Update: In June 0f 2018 UBS delisted these funds. The funds performed pretty much as expected but never gained enough assets to be profitable for UBS.

The indexes that power VelocityShares new BSWN, LSVX, and XIVH funds have been live since 2011, but they haven’t been directly accessible via exchange traded products until July 2016. The goals of these new funds are pretty straightforward, on the long side BSWN & LSVX track upside volatility with some fidelity while minimizing decay costs, while XIVH captures the premium typically available by being short volatility, but with a hedging component to reduce drawdowns during corrections and bear markets.

The technology backbone of these VelocityShares funds is quite simple—and counter-intuitive. Each of these Exchange Traded Notes (ETNs) tracks a mix of both long and short VIX futures. You’d think that the short and long positions would just cancel each other out—but they don’t.

The long positions are managed as a 2X leveraged fund (similar to TVIX), and the short positions as a –1X inverse fund (similar to XIV). Both long and short positions use daily end-of-day rebalancing to keep their daily percentage moves consistent with the moves of their underlying index (short term VIX Futures—SPVXSP) and their leverage factors. By selecting the weights of the long and short positions in these funds VelocityShares positioned them at three different points on the volatility spectrum—ranging from volatility spike catcher all the way to hedged inverse volatility.

The baseline allocations / strategies for these three funds are shown below:

| Ticker | 2X long % | -1X short % | Strategy |

| BSWN | 45% | 55% | Tail Risk (strong long bias) |

| LSVX | 33.33% | 66.67% | Long / Short (long bias) |

| XIVH | 10% | 90% | Hedged short volatility (strong short bias) |

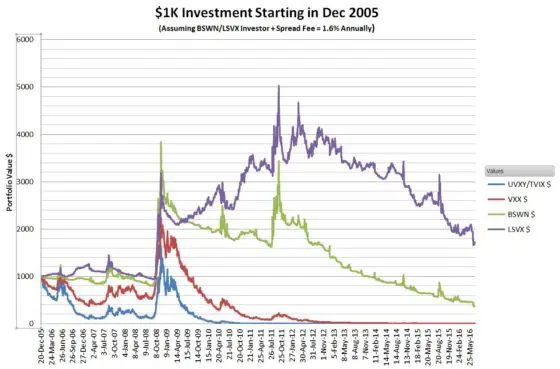

The chart below shows the simulated behavior of the two longish funds against the popular VXX and 2X leveraged UVXY / TVIX.

This simulation shows that the BSWN and LSVX portfolios managed to retain an impressive amount of value ($368 & $1724 respectively) over an eleven year period while the VXX and UVXY/TVIX portfolios withered away to nothing ($2.86, $0.00008) respectively).

The next chart shows the simulated behavior of XIVH compared to the popular XIV and SVXY -1X inverse volatility funds.

Wow, quite a ride—including a peak value of more than $12K for the XIVH portfolio followed by a drawdown to half of that in less than 2 years.

Over this time span, the 2008/2009 bear market was the key differentiator between these two funds. The 2X long allocation of XIVH’s portfolio beautifully protected it during the financial crisis.

The chart below compares the two funds starting immediately after the 2008/2009 bear market.

When starting in April 2009 XIV/SVXY has better absolute performance, but XIVH’s volatility and drawdown percentages are better. XIVH’s drawdown percentage during the 2011 correction was half of XIV/SVXY’s.

The Trend is Their Friend

Leveraged funds actually perform better than their leverage factors in trending markets. Consider the example of a hypothetical 2X leveraged fund where the underlying fund goes up 10% a day for three days:

| Day | Underlying % | Underlying | Underlying Cumulative % gain | 2X leveraged

With daily reset |

2X fund

Cumulative % gain |

| Day 0 | 100 | 100 | |||

| Day 1 | +10% | 110 | 10% | 120 | +20% |

| Day 2 | +10% | 121 | 21% | 144 | +44% |

| Day 3 | +10% | 133.1 | 33.1% | 172.8 | +72.8% |

Instead of the 66.2% gain you might have expected from the 2X leveraged fund, it went up 72.8%—a 6% bonus. See this post for a real world example of how the 2X long TVIX overachieved in this fashion.

Leveraged funds can also lose less than you’d expect in markets that are moving against them—if the underlying is strongly trending against them the percentage losses in the leveraged funds will be less than the leverage factor would indicate.

Winner Take All

The other key attribute of these funds is a “winner take all” characteristic. If there is a volatility spike the 2X long portion of the portfolio grows rapidly and the inverse portion shrinks rapidly. Fund allocations (e.g., initially 45% long, 55% short) dynamically shift towards the long side of things during a volatility spike –exactly what you’d like to see happen. Conversely, if volatility is slumping the funds dynamically shift their allocations towards the short side.

Some Reset Required

There are some downsides to using this long / short technology. With an unconstrained “winner take all” strategy the losing side of the portfolio shrinks to the point where there’s nothing to build on when the trend reverses—and the trend will always reverse. To address this issue the funds do periodic resets back to their initial weighting factors. However, this resetting introduces another problem—path dependency. Not only does it matter how much VIX futures move in price, it also matters when the VIX futures move relative to the reset schedule of the funds. For example, if a volatility spike occurs right before a reset it can have a significantly different impact on the fund’s value compared to a spike right after a reset.

The funds take a two-tiered approach to mitigate path dependency. Each of the funds is rebalanced back to its target weighting quarterly and there’s a weekly rebalance of a rotating subset of assets within the funds.

Volatility of Volatility is a Drag

Another downside of these funds is that they don’t do well if the values of the underlying VIX Futures are choppy. If VIX futures are up strongly one day, and down sharply the next these funds will suffer—both their trend compounding and their “winner-take-all” strategies take multiple days of trending action to work well. When volatility of volatility is high it drags down the performance of all leveraged funds—both long and short.

Not Great at Black Swans

Volatility spikes that ramp up quickly (e.g., flash crashes, overnight geopolitical / economic surprises) are not captured particularly well by the longish funds (BSWN, LSVX). If these funds are operating close to their target weights then the short side will significantly drag down the performance of the 2X long side during quick volatility jumps.

The short volatility oriented fund, XIVH would be at some risk of termination if a historically unprecedented volatility spike (e.g., VIX spike of >70%) occurred. These funds terminate if the intraday indicative value drops 80% or more from the previous day’s close. If this situation occurs the holder would likely receive somewhere between 0% and 20% of their previous day’s holdings in cash (no lower than zero). XIVH would be significantly less likely to terminate than standard inverse volatility funds (e.g., XIV/SVXY) because it maintains a 2X long position also.

No Signals Need Apply

Most volatility funds that aren’t just pure long or short plays rely on algorithms to monitor market parameters (e.g., VIX moving averages) and then generate signals that cause allocations to be shifted. I’ve listed some of these funds and the parameters they monitor.

| Tickers | Parameters Monitored |

| VQT, PHDG | S&P 500 volatility, VIX 5 & 20-day moving averages, Fund losses |

| VQTS | S&P 500 volatility, VIX Futures Term Structure |

| XVZ | VIX term structure (VIX/VXV) |

| VIXH | VIX Future absolute prices |

BSWN, LSVX, and XIVH and two other VelocityShares funds (TRSK and SPXH) do not make allocations based on signals, nor do they rely on any characteristics outside the underlying short term futures themselves. They don’t shift allocations based on the term structure between short and medium-term VIX Futures, VIX term structure, VIX volatility or S&P 500 historic volatility.

I think this self-sufficiency is a significant advantage. The volatility landscape is relatively young, with VIX futures only trading since 2004. The interplay between VIX futures of various expirations, the VIX, and equity markets has evolved over time and I don’t see any indication those relationships have stopped shifting. By avoiding linkages to these factors BSWN, LSVX, and XIVH should exhibit more consistent behavior over time compared to the other strategy funds. But to be clear, they do have their dependencies—specifically the trendiness and volatility of the underlying short term VIX futures index.

Complicated Fee Structure

The issuer of these ETNs, the Swiss bank UBS, has levied a complex transaction fee in addition to the annual fee (1.3%). The “Futures Spread Fee” captures some of the costs associated with the daily rebalancing of the funds’ long and short positions. I’m guessing this fee will increase the annual costs associated with owning these funds by around 0.3%.

Low Volume and Low Asset Base

Initially these funds will have low volumes and relatively low asset levels. This naturally leads to concerns about liquidity. In reality, the liquidity of all Exchange Traded Products is critically dependent on the nature of the underlying securities they track. If the underlying index of an ETP is based on small-cap stocks in a 3rd world country then great care is required for all but the smallest trades, however in the case of these VelocityShares ETPs, their underlying is short term VIX futures—which are high volume, very liquid securities. As a result, traders will find that with a little care they can make large purchases or sales without significantly shifting the prices of these funds. For more information and suggestions on trading low volume funds see Evaluating ETP liquidity and Trading Low Volume ETPs.

Hedging Hurdle—How Much Decay?

Funds that are effectively long volatility are attractive candidates for hedging equity portfolios because volatility reliably spikes up when stocks plummet. Unfortunately when the market isn’t panicking long volatility positions often decay quickly. One approach to get around this decay is to apply these hedges only during high-risk times. However, corrections / bear markets are notoriously difficult to predict—if crystal balls were that good there’d be no need for hedging. Since BSWN and LSVX’s decay rates are relatively low holding them all the time becomes a viable option.

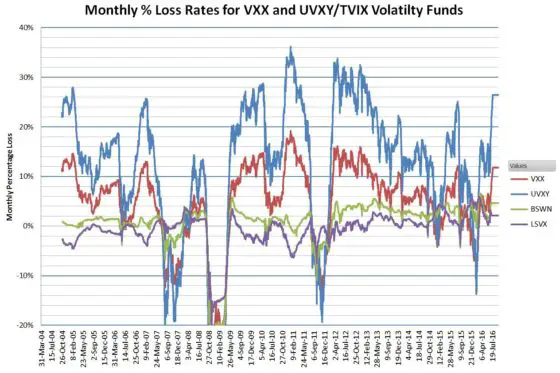

The chart below shows historical monthly decay rates.

This simulation shows that the decay of VelocityShares’ BSWN and LSVX would have been dramatically lower than TVIX/UVXY and VXX during relatively quiet markets—BSWN decaying mostly in the 1% to 2% per month range and LSVX running in the -1% to +1% range.

How Much Oomph do BSWN and LSVX Have?

While low ongoing losses are very important for any potential hedge strategy it’s also important to know how much these funds will likely jump when a volatility event occurs. This jump data helps establish the required “hedge ratio”—the percentage of a portfolio’s assets that should be held in a long volatility fund to compensate for the losses in the rest of the portfolio during a market correction / crash.

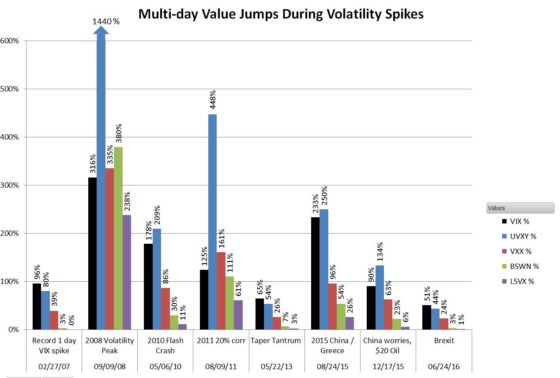

The chart below shows the peak percentage increases in VIX, UVXY, VXX, BSWN, and LSVX during some historical volatility spikes—some of which lasted months, others a day or two.

Not surprisingly, in the jump category UVXY is the top performer for investible securities, with VXX coming in second most of the time. BSWN and LSVX perform very well during longer, more severe events—not a bad characteristic to have.

Traversing the Volatility Landscape

Volatility investing has been a minefield for investors. If you’re long volatility you expose yourself to devastating decay losses if your timing isn’t perfect. Alternately if you’re short volatility you risk being blown up by vicious volatility spikes.

VelocityShares’ long/short strategy funds allow us to mitigate risk on both sides of the spectrum using a technology that doesn’t rely on backtested volatility signals or VIX future term structure assumptions. The indexes the BSWN, LSVX, and XIVH funds are based on have been published since 2011 and have performed appropriately through a wide range of market conditions. I expect them to continue doing their jobs well.

Resources

- VelocityShares websites: BSWN, LSVX, XIVH

- Prospectus for BSWN, LSVX, XIVH

- Hedging Equity Volatility with VIX-Based Instruments

- Volatility Strategies Explained: Long & Short VIX Strategies

- S&P 500 VIX Futures Long/Short Strategy Methodology

- Chart of performance of long funds using log scale

- Chart of performance of short funds using log scale

I don’t understand how can the price for BSWN and LSVX have decayed faster than VXZ or VIXM? Both of them have lost almost 50% value in just past 6 month.

Exceptionally large negative moves for all three of these funds today.

Losses were 56%, 63% and 75%

Volatility has been too volatile.

This is a very “green” question but if I anticipated volatility, and was looking for a way to take advantage of that and also hedge a typical stock portfolio (or at least have something that would be out of correlation with the market in general) would I be better served buying ONE BSWN or LSVX or buying them as a pair? This would simply be part of my “alternatives” portfolio allocation whereby I have 20% of my portfolio roughly equally divided between direct investment (PSP), REITs, MLP’s and Commodities & pm or pm related companies (GDX). Just to give some context.

Why doesn’t the LSVX positions cancel out? For example, suppose I buy $0.333 dollars of of TVIX and $0.666 of XIV for a total of $1. And suppose, in one day, TVIX increases 100% which implies XIV drops 50%. Now I own $0.666 of TVIX and $0.333 of XIV for a total of $1. No change. What am I missing?

I wouldn’t worry about it anyway, because TViX will never increase 100%! It would be impossible to happen, and besides that if it did increase 100% it would immediately be shut down due to restrictions. Not to worry it would never happen anyway. Also, VXX moves along with TViX, so that is what you are getting wrong. They move together, 99% of the time. VXX could never drop while TViX rose. Don’t worry, because decay and contango keeps the ViX ETN’s pressured on the ground more than gravity. The most that any of these ETN’s would ever rise in a day is ~20% and that happens once every ten years or so, for a day or two. The rest of the time, they lose on average about ~5% a day. Stay far away from these and don’t believe the lies.

Large buying in BSWN today.

So is it plausible to say that a long(er)-hold strategy using BSWN that looks for a market correction could involve also involve brief, interspersed add-in positions with UVXY aiming to capture rapid, terse selloffs but not necessarily broader corrections? Is that the way to sort of “cover the bases”?

Hi James, I’m not sure I understand your question, but I think you’re asking if UVXY could be used to offset BSWN’s sluggishness in responding to quick volatility spikes. If that’s your question my answer is yes. The challenge, as always is how to know when you put on those long UVXY posiitions. The decay can be brutal if you don’t call it exactly right.

Thanks so much. Yes, you clarified it correctly.

Separately, I’ve looked through the site but can’t find what I’m looking for. Have you done any studies into trading non-VIX vehicles that can be triggered by VIX activity but are not VIX ETFs/ETPs themselves? For example, trading correlated instruments gold, oil, currency, etc? I’m interested in avoiding some of the sheer circumstantial difficulty (decay, mostly) that other kinds of products won’t have as much of. It’s hard enough to time and hedge. Many of these VIX products devalue themselves and as a result bring an additional complexity. Have you looked into trading other vehicles with VIX as the indicator?

Thanks for this very informative write up. One wish though: could you please consider switching to log scale for the price/returns charts. Linear can blow even subtle local differences out of proportion as seems to be the case e.g. with xiv vs xivh most of the time, which makes such graphs pretty useless as a visualization device.

Can anyone help explain why BSWN has dropped the last 3-4 days while volatility is rising rapidly? I get that due to the short component it won’t track VIX as aggressively or perfectly as things like VXX, but I am surprised at the large down move in the face of a few days now of volatility spiking. What am I missing (other than patience-ha!)?

Hi Scott, Unfortunately BSWN & LSVX are no help on the relatively minor downswings, it takes a significant correction or a bear market for them to really do their thing. It takes sustained downswings for their long / short portfolios, which start out relatively balanced (to minimize contango losses) to shift to the point where the long vol portion is dominate.

Thanks for the response. That’s exactly the way I understood it as well, and am glad to just hear it as confirmation from another. I was not expecting anything immediate, yet I was a bit surprised at the down move vs. just kind of “standing pat” until the move either increased in amount or lengthened in days. All’s good.

For now these ETPs seem like they are traded by appointment.

Until they have a track record there won’t be much volume on these. However, should be able to trade large amounts within the spread.

Hey Vance as a Product, I think there would be interest in a simulated history like you’ve done for vxx , xiv etc.

Hi Hans, Link to spreadsheet purchasing information. https://www.sixfigureinvesting.com/2016/08/backtest-simulated-bswn-lsvx-xivh-etn-from-2004/

Hi Vance, Fascinating products, thanks for the article. Any chance you could share/post the calculated share prices for these funds you’ve generated for your analysis? Or barring that, perhaps a simple-to-follow explanation of how the historical share prices can be estimated from the historical index values?

H Bitfool, Share price simulations: https://www.sixfigureinvesting.com/2016/08/backtest-simulated-bswn-lsvx-xivh-etn-from-2004/

If you have the underlying index information (e.g,, SPVXVST for LSVX) then the share price is approximately a static “k” multiplier on that index. Fees complicate this considerably if you need them to be included. This post discusses that issue: https://www.sixfigureinvesting.com/2013/11/backtest-on-vxx/

Vance, thanks for all the great efforts. When you talk about termination, Brexit was an eye opener for how bad SVXY or XIV could move over night. My question is are there not any circuit breakers or limit up/down protections in the VIX futures market that would kick in before these short VIX ETFs collapse? Do you think it’s just a matter of time before one of these terminates?

Hi Gavin, There are halt processes associated with VIX futures https://www.sixfigureinvesting.com/wp-content/uploads/2016/08/VIX-Futures-trading-halts-a.pdf At this point I don’t know how effective these would be at preventing a termination of the inverse VIX ETPs.–at face value they seem like they should be enough to prevent an 80% intraday move.

I completely disagree, seems like it wouldn’t even need a level 2 decline in the es futures to reach the 80% threshold.

I saw vx1 rise 75% with the after hours lock limit down of 5% overnight after the brexit vote.

So surely an event close to triggering a level 2 halt (13%) on the ES would already have been enough.

As long as the decline is limited to a level 1, is xiv safe.

Vance, do you expect XIVH to perform better going forward than XIV like it would have in late 2008 once the markets got choppy? Or would you stay the course in XIV if you had to choose between the two in the near term?

These products make too much money to terminate. The creators would rather jump off a building than default on one of these products. There is a fictional story that says that these ETF’s will terminate if they move too much in one day. But, they only provide the fine print to lure you into thinking it could actually happen. These products were around during the 2008 crash and did what they should have done, mostly, I’m sure the holders then would of appreciated a bit more upside. All I know is the contango and decay in these products are a joke. They are only good for short term intra-day option plays.

“There is a fictional story that says that these ETF’s will terminate if they move too much in one day. ”

It’s clearly defined on page 5 of the prospectus for xivh and I know for a fact it’s defined in xiv’s prospectus as well, so perhaps your definition of “fiction” is wildly at odds with the dictionary and commonly accepted usage.

I bet anybody 1 million that these charts are not even close to the real results!!!! 1 million right now!!!!!!! Notice how after the first chart the negative truths start to emerge about these funds! I am sure that they will not be as bad as the current options, but they won’t be much better either. It is best to leave these to rot! I wish I could start a boycott of any of these decaying, contangoed, expensive expense ratio funds! That is my life dream! Take these funds and shove them you know where! They are a disaster, they will turn your six figure investment into six fingers cut off because you owe the Russian mob after the decay and contango set in!

Thanks for sharing. Very excited to see how they trade going forward.

I’d love to see these new funds take off.

More importantly though, I’d like to see enough liquidity in the weekly vix futures for trading.

As of right now they only serve as a pricing mechanism .

A tight spread in those markets in my opinion offers huge flexibility that we don’t have now.

These products will take off every once in a while BUT, they will take DOWN much faster due to decay and contango. These products are like a mexican jumping bean…. the only problem is that gravity weighs heavier than the jump! If you happen to get very lucky and time these products at the right time and they go up make sure that you sell your win quickly before these products go back down when they should still be going up! And, if you buy and they go down, when they should be even or going up, then I have no advise except for think to yourself, “there is nothing I can do about it now, it is too late, I am stupid!” There is about 150 days a year, when the market goes +up ~.15% and all these products -lose ~6%. That is when there is no escape and every angle is a losing proposition. It is similar to playing texas hold-em, but you are the only player that must use only one card and you have to show everybody what the card is pre-flop. BUT, every once in a while you will still get lucky, just make sure to cash out quickly!