Proshares has announced a 1:5 reverse split, effective the morning 11-April-2024.

Some people seem to anticipate that there will be significant price moves in UVXY, motivated by a reverse split. I’m not in that camp. UVXY’s price is tied to VIX futures’ price, which couldn’t care less about UVXY’s share price. A long time ago it was common for stocks to have sizeable run-ups motivated by upcoming splits (not reverse splits). But a split does not provide any economic edge or penalty, at least with the shares themselves, and I think this strategy stopped working a long time ago. At best, forward stock splits are a momentum indicator.

Reverse splits do have some significant second-order effects on options, which I talk about later in this post.

Proshares’ 1.5X leveraged short-term volatility ETP, UVXY, must frequently reverse split to keep its prices in a reasonable trading range—otherwise, its share price would rapidly approach zero. For example, an original share of UVXY purchased for $40 at the fund’s inception in 2011 would now be worth less than 0.0001 cents.

For a discussion of what causes this ruinous price erosion, see “How Does UVXY Work?” Lacking bear markets, these funds are ravaged by contango at rates that vary between 50% and 75% per year. Monthly decay rates run in the 7% to 18% range. See this post, for a chart showing how those decay rates have changed over time.

From my simulations, 1.5X leveraged volatility funds will reverse split about every 8 to 22 months.

UVXY Reverse Split History

| Event | Dates | Split Ratio | Inception / close price right before reverse split (split adjusted) | Months since inception /last split |

| Inception | 3-Oct-2011 | $40 ($120 Billon) | ||

| 1st Rev. Split | 8-Mar-2012 | 1:6 | 5.58 | 5 |

| 2nd Rev. Split | 7-Sep-2012 | 1:10 | 3.92 | 6 |

| 3rd Rev. Split | 10-Jun-2013 | 1:10 | 6.25 | 9 |

| 4th Rev. Split | 24-Jan-2014 | 1:4 | 15.48 | 7 |

| 5th Rev. Split | 20-May-2015 | 1:5 | 8.19 | 16 |

| 6th Rev. Split | 25-July-2016 | 1:5 | 6.01 | 14 |

| 7th Rev. Split | 12-Jan-2017 | 1:5 | 6.12 | 6 |

| 8th Rev. Split | 17-Jul-2017 | 1:4 | 8.56 | 6 |

| Leverage Shift from 2X to 1.5X | 28-Feb-2018 | |||

| 9th Rev. Split | 18-Sept-2018 | 1:5 | 7.36 | 14 |

| 10th Rev. Split | 26-May-2021 | 1:10 | 3.81 | 32 |

| 11th Rev. Split | 23-June-2023 | 1:10 | $2.07 | 25 |

| 12th Rev. Split | 11-April-2024 | 1:5 | ~ $6 | 10 |

If you hold shares of UVXY there isn’t anything to worry about when it reverse splits. The value of your investment stays the same through the reverse split process, however, your broker may charge some fees, e.g., a $20 “Reorg Fee”. You just have 5X fewer shares that are worth 5X more each (assuming a reverse split ratio of 1:5). If your share holdings are not a multiple of five, say 213 shares, you will get 42 reverse adjusted shares and a cash payout for the 3 remaining pre-split shares.

If you are short UVXY, same story, no material impact.

In theory, if you’re holding UVXY options (long or short) when the reverse split occurs there’s no material impact, There will be sets of spilt-adjusted option chains generated that will show pricing on your options, and those prices should have continuity with the pre-split values. However, In practice there are issues.

- The split-adjusted chains can take up to a week to start trading again, which if the timing is bad could be a big deal.

- The bid/ask spreads tend to widen out on the split-adjusted option series. The option market makers’ attention has shifted to the new option series created after the split, so they aren’t competing for business on the adjusted options. I’ve seen zero bids on options that are clearly worth something and outrageous asks. If this happens, don’t freak out, if you want to close the positions, you should still be able to get fills via limit orders between the bid/ask price. You can use an option calculator + prices on the new option series to figure out an appropriate price. If you’re long, you also have the capability to exercise your options, and sell the underlying to capture any intrinsic value. Lack of volume or open interest doesn’t mean there isn’t liquidity, if your position still has significant value, you can still close out your position to capture most of that value, it will just require more effort on your part.

- If your option positions are being used to hedge a position in the underlying, e.g., long calls to hedge a short UVXY position, then there is a risk that your broker’s margin calculations will be disrupted by the reverse split on the options. If there are no quotes, or if your broker’s software can’t handle the non-trivial calculations associated with the adjusted option series, you might get a margin call and/or a forced close-out of your position. If you’re in a situation like this, a call to your broker before the reverse split is in order. One possible workaround would be to shift the options to another security (e.g,. VXX or $VIX ) at appropriate ratios until after the reverse split, or hedge the underlying by effectively nullifying the position (e.g., by holding the appropriate number of VXX shares) until the split has happened and the options are trading again. This strategy is sometimes called “shorting against the box”, which refers to when people used to hold their paper stock certificates in safety deposit boxes.

- Understanding the split-adjusted options chains is going to hurt your head. The Options Clearing Corporation adjusts for the reverse split by adjusting the number of shares per contract by the split ratio. For a 1:5 reverse split the number of shares of the underlying represented by the option contract will go from the usual 100 to 20. The option chains don’t adjust the strikes, and the underlying symbol changes to UVXY(some number)—which is 20% of UVXY’s price. New options will be generated with newly reverse split UVXY as the underlying, but the old adjusted options will hang around until they expire. In general, if you’re hoping to sell your options at some point, rather than just letting them expire it’s probably a good idea to roll your options into the current series after the split. A combo order closing out the old position with an opening order in the new series with an appropriately priced limit order, is probably the best approach. Start with a price you know that’s too good to be true for you, and gradually shift it in the market maker’s favor until you get filled.

For regular, forward splits things are more straightforward —the strike price of the options is divided by the split ratio, and the number of contracts is multiplied by the split ratio. See the OCC memo on an SVXY’s 2:1 split for an example. SVXY did a 2:1 split on 14-July-17. This basic approach can’t be used on reverse splits (multiply the strike price and divide the number of contacts by the split ratio), because depending on the number of contracts held some customers would end up with fractional contracts—which is a no-go.

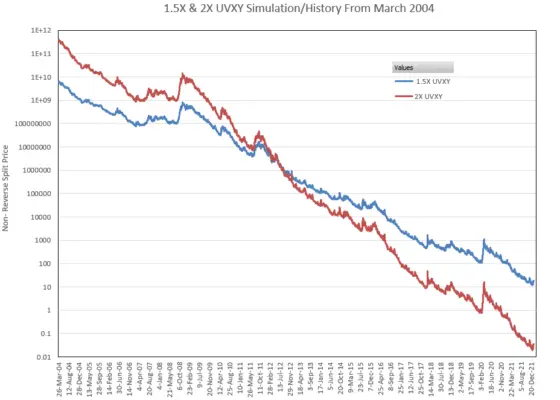

The chart below uses my simulated data to show what 1.5X UVXY & 2X UVXY prices would have been starting in 2004

Updated 13-Jan-2023

For more on UVXY see:

Thanks for the detailed information. I currently hold some in-the-money put UVXY2 options with a strike price $8.5 (i.e. $42.5 for UVXY) and the current price for UVXY is about 32. I find it hard to find a good deal to close the put options as the spread tends to be wide. Just wondering– suppose we hold the put option till the expiration date, will the trading platform (say Firstrade) automatically exercises in-the-mony put options of UVXY2 (i.e. buying UVXY at the price on the expiration date and selling UVXY at 42.5 to the put sellers)?

Hi Jimmy, UVXY options are American style, so they are an option to sell shares at a given price. If you hold them into expiration when they are in-the-money your broker will close out a corresponding position of UVXY that’s in your account if it exists (unlikely), otherwise, they may attempt to short shares for your account. If you don’t have sufficient cash/margin in your account for a short position this could be sort of ugly, with you being forced to cover immediately, etc. I suggest you contact your broker to find out what they do. Assume that if they cash things out for you they will likley do it at a worst-case fill price. Since UVXY’s spreads tend to be pretty tight, probably not a big deal.

Alternately, if it’s a slow day you can put in a limit order at an appropriate price, Trading price-strike plus a little juice for the market maker, a few pennies. (make sure the dollar value of the order looks right!). This price must be between the bid & ask price. The wide spreads are not a liquidity issue, the underlying, UVXY is very liquid, it’s just that the market makers don’t want to deal with these split-adjusted options, so they use a wide spread to discourage people from using them. With this approach you are at the mercy of market moves, so you might miss out a bit if the market moves against you (UVXY gaps up) after you put in the order.

A likely better approach is the effectively close out the position with a LIMIT combo order by buying a OTM put and selling your ITM put. Your limit price should be close to the mid-point of bid/ask for the two options. The value should be very close to the intrinsic value of your ITM puts. You should get a fill close to the mid price value, and you then let the OTM put expire…

Vance

I asked the following question about a year ago but didn’t get a reply. I know you have a full plate but my curiosity about it is still there. When/if you have the time, I would appreciate it. Thx.

Does UVXY move dollar for dollar at the same rate when it is $10 as it would when it’s $35? Or does the rate of descent slow as the price gets smaller. I guess my point is that on a percentage basis, wouldn’t profits be higher shorting from $10 rather than $35 if all other things are equal?

Thanks for keeping the UVXY split analysis going.

Hi Kevin,

Sorry I missed your question before. I think it’s most accurate to view UVXY’s moves to be relatively consistent in terms of percentages, not in terms of absolute dollars. Obviously, UVXY’s volatility is going to vary depending on the mode the the market is, but let’s say the market is pretty volatile and UVXY’s daily volatility is running in the 10% range. For similar market conditions, it wouldn’t matter if UVXY was trading around $10 or $35, that daily percentage move number would be around the same. So if the market is in the 10% mode then UVXY at $10 would typically be having +-1$ moves, and if trading at $35, would be having +-$3.5 moves.

Best Regards,

Vance

That answers it, thanks much.

Finally the day is coming! is my 1st big trade and my calculations are if it reach 30.00 next friday I’ll get a profit of 2000%. Using CFD. I hope everything gets well. Thanks Vance for opening a site of this quality.

Sorry Augusto, No free money here. You will be disappointed. — Vance

Hello Vince!

Boy, they’re really hanging onto this low priced stock for quite some time! I’ve been watching this stock and trading it for quite a few years and I think this is the longest I’ve seen it be this low without doing a reverse split. Any idea when you think they’ll do one?

23rd of June. https://www.proshares.com/press-releases/proshares-announces-etf-share-splits

Well, we are now in 3,72$ if decays to 2,5$ margin will call and I just can add money to survive untill 1,4$. I hope it doesn’t happen, Why the split doesn’t happen yet Vance?

Proshares is probably just waiting to align with some other upcoming reverse splits (e.g, VIXY). Economically it doesn’t cost them anything when an ETF is trading in a low range, so they often don’t show much urgency in getting it taken care of.

— Vance

One thing you did not cover in your analysis is that Proshares adds shares after they conduct a reverse split. For example, at the end of 2021 there were about 66 million shares outstanding. However at the end of 2022, that number increased to over 95 million shares. just doing simple math would show that the stock price would be about 50% higher if the just let the share count remain constant. hence Proshares effectively shoots itself in its proverbial foot by increasing shares after a reverse split, hastening the next reverse split, and showing questionable management of the fund. Also you did not mention that it also ties to the S&P. If it was tied to the VIX only there would be no need to reduce shares as the VIX hasn’t gone much below 10 or above 90. having the share price be at 2x the VIX for example would give a trading range of about $20-$180. Thoughts or comments?

Hi Andre, Exchange traded products (ETP) don’t work like corporations issuing stock. New shares are issued by an ETP when they receive cash or the appropriate basket of securities, they don’t issue them on their own initiative after the initial startup event. UVXY’s share count went up because external people wanted more shares, it’s not a dilution event. The reason for the ongoing reverse splits is because of contango primarily, not dilution. see https://www.sixfigureinvesting.com/2016/09/the-cost-of-contango-its-not-the-daily-roll/

With regards to being tied to the VIX, while this would be very desirable, this is not possible because the VIX is not a tradeable index. If you tried to buy/sell the SPX options that the VIX is priced with, you’d find that you’d be constantly having to change your positions and would lose large amounts of money because of bid/ask spreads. Any ETP needs to be able to efficiently hedge its underlying index, so this eliminates the VIX as a tracking index. The volatility ETPs use VIX futures instead, but they are a poor substitute for the VIX with their heavy carry costs. — Vance

Hello Sir,

It seems you just made my point in your first paragraph about new stock issues that do cause dilution. If external people wanted to buy shares, then they can purchase the shares in the open market based on the number set after the last reverse split, which would then cause the price of the individual shares to rise – similar to a closed end fund and more closely matching the NAV. the fact that they are issuing shares new shares is by its nature a dilution, as the price according to your chart is on a steady downtrend. If demand lessens, why doesn’t Proshares remove shares from the market like other sector tracking funds? This would also act as support for the share price and lessen the need for reverse splits. Having watched and traded in UVXY for over 3 years it appears they only way they reduce the share count is via a reverse split, which costs $38 per account on Scottrade and TD Ameritrade.

One of the differences betseen an exchange traded product (ETP) and the stock of a company is the price of an ETP is tied to an index, in the case of UVXY, 1.5X times the daily moves of SPVXSP. Small deviations from that do occur, but if they get too large they are arbitraged away by authorized participants (AP). They are the ones creating or redeeming shares. If you watch the shares outstanding over time it does vary with the asset value of the fund. For more on this see https://www.sixfigureinvesting.com/2022/07/arbitrage-in-etf-etn-share-closed-creation-redemptions/ — Vance

Thanks for the explanation! As of mar 31, 2023, schwab is now showing a side option chain which suggests to me that the reverse split has begun.

As a trader of UVXY for years, I’ve lost a lot of $$ unfortunately. I think the only winning strategy is to wait for a volatility event and price increase, then short the heck out it using puts. I would not short the underlying itself as I got the short end once again doing that in early 2020 with the market Covid implosion. Margin called. I know, I’ve got great timing.

Use the decay to your advantage and buy puts that are several months out- they will bear fruit from this diseased tree.

Nicely PUT

Will UVXY possibly be allowed to go to zero and delist?

I view that as highly unlikely. With $550M in assets it’s likely a good money maker for Proshares. We should see a reverse split in the next couple of months. — Vance

Does UVXY move dollar for dollar at the same rate when it is $10 as it would when it’s $35? Or does the rate of descent slow as the price gets smaller. I guess my point is that on a percentage basis, wouldn’t profits would be higher shorting from $10 rather than $35 if all other things are equal?

Thanks for keeping the UVXY split analysis going.

Well all it does is decay, when and why would you buy this, seems like rolling a C &E at the craps table

Two reasons, one it is an attractive short–long term value is zero. Second is that it moves up a lot when the market goes down–which causes much pain to those that are short… — Vance

Sorry my silly question, but when is it better to buy UVXY?? after reverse splits or before?? I guess that before because price will be lower or not?

Hi Alexander, My opinion is that share splits are neutral from a forecasting standpoint. Many years ago, forward (not reverse) splits were often followed by price upswings, but I think that pattern no longer works.

Thank you so much man, It is incredible what you do 😉

Probably not high on your list of priorities, but could you add a filter that would allow comments to be listed in order of newest first? Thanks.

Thanks for this excellent,,educational article.. lessons learned but at the lowest-priced then hold short-term. Too bad I got caught at $10 !

Well, it’s happened. Announced after the close, 10:1 as you said. Pretty good timing too! How did you get so close?

https://www.proshares.com/news/proshares_announces_share_splits_051121.html

Once UVXY dropped below $7 the reverse split could have been announced any time. I just guess…

Great article. I just wanted to point out, if I may, that reverse splits are noted as 1:10, 1:5, etc. A regular forward split is noted as 10:1 or 5:1, etc.

Keep the great insights coming. Nice read.

Thanks Joseph, I’ve revised the notation in the post.

This time they didn’t release any reverse split plan when the price is approaching for dollars. Does it mean that they will give up this ETF?

ProShares still makes good money on UVXY. I think it is unlikely they will not reverse split it.

Hi, nice article.

If i understand correctly the only negative aspect as a UXVY holder facing a split is that my UXVY stock will be traded in a lower volume market that the new UXVY’s?

If it’s only that, why wouldn’t everybody be on this boat waiting for the crash to cash in insane profits?

Sorry for this silly question but i’m trying to understand how this works.

Thanks in Advance

Unlike options, when UVXY reverse splits there aren’t separate shares to trade, you just have fewer shares of UVXY (e.g, 4 times fewer for a 4:1) at a higher price. Unfortunately UVXY’s price will still trend towards zero with occasional increases when the market crashes. Unless your timing is really good you’ll typically lose money buying UVXY shares.

Hi Vance,

I have a strategy that I believe could be bullet-proof for an ETF like this.

Any chance you can review my thesis?

Hi Jeff,

Sure, I’ll take a look. My email is [email protected]

— Vance

Hi Jeff, may i see your Thesis as well ? [email protected]

Hi Vance

Thank You for Your insights!

In Europe we are not allowed to buy it as an ordinary share, but if I buy/sell it as an CFD I know I gotta be carefull, or it will be expensive!, what is Your take on that?

Kind regards Carsten C

Hi Carsten, Sorry I don’t know anything about the CFD process. My apologies for the slow response.

Vance

when next reverse split now ?

Hi Brijesh, I’m expecting the announcement any day now. Usually they give a couple weeks notice so I’m guessing mid-February.

Next reverse split coming ?

Hi Brijesh, I’m predicting 16-Jan-2018 Vance

Hi Vance,

Any idea when UVXY will reverse split again #9 ?

Hi Brittloren, I’m predicting 16-Jan-2018 Vance

Hi Vance, Thanks for your insight and experience in this fascinating area. I’ve searched and can’t find info on this, but might have missed it.. I’m short jul 17 UXVY 9.50 puts [which now show up in optionsXpress as UXVY1]. The underlying displays as 30.93 which would seem to mean I’m safely OTM ! but as the price of the option has doubled you can understand that I’d like to get a better grip on what’s going on. The option chain in OX shows pricing for 9.50 and 9.50* the latter being the UVXY1 series. Can you help me find the real exposure which my 9.50put represents, please?

I’m also an OPEX customer (soon to be Schwab). Just keep in mind that the old options are now for UVXY1 and not UVXY and that the price of UVXY1 is simply .25 * UVXY.

Question for the board. I sold two UVXY calls for $9.50 which at the time of the split were worth about $4.50. My P/L showed a $1000 gain. With the reverse split the options are $4.45 and my P/L shows $0.00.

My understanding is that those calls now control 1/4 of the share but shouldn’t the P/L be the same? Or am I missing something.

Thanks!

Help! had UVYX puts, $8 strike with Sept 1 exp. before the reverse split… my brokerage says the new symbol for the option is UVXY1, but nothing comes back on that quote request? I also tried CBOE.com, and not recognized either? I’m concerned I am being taken advantage of based on liquidity. The new reverse split option should be tied (LOCKED) to some factor that of its current equal (after all, it has the same value at expiration ) Net, I want to simply get to a current equivalent trading put symbol with generally the same strike and expiration… any ideas/suggestions? Thank you in advance!!

Hi Paul,

UVXY1 is just 25% of what UVXY is trading at. It might take a couple days but your options should show up in the “adjusted” options chains (make sure you’ve turned on the capability to see adjusted options). They will now control 25 shares of UVXY instead of the 100 you had before–so it all nets out the same as the reverse split. The bid/ask spreads will probably be quite wide but assuming you are long the options you can exercise your options if you can’t get a fair price from the market maker. It’s always fair game to do limit orders on options trades that are inside the bid / ask spread (start around mid way). If you exercise your options or if they are assigned your broker will transfer the requisite number of shares out of your account, so unless you want a short position you should be ready to buy shares right before the exercise or be ready to cover the short position. If you go the exercise/assignment route make sure you have the appropriate amount of buying power.

Vance

I have just started becoming interested in these concepts, and I find the whole reverse split thing stange. Is there not a limit to the number of times a stock can be reverse split? UVXY has done this 8 times already as of today. How much longer will UVXY be trading if it has to keep doing this?!

Hi Darren, There is no limit to number of reverse splits. As long as the fund has sufficient assets (it has around $385 million now) the issuer will continue reverse splitting it. It would have to drop below $50 million or less before ProShares would consider discontinuing it.

What controls the size of the assets of UVXY?

Hi Kevbo, The asset size is determined by how many people are willing to buy UVXY shares. When a fund starts there’s usually some seed money that is put in by the issuer (e.g, 20 million) , but after that it’s a process of how many people are buying UVXY shares vs number of people selling shares. If the demand is high enough that the market price is being driven higher than the value of the underlying asset then entities called authorized participates will go to the issuer (ProShares) in this case and give them money in exchange for shares to use in satisfying the demand.

ETFDB.com is showing UVYX as having $400M in AUM, which is assets under management.

Best Regards, Vance

Thanks for the answer again Vince. But, as so many people want to short UVXY, surely there is an inbalance that will result in more people selling than buying, thus driving down the asset size long-term? I may have this completely wrong……….

Thanks for the answer.

I suspect that the July 17, 2017 reverse split is 4:1 because option contracts on lots of 100 shares expiring January 20, 2018 were available just before the last two 5:1 reverse splits, and this way those option contracts will be adjusted still to apply to a whole number of the new UVXY shares (100 / 5 / 5 / 4 = 1).

HI Adam, Very interesting. My first reaction is why ProShares would care, but having to cash out those options due to a fractional share count is going to make someone unhappy–maybe they leaned on ProShares… Thanks!

Hello Vance,

I have much respect for your knowledge sharing on this post in particular on UVXY options trading & its mechanics.

I’d be grateful for your advice :-

I have now several short call options on UVXY at strike prices ranging 28 – 30 expiring Dec 2017 and intend to hold them till expiry worthless. But with the reverse split that is forthcoming in 2 weeks time on 15 July 2017 and assuming the underlying price before split remains at $9+ , will I be in trouble with margin call or worse, be assigned in the shares, just so because the prices are being multipled from the current $9+ to become $9 X 4 = $36?

Thank you.

Hi Coco,

No need to worry. You’ll be fine. Your calls contracts will be adjusted (number of shares controlled per contract) such that their value does not change even with the new reverse split price.

I was also confused by this the first time I dealt with a UVXY split. I had conversations with my broker and in fact OCC and it still wasn’t clear. That was until I realized that the old options point to an underlying of UVXY1 *not* UVXY (after the split)! And the press release states in small letters that the price of UVXY1 is .25 times UVXY. Then the math all worked out.

Vance I have a question about the section on Reverse splits for UVXY, if i own a 2 puts @ 7.00 when it reverse splits will i own a .4 puts @ 35.00, expiring i January 18, now if before it expires I buy from the market 40 UVXY will I be able to exercise my Puts ? what if I own 5 puts will it be 1 put of UVXY2 with very low liquidity?

Hi Himanshu, With a reverse split the number of option contracts doesn’t change, but the options refer to a different ticker (e.g., UVXY3) and the number of shares controlled will be 20 rather than a 100 (assuming a 5:1 reverse split). 40 shares of UVXY would be required to exercise your puts. If you have 5 puts now you will have 5 puts post split. Yes, liquidity will probably not be good.

Hi Patrick, I came up with July by projecting when UVXY would drop below $10, that’s usually when they initiate a reverse split. Split should happen within a month or two.

Hey Vance, I just was looking at all my short uvxy calls and thought a reverse split was coming soon. I googled it and found your post from last Friday. What a coincidence! My only comment on your post is that the illiquidity of the calls after the split is, in my mind at least, definitely material. You can’t get rid of them once the price adjusts. So I would say that’s material. Even though the split math supposedly protects the short seller, the market says, NO WAY. But you do acknowledge the illiquidity in your post. Happy trading…

Hi Vance,

I have been keeping up with this post for the past 6 months. I’m currently interested at looking at the old option chains prior to splits that are close to expiration. Do you know where I can view those? My current platform is eoption.

Hi Alex, As far as I know none of the brokers keeps their option chains around after the options expire. You would probably have to buy historical data in order to get that information.

Vance

Wanted to note something – you said there is no material impact – I had a UVXY position when last reverse split happened and I got charged $20 by Scottrade for “PROSHARES ULTRA VIX ST 2X Reorg Fee”

Just so happened that I had both a short and a long position and got charged $20 for each.

Vance – Happy holidays and thanks for the post. I had a few questions here: 1. UVXY has had only reverse splits thus far. So how do I explain strike prices such as 1.5/2.5/3.5/…in the Jan’17 option series? I understood from your post that the strikes remain unadjusted when there are reverse splits. Did the market maker introduce these fractional strikes for some other reason?

And 2. It’s only logical to me that, starting from the day after the reverse split, any options trader looking to open new positions would want to trade standard contracts that control 100 shares. Does that not naturally mean that the liquidity of the old series will be limited?

3. How exactly would I pull up the old option series on my broker platform (options house in this case)? I tried UVXY2 and UVXY1 and had no luck.

Thanks again for all the valuable info.

Hi rttrader,

Regarding the fractional strikes, for a series like this that’s be around a long time the market makers will sometimes create options that are far out of the money, SPX for example has strikes down to 100 on some series. Some possible uses for these options might be their IV and gamma characteristics–which tend to be pretty interesting for institutional traders. The fractional strikes are probably just to give finer resolution–the percentage difference between 1 and 2 is pretty big.

You are correct, the volume on the adjusted options is low and their bid / ask spreads are wide. Liquidity is probably ok, because the market makers are typically the primary source of liquidity anyway, but they won’t be giving any bargains. The longs still have the right to exercise, which keeps the market makers sort of honest, and the shorts can just wait until expiration to guarantee a fair price.

Regarding the chains for adjusted options, all the ones I’ve seen are listed under the primary ticker (e.g, UVXY). There’s usually an option to turn on visibility of adjusted options somewhere. You might have to give your broker a call if you can’t find it;

When do I get the cash payout ?

I’m guessing the payout on the fractional shares will be on the 28th or 29th. It won’t be much, maximum payout will be around $25.

Making uvxy2 20% of uvxy in terms of strike price means a a $10 option that was 4 dollars off the money before the split is now 20 dollars out of the money. This is the position I am in. How on earth can that be fair? How can uvxy moving from $4 to $10 be the same as it now moving from $30 to $50. How can no one have started a class action suite against the clearing house for these kinds of practises? Or am I misunderstanding something?

Hi Doug,

The key is to view things in terms of percentages, not absolute dollars. Is a $0.1 move in a $10 stock any more likely (or lucrative) than a $1 move in a $100 stock? The same for UVXY, a $20 move on a stock priced at $30 is just as likely as a $4 move on a $6 stock–both 67% moves. One apparent math error in your comment, I think your “$4 to $10” comparison should be $6 to $10.

Vance

Thanks for the reply and the math correction Vance. I did start to think that way myself but then I looked at the $30 price of UVXY and if I were buying I would go for a $35 option. I have a hard time believing that the option calls for $50 are going to be trading for the $.35 that the 10 calls were trading for prior to the split, but my system can’t pull up any quotes for the new or old options right now.

Offhand I’d guess they would be trading at around 1.75 because the notional value is 5X higher. 100 shares worth ~ $3K vs $600 before.

hypothetically, lets say I could see the future and knew that over the next year or 2 we’d see an ’08 like crash in the markets, if not, worse. would UVXY be a good buy or is there a better option. I know it seems like a ridiculous question and ive read some of your posts about UVXY being bad in the long run. but would it work in this hypothetical scenario? if im looking to “win the lottery” (as i believe you put it). is there another option that could provide me with that level of return without the steady decrease in value?

Yes, during the August flash crash a few months ago UVXY went from in the low 20’s to 87 in less than 2 weeks. When people sell in a panic, volatility is a good place to be positioned.

Look at the pricing on some of these NS contracts. It looks like if you buy them with a view to exercising them into UVXY common you get a pretty steep discount on the time value. Or am I totally missing something?

Hi, Don’t know what “NS” is, near strike? Very much doubt a good discount, could you give specific exp date, strike, price?

— Vance

Sorry about that Vance. “Non-Standard”. Look at 16 Jan 20 2017 UVXY Non Standard, 20 Share Contracts. They trade at .65. Yeah you have to buy 5x more but that is a huge discount to the Standard Contract premium of 6.20

So will UVXY and VXX will they just be able to continue to reverse split forever? (I assume they are trying to keep the price in a certain range) Is there some sort of limit or wall that they will run into eventually and force them to stop?

Hi Iyad, No, no limit. They can keep doing this indefinitely.

— Vance

Everywhere I have gone to read about UVXY reverse split, “they” all say, “The Options Clearing Corporation adjusts for the reverse split by changing the number of shares per contract from usual 100 to 20” Nothing to Worry about. Everything is still Equal.

Im sorry but everything has changed. No one will trade Non-Standard lot Contracts of 20 instead of standard contracts of 100. Essential your up front cost basis has now been 95% guaranteed lost because you have been knocked out of the market you thought you were in in the first place.

This is what has changed, and all things will not be equal when a stock splits or reverse splits, for option contracts…and strangely enough, it translates into options for a loss by Market Ejection, more than, the normal arena of win/loose by Price declination or promotion.

A buyer has know way to pinpoint exactly when a split might happen, if it all, is still in question as well. If The Clearing House Corporation thinks the Option Contracts retain “of equal value” after a split, and are OK creating a non standard product after the fact, then The Clearing House Corporation is a participant in unfair business practices and should be investigated further.

If Option Trading is a Zero Sum Game, and Volume diminishes to near zero on the thousands of adjusted options contracts that are now, non standard, and no one wants to participate in a market for them, thus rendering them ill-liquid, is that a fair market to the purchasers of the contracts in the first place looking for a market?

Last Question….so where, or who, does all that money go to??? Follow the Money….Truth be Told.

Hi Sean,

Can you give me a specific example? Looking at the adj option chains there is volume and bid / ask spreads that look functional. I don’t doubt that the liquidity has dropped dramatically, but are the spreads that far out of line?

— Vance

Hi Vance, you mentioned that in the past year erosion due to contango has slowed to 60%. Any idea what sort of market conditions are causing the slowdown, and whether the decay rate should continue to slow, or rebound to the rates of past years?

Split Bitch!!! $UVXY

Boy am I glad I didn’t hold any UVXY options into the 1/24 expiry. My brokerage was a mess, showing no bid on my puts (for later expiries). I’ll keep this in a mind and be sure to close positions before reverse splits if I have an option expiring shortly thereafter.

Hi Andrew, Yes, when I was looking at it last night it looked tailor made to screw up broker software. It certainly hurt my head. The SVXY split adjusted the contract multiplier and the strikes–it looked very reasonable. Any ideas why the reverse split was handled differently?

I’m not sure why they decided to handle the split this way. My brokerage seems to be handling it properly now. It was a bit of a wake up call on Friday to see that I probably would have had to phone in the order if I had to close a position then. I would hope they don’t schedule a reverse split around the time of the monthly option expiration.

I think I figured it out. Using the basic approach used for regular splits for reverse splits would sometimes result in fractional contracts, which would be unacceptable.