Investors betting on the next volatility spike have taken a beating.

The last time the CBOE’s VIX® index closed above 30 was December 8th, 2011. In the 16 months since the split adjusted price of Barclays’ VXX has dropped from 174.84 to 20.34—an 88% drop. None of the 14 other USA based volatility funds that are designed to rise with volatility increases did well, the best being Barclays’ VQT, which eked out a 5.5% gain—while the S&P 500 went up 26%.

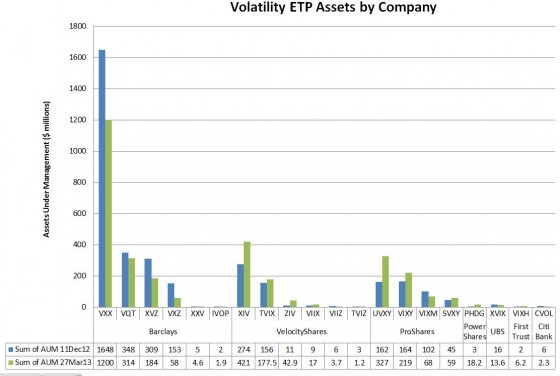

The worst of the short volatility funds, Barclays’ XXV went up 21%, the best, VelocityShares’ XIV went up 326%. This sort of performance gathers attention and assets—XIV is now the second biggest volatility fund with $421 million in assets. ZIV, VelocityShares’ mid-term inverse fund quadrupled its assets from $10 million to over $42 million. The chart below shows the assets under management of the current 20 volatility funds—the green bars are 27-March-2013 numbers.

|

Buying XIV or ZIV isn’t the only way to short volatility. Not counting investing directly in VIX futures there are at least four different ways to go.

The most obvious strategy is to just short one of the long funds.

Direct Short (VXX, UVXY, TVIX, etc.)

- The primary advantage is that there is no compounding errors or path dependencies. It doesn’t matter what price path these securities follow, the end result of the position will be the same. However there are a host of disadvantages.

- Losses can be much greater than your initial investment. If a volatility spike comes along (and they tend to be fast), you can get in trouble in a hurry. No respecter of market hours, the volatility climate can change overnight.

- These shares are usually hard to borrow—other people have the same idea

- You can’t short shares in an IRA account

- The best you can do with your initial position is a 100% gain (security goes to zero). To get more than 100% gain from your initial position you need to short more shares.

- The leverage factor is not in your favor. After starting with a leverage of 1X when you place the short, the leverage goes below one if the security drops in price, and above one the security moves against you.

To address investors that can’t / won’t short, or don’t want to babysit their positions as closely Exchange Traded Products (ETPs) are attractive. There are two different implementations:

- Daily Resetting Inverse Funds (XIV, SVXY, ZIV)

- The primary disadvantage is compounding errors. If the security thrashes around a lot your position will drop if value even if the long side ends up right back where it started. However, there are a lot of advantages.

- You can’t lose more than your initial investment. The fund might terminate, but it won’t go below zero.

- The leverage is a consistent 1X and your profits are unlimited—the daily reset sees to that.

- They are easy to invest in. There’s no problem using these in most IRAs.

- In trending bull markets these funds can do better than their leverage factor.

- True Short Funds (XXV, IVOP)

- The primary advantages of these mostly forgotten Barclay funds is that they do not have compounding errors and you won’t lose more than your original investment. There are a lot of disadvantages.

- Your maximum profit is less than 100%, probably much less, because these funds can’t go higher than $40 per share. There’s a feature…

- Like a true short, these funds have variable leverage. When things are going bad for you the leverage gets higher. Because of this accelerating leverage these types of fund are prone to termination events (IVO), or get dangerously close (IVOP).

At first glance, options are the ideal approach for shorting volatility. They have no compounding error, limited downside, good leverage, and reduced capital costs. The bad news is that Wall Street knows this, so profits are tough to come by.

Option Strategies (VIX options, options on VXX, UVXY, SVXY, etc.)

- For an option based strategy you should figure out how much movement you need in the underlying before your position breaks even. Obviously things like time to expiration and implied volatility complicate this analysis, so I usually start with the easiest case—position value at expiration.

- For example, consider a long put on UVXY using data from 6-Mar-2013:

- UVXY is at 9.47 and the Jan 2014 puts (318 days), with a strike price of 9 are selling for 4.55.

- The prices on the puts look reasonable; the IV is around 150 which is a pretty good match to the 22 day historic volatility which is running in the mid-150s.

- For this trade the UVXY break even point is around 4.55—in January 2014.

- Obviously just breaking even isn’t enough. To get a good profit, say 80% of your investment you need UVXY to drop another 3.64 points, down to $0.81, a 91% decline. That’s certainly possible, even likely for UVXY—unless the market has bearish period during 2013. UVXY can really skyrocket during a sustained correction, so if something similar to the 2010 Flash Crash, or the 2011 Euro worries happens you would be lucky to break even.

- Bottom line, if you’re buying puts you’re probably not minting money. Of course if you predict a period of low volatility correctly then you’d do great, but just randomly buying puts will probably not work that well. If you think you are going to average down your basis during spikes by buying cheap puts then you might be surprised. The prices on the low strike puts will stay surprisingly high because their IV will spike too.

- No sane person would write naked calls on a long volatility product, but spreads could be used to harvest premium and limit potential losses. The big problem here is call skew—the IV of the calls rises rapidly with the higher strikes. Again, Wall Street is ahead of the game and to get interesting profits you’d have to go with wide spreads, increasing your risk considerably.

Eventually there will be another volatility spike that will slam short volatility positions, but predicting when that spike occurs will be tough—and it might be years off. The current set of long volatility products get killed by contango during the 75% of the time that things are quiet, until that changes I think investors are going to be much more successful going short volatility—bailing out when the market gets nervous.

Interesting that you think making money with options is hard. I’m partial to an allocation to 2 month uvxy ATM puts. The shorter time frame (vs 1 year) means you can run more independent trades (12 per year) with roughly the same risk/reward. I’m skittish about naked shorts of uvxy as it can get away from you pretty quickly.

Vance, another great article. Wouldn’t the UVXY puts have to fall below 4.45 to be profitable (strike of 9.00 minus cost of $4.55?) Anyway, your articles are always informative and interesting.

– Darryl

Hi Darryl, Thanks for the correction, as you say the break even would be 4.55 and the 80% profit point would be $0.81, a 91.5% decline. Fixed in the post.

Thanks,

Vance

Thank you Vance for all your brilliant ideas and explanations about volatility ETFs.

Longing XIV surely made people happy in 2012. And you are right about bailing out when the market gets nervous to avoid the free fall in 2008 and 2011. In addition to that, as you mentioned “compounding errors” may make your portfolio bleed slowly but painfully in market like in 2007. I guess most people would not pay attention to your “compounding errors” statement since XIV was not in existence until late 2010, but based on your simulation we know what could happen to XIV in 2007 although SP500 reached “historical high” in that year. Sometimes it is just impossible to tell if the market is getting nervous for a long period or just freaking out irregularly. So just be aware of the “Irrational Exuberance” 🙂

another great article, thanks Vance