. Of course the big issue is avoiding / mitigating vol spikes.

— Vance