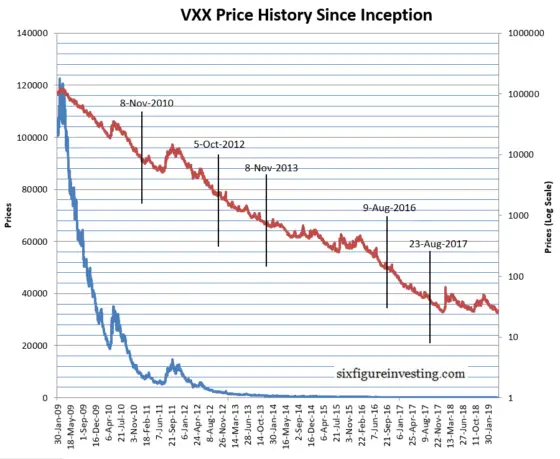

I’m predicting, based on historic decay patterns that VXX’s next reverse split will be 12-August-2026, at a four to one ratio. For a security doomed to decrease in value over time Barclays’ VXX does amazingly well. Its volume averages over 5 million shares per day and its assets under management run around $250 million, not bad for a product that has averaged a 52% annual loss since its inception in January 2009. This works out to an average loss of almost 6% per month. See “Volatility Fund Monthly and Year Decay Rates” for a chart showing how these losses have varied over time.

According to its prospectus, Barclays can reverse split VXX any time after it closes below $25 and that reverse splits ratio will always be 1:4, one new share for every four old shares ratio.

History of VXX Reverse Splits

| Event | Dates | Split Ratio | Inception / close price right before reverse split (split-adjusted initial share price) | Months since inception /last split |

| Inception | 30-Jan-2009 | 100 ($6.553Millon) | ||

| 1st Rev. Split | 9-Nov-2010 | 1:4 | 13.11 | 21 |

| 2nd Rev. Split | 5-Oct-2012 | 1:4 | 8.77 | 23 |

| 3rd Rev. Split | 8-Nov-2013 | 1:4 | 12.84 | 13 |

| 4th Rev. Split | 9-Aug-2016 | 1:4 | 9.27 | 34 |

| 5th Rev. Split | 23-Aug-2017 | 1:4 | 11.94 | 12 |

| 6th Rev Split | 23-Apr-21 | 1:4 | 10.45 | 44 ( 3 years 8 months) |

| 7th Rev Split | 7-Mar-23 | 1:4 | 10.71 | 23 |

| 8th Rev Split | 24-Jul-24 | 1:4 | 12.29 | 16 |

| 8th Rev Split | 12-Aug-2026 | 1:4 | ~ 10 | 25 |

The first and second splits of VXX occurred after about 22 months, but 2012 did not have volatility bumps like 2010 and 2011, so the 3rd reverse split was only 13 months after the 2nd one. Volatility kicked up quite a bit in 2014 and 2015 so it took a record 34 months before Barclays reverse split this product again. The approximate decay per month slowed down to “only” around 3.5% per month (35% per year). In 2016 decay rates returned to more historic norms—with decay rates in the 7% to 9% range. After the 2016 reverse split a period of high contango and low volatility eroded VXX back to reverse split range in a record low 12 months. The period after the 2017 split has had some significant volatility spikes that have reset VXX’s levels to the point where the time between VXX’s reverse splits set a new record of 44 months.

The chart below, with both log and linear scales, shows VXX’s sordid split-adjusted price history.

Given its horrid track record, it’s fair to ask why people keep investing in VXX. Some are just trying to profit from volatility spikes, hoping to catch the next big crash that somebody is always predicting to happen soon. Others are trying to hedge their equity holdings with VXX because it is one of the few securities that reliably goes up when the market is panicking. Unfortunately, this strategy rarely works well. Unless your timing is very good owning enough VXX to effectively hedge your portfolio is prohibitively expensive.

Specifics of the Split

If you hold shares of VXX there isn’t anything to worry about when it reverse splits. The value of your investment stays the same through the reverse split process. You just have 4X fewer shares that are worth 4X more each (assuming a reverse split ratio of 1:4). If your shareholdings are not a multiple of four, say 215 shares, you will get 53 reverse adjusted shares and a cash payout for the 3 remaining pre-split shares.

If you are short VXX, same story, no material impact.

If you were holding VXX options (long or short) when the reverse split occurred there’s theoretically no material impact, however, the option chains are going to hurt your head for a while. This Options Clearing Corporation memo describes the adjustments for the August 2017 reverse split. It adjusts the number of VXX shares per option on the pre-split contract from the usual 100 to 25. The option strikes are not adjusted and the underlying symbol that the options trade against is VXX2, a new symbol—which is set at 25% of VXX’s price. These contortions are required so that holders aren’t left with fractional contracts–something the options clearinghouse doesn’t want to deal with.

So, as an example, let’s say you hold ten pre-split call options on VXX with an expiration date of September 15th and a strike price of $10. Each contract was worth around 2.81 ($281) at the close on August 21st (VXX’s closing price was 12.77) so your overall position value is around $2891. After the reverse split, your contracts are adjusted so each contract has 25 shares of the new reverse split VXX as its deliverable. The strike price, $10 stays the same, and the effective price of the underlying that the option is priced against is the current VXX value divided by 4. So, if on August 24th, right after the reverse split VXX’s price is $51.08 and VXX2’s price is 12.77. Your options will continue to be worth about $281 each, and you still own 10 contracts so your position is still worth around $2891. The only difference is that if you exercise all your contracts you won’t get 1000 shares of VXX, you’ll get 250 shares. If you do exercise your shares the price you pay per share will be the reverse split value of the strike price, in the example above you would pay $40 per share (4*10) if you exercised.

New options created after the split will be generated with VXX as the underlying, but the old adjusted options will hang around until they expire. Typically the liquidity on the adjusted options is not good and sometimes margin calculations are disrupted by reverse splits, so if you are planning on exiting your options, rather than just letting them expire you should consider closing out your positions and re-establishing them after the split. For more on this topic see the end of my UVXY reverse split post.

For regular, forward splits things are more straightforward —the strike price of the options is divided by the split ratio, and the number of contracts is multiplied by the split ratio. See the OCC memo on SVXY’s 2017 2:1 split for an example. This basic approach can’t be used on reverse splits (multiply the strike price and divide the number of contacts by the split ratio) because depending on the number of contracts held some customers would end up with fractional contracts—which is a no-go.

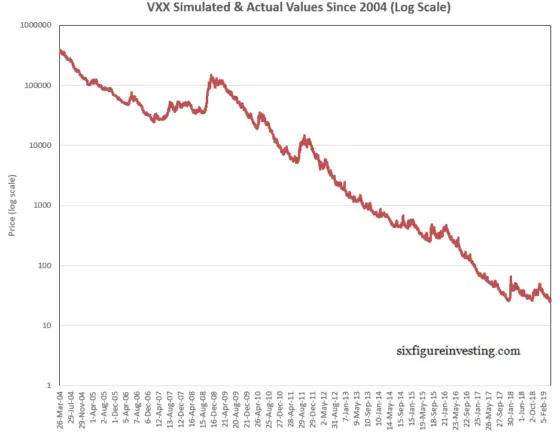

The chart below uses my simulated data plus actuals to show VXX’s price history since 2004

Updated July 15, 2024

For more see:

Hi Vance,

So today the VXX Option Chain started showing up again. However, there is no Weeklies anymore. Did something significant change from the ETN product from Barclays?

Felix

Hi Felix, I expect the weeklies to come back soon. I just think the market makers have made it their first priority to get the regular expirations up and running well before they add weekly expirations.

Vance

Thank you for the explanation. I didn’t see this coming and the reverse split totally threw me for a loop. I wish I had sold out before the split as my calls lost a ton of value.

Hi Keith, Actually your options should not have lost much value. The option prices seem to be stabilizing some now. You should be able to buy/sell option the options near the half way point between bid and ask using limit orders.

Vance

I have VXX Puts so far.

I see some people closing out their VXX Options prior to Friday, April 23rd Trading Day to avoid ticker change and illiquidity.

Would you recommend the same?

If your intent is to just hold VXX puts until they expire then I don’t see any reason to close them, you can always exercise them to get the intrinsic value if need be. If you are trying to harvest premium somehow then that may be tougher post split. The bid/ask spreads will get wider with the adjusted options and the market makers will not be focused on those adj option series. If you do exit, limit orders are mandatory, putting in market order trades for all but the most liquid options (e.g., SPY) is giving away money.

Thanks!

Yes to clarify, these would be open long-dated (Sep 21-Jun-22) VXX Put positions shorting volatility. After April 22nd they will convert to adjusted option series, and the bid/ask will be wide.

Options are:

1) Use Sell Limit Orders to get a fill at Target Desired Price from MMs likely

2) Exercise to assign if they go ITM and the extrinsic is gone…

I can see why they are closed for reopening and maybe worthwhile to close them at profit targets between now and prior to adjusted split.

I have VXX Puts so far.

I see some people closing out their VXX Options prior to Friday, April 23rd Trading Day to avoid ticker change and illiquidity.

Would you recommend the same?

Hello Vance,

Very Informative Article, Thank you for writing and curating it. I have a question about the VXX.

The VXX right now is about 17, so suppose the Reverse Split happens at 10, the price of VXX goes to 40…now does the decay also increase in light of the higher VXX figure?

Coz when you see the charts, VXX is hardly able to sustain itself when it goes above 35, the drop is always quick and sharp. Since the VIX on which VXX is based, will be suppose 16 then will the higher number of VXX fall quicker?

Or does the values of VXX and VIX move separate to each other and can not be directly compared?

The decay mechanisms on VXX are percentage based, so when you have a reverse split the decay in terms of points are higher, but the percentage decay stays about the same. VXX is not based on the VIX, it is based on VIX futures, which have significantly different characteristics than the index. VXX is effectively a rolling position in the first and second month VIX futures. Much of the time the price relationship of these two is in a configuration called contango, where the further out month has a higher price. In this case both the 1st & 2nd month tend to decline in price over time, thus driving down the price of VXX. For me see: https://www.sixfigureinvesting.com/2013/04/how-does-vxx-work/ and https://www.sixfigureinvesting.com/2016/09/the-cost-of-contango-its-not-the-daily-roll/

Thank you for the reply,

Further to what you have said, the Contango on the VIX Futures isnt the real reason for the decay, but its the fact that the Vix Futures converge with the spot each month that causes the decay, so with that theory, if the market crashes and the VIX Spot shoots up like it did back in March,

1. Since the gap between Spot and the First month (M1) futures widens, does this actually lead to the VXX decaying faster when the market stabilizes?

2. When the VIX Futures go up on a crash event, the Futures may go into backwardation…when this happens the M2 will be lower than the M1, will it lead to a period of Zero decay in the VXX till it goes back into contango?

How much time is generally given from notice to split?

And what website can I follow to gain prompt knowledge of the split?

Pro shares are easy to follow but I have not found the proper site at Barclays.

Hi Vance,

Any idea on why VXX options with maturity in December 2021 are not traded yet?

I cannot even see them in the option chain in SaxoBank.

Thank you in advance

Tasos

Hi Tasos,

They should be listed in the next couple of months. Since Jan 2022 options are available I doubt there is that much demand for the Dec 2021s.

Best Regards, Vance

Hi Vance,

Thank you for this informative post.

Regarding Jan 2022 expiration, is that because people would hold short vol LEAP Puts to that point and realize gains then for tax purposes.

Hi Felix, I arrived at the Jan 2022 date looking at decay rates in VXX. ProShares doesn’t really care about the options that people are holding so I don’t view the two dates as correlated.

Vance

Hello, since volatility spiked this year, will the reverse split happen much later than originally thought as a result?

Yes, you are correct. I redid my estimate. Now I’m estimating December 11th, 2021. That assuming an average 6% drop per month.

Cool. I do want more clarification on the effect a reverse-split has on short positions though.

Let’s say I am short 100 shares of VXX at $40 pre-split. Post-split, I’m short 4x fewer shares that are worth 4x each (I’m now short 25 shares at $160). Since VXX is unlikely to spike to $160 level considering historical data, wouldn’t it be a relatively risk-free trade if the short positions are held through a reverse-split? Now, give it enough time, another reverse-split comes, the risk of a spike becomes infinitely smaller.

I’m not sure if it make sense. But if VXX has unlimited downside over time, wouldn’t a short position has unlimited upside over time, provided that you can survive all the spikes in between?

Hi Joshua,

VXX doesn’t have unlimited downside. It can’t go negative, so the limit of its downside is zero. If you short 100 shares at $40, you received $4K. The lowest price VXX can go down to is zero, so your profit is capped at $4K, buying back your VXX shares at zero. To make more than that $4K you’ve got to short more stock, which makes you more vulnerable to the periodic spikes. Short vol funds like SVXY get around this problem because they releverage their assets every day, shorting more stock if things go their way, covering part of the short if it goes against them. This removes the 100% profit limit, but creates a path dependency behaviour where if VXX goes from 30 to 40 and then back to 30 you end up slightly lower with an inverse ETP. For more on storing stocks see https://www.sixfigureinvesting.com/2014/03/short-selling-securities-selling-short/.

Best Regards,

Vance

Thanks!

Hi Vance, somehow vxx options are not being traded after split on td ameritrade… i have little weekly put position left. do u have any idea what will happen?

Hi Kuan-Wei, Options often don’t trade on the day of the split. Too much confusion. In the next day or two your options should show up as adjusted tradeable options in your account.

got u, thx vance

I had five various buy positions open in Vxx on Etoro platform averaging 12 to 18. So when market opened my positions were showing very good profits in these positions and so I closed all for profit and went for withdraw. But at closing time I see nothing credited to my Paypal account and Etoro account on negative. When it was in positive despite withdrawing $20000 from it. I have had an email from them about something called split. Anybody can explain me pls. All I know is I want my money that thoes positions showed and my leftover account as it was after withdrawal that was still in positive

Hi Sal, VXX reverse split today, which Barclays does periodically to keep VXX trading above $10 / share. It is a cost neutral operation with your accounts being worth the same after the reverse split. What probably happened to you was that your broker’s software had not yet adjusted the number of shares in your account down by a factor of 4 but the price was showing 4X yesterday’s close. Your account values were close to what they showed yesterday, there wasn’t any big profit today. My guess is that you may have to return some of the money you withdrew from Etoro because the profits you saw there weren’t real.

Thank you Vance,

Nobody told me about this and there was nothing from eToro sent to me or on their website that this will happen on market open. All I know is my five Vxx positions showed healthy profits all in range of $3000-4000 and I was over the moon as I have lost in fx markets a lot in past, I quickly withdraw avoid junk of my account and left some, but on market close I checked my Paypal account nothing coming in and shocked to see my balance showing negative -$17,125. Not good, I got email from Etoro on close as well saying profits invalidated and technical issues blah, blah. Also they have blocked my account, can’t open new positions. What do I do, I make losses they are happy I make healthy profit they make excuses, block my account to trade further, put it on negative. At the very least they must restore it to previous position of the split, please advice thanks.

VXX is an ETN, it has no assets under management, the figure you give is thecurrent value of the debt Barclays has raised.

I only have 1 share of $VXX on robinhood. what will happen now that the rs is taking place.. my account shows a loss of $12 …the last close price of the $VXX

Hi Josh, Your one share will be cashed out. You’ll get something equal or less than yesterday’s closing value of 11.84 depending on fees and commissions.

Vance

Hi,

Thanks for all your great articles on VXX.

Just a newbie question – with each reverse-split the number of shares which can be traded go down by a factor of the split ratio – in a few more splits there will be a very small number of shares. How does Barclay’s handle that?

I saw that currently there are ~6M shares – do they issue more? If so, isn’t it just like a split which reduces the price?

Thanks in advance!

Vance,

Why would anyone would want to trade the VXX1 if they can trade VXX?

I currently hold (pre-split) 40 VXX 1/2018 Strike $60 @ 0.75 = $3,000 investment loss 🙁

Hi Scott, The market maker is your counter-party here. Give what I suggested a try, there’s no downside in trying.

Just curious how your broker handled the recent reverse splits on VXX and UVXY. I am using ToS and I had options open (Paper trading) and the totals went from +$200 to -$2000 after the split. It seems like they tried to convert my options over to new ones.

Anyone else have experience with ToS? I will try calling support but since it is paper trading they may not care. I am hesitant to trade live now.

I also have a IB account if anyone had traded options with them through the reverse split can comment

Hi Lyad, I’m not holding positions right now, but I’ve heard some reports of broker software not handling this correctly. Not real surprising given that having options on a stock that reverse splits is pretty unusual. The brokers have a responsibility to get these things corrected on live accounts, although it might take a few days. The paper trading might be a different story.

It will probably be at least 6 months before UVXY reverse splits again and at least a year before VXX splits again.

Vance,

Do you know when the new VXX options contracts come out? Waiting for the new strike prices. Thanks!!!

Looks like they are trading now (10-Aug-16),

Hi Vance,

May be you can clarify.

If I held 100 contracts(100 shrs) of VXX180119P5 before the split. I will now have 100 contracts ( but of 20 shrs) after the split and put price multiplied by 4. Right? So how on the earth this contract will ever get ” in the money” to exercise since they will never let VXX drop below $5. Will this be a loosing trade even if VXX looses 70-80% before expiration and why?

Hi Vance,

Thanks for the informative article. You wondered, “Given its horrid track record, it’s fair to ask why people keep investing in VXX.”. Personally I would like to see a product like VXX in the market. At QuanTimer.net I run a couple of VXX-based models. In one of the aggressive models I short VXX most of the time. These models are offered to others on a subscription basis. However, I have been trading one of the earlier models myself almost for a year now. Visit my website http://www.quantimer.net to learn more about them, if you are interested.

Regards,

Ryan

Vance –

I have a general question for you….this article brought it to mind.

I understand the mechanics of option position adjustments in the event of a reverse split. I don’t need a refresher on that….

But could it be the case that there is a potential reduction to the time value of some of the at and some of the near but still out-of-the money options, as a result of a reverse split ?

While it is true that options will remain out of the money in the exact same percentage as previously, there seems to be a factor at play – either because of the reduced number of shares per contract or because of the introduction of several new intermediate strike prices.

I am not sure exactly why that might be, but I recall having actually

seen an example of this with some positions in the past. My memory is that I held some LEAPs and was writing calendar spreads. It seemed that the long position fell in value as it became more in the money on an absolute basis …and to some degree and my ability to sell shorter term at the money or somewhat out of the money options was hurt to some degree as option premium declined across the time series.

I know this is very anecdotal, but I recall thinking it was an actual phenomenon that I should investigate. I don’t recall thinking that it was something to be exploited but I remember thinking that it might be something you wanted to avoid being on the wrong side of.

Do you have any thoughts or have you possibly come across this in the past ?

Hi Sam, Theoretically I don’t see a mechanism that would impact the time value. The only thing I’ve heard of is that liquidity on the adjusted options goes down significantly. Certainly most retail traders wouldn’t even see the adj strikes in the chains, and if they did wouldn’t know what to do with them. The market makers would likely make the holders pay for that lack of liquidity.

— Vance

Wow, this discussion has gotten little play. Short VXX the last 4 years and adding during vol. spikes.

with ‘normal’ (i.e. shares based) ETFs like say SPY market making banks will hold the ETF vs. the stock basket (long one and short the other) and can create and redeem ETFs shares with the ETF sponsor in exchange for the basket. So their holding in the ETF wouldn’t usually mean much as it would usually be hedged.

Not sure how that works with the VIX future based ETN’s and whether the market making banks can create and redeem ETN’s vs. VIX futues with the respective ETN sponsors (Barclays for VXX, Credit Suisse for TVIX etc.)

Also there are several ETFs out there like VQT that try to hedge long stock exposure with VXX. Don’t know if they hold VXX ETN for that or whether they just replicate the same index as VXX with VIX futures.

Hi Marco, With the ETN’s the market makers / Authorized participants have a cash / shares style transaction with the issuer. The issuer will create / redeem shares at the index price for cash, so there is no index tracking error. The market makers hedge their positions internally, I assume usually with VIX futures. In the case of VQT I suspect they would use VIX futures directly to hedge their positions-using VXX would incur additional costs.

— Vance

Interesting but how do we discern if these institutions are not potentially held SHORT the instrument?

Hi Hans, I don’t know if they have to report short holdings as well as long. It seems like they should. In the case of Barclays, it can be subtler than that. Since VXX is an ETN, not a ETF Barclays does not have to reveal what, if anything they are using to hedge their position. My guess is that they might hedge only 90% of their position, essentially giving them a 10% short position. For more see https://www.sixfigureinvesting.com/2013/04/how-does-vxx-work/

Best Regards,

Vance

Thanks Vance

It sure would be nice to know who is net long or short volatility.

I just find it hard to believe the smart money is long these things. Besides the COT report where else would one look to get an idea behind what type of entity has which bias?

I think this is going to become important because one of my concerns is that I expect shorting volatility to become a crowded trade in the future.

Do you have any speculations as to HOW and what types of idiosyncrasies might manifest as a result?

Hi Hans,

I don’t know of any other way of determining institutional holdings, but that subject is certainly not in my expertise. I agree with you–I don’t think they are net long. With regards to the short trade getting crowded I think it is possible to get a feel for the short interest on VIX Futures. I’ll look into that. The short interest on the ETPs is visible via sites like shortsqueeze.com. In general I would expect heavy volatility selling to compress the VIX premium over historic volatility and flatten the overall VIX term structure.

— Vance