Update

On September 26, 2018 REX ETF shutdown VMIN. See this link for the newsrelease. The 2018 market was not friendly to short volatility products and VMIN never recovered its asset base after the 5-Feb-18 Volatility Tsunami.

March 2018 Update

As of March 7th, 2018 VMIN will shift its trading strategy to use longer-term VIX futures with 3 to 5 months until expiration in addition to it holdings of short term volatility Exchange Traded Funds. I’m estimating that this new strategy will result in a leverage factor of around -0.53X of the short term index futures index SPVXSTR that VXX is based on. This change was likely in response to the events of February 5th, 2018 when a massive VIX futures spike occurred in the last 30 minutes of trading. This change to VMIN will make it less susceptible to a termination event if VIX futures were to increase 100% or more from the previous day’s close. This leverage change will likely reduce VMIN’s performance when VIX futures are in contango and reduce its price decreases when VIX futures fall. I have not updated the content of the post below to reflect the strategy—I will when the details of the change become clearer. REX ETF Press Release

———————————————————————————————————————————————————————————

In May of 2016, REX Exchange Traded Funds introduced two volatility oriented products, VMIN and VMAX. One is a bet on market volatility staying the same or dropping (VMIN) and VMAX is essentially its mirror image—betting on short term volatility increases. VMIN has some important structural and performance related differences that distinguish it from the other short term inverse volatility funds—VelocityShares’ XIV and ProShares’ SVXY.

In this post I focus on VMIN’s differences from its competitors. If you are new to inverse volatility investing I suggest you review the fundamentals by reading How does SVXY Work?

For a good understanding of VMIN (full name: REX VolMAXX™ Short VIX Weekly Futures Strategy ETF) you need to know how it differs from other inverse volatility funds, what it tracks, its risks to the investor, and how well it has performed.

How Is VMIN Different From a Performance / Tax Standpoint?

- Far from being a “me-too” product, VMIN differs from its SVXY and ZIV competitors in a number of important ways. One key difference is that VMIN is designed to track the daily moves of the CBOE’s VIX® better than existing securities. VMIN is an inverse fund, so it generally moves in the opposite direction of the VIX.

- In addition to this improved tracking, VMIN also outperforms its competitors in taking advantage of the structural drag of VIX futures when their term structure is in contango. Contango exists when longer-dated VIX futures are priced higher than VIX futures that have less time until expiration. The VIX futures that underlie the volatility Exchange Traded Products (ETPs) are in contango around 75% of the time. In the May 2016 to March 2017 time period, VMIN outperformed its completion by 28% due to this characteristic, more than tripling during that period. In fact, VMIN was the best performing fund in the ETP universe in the first quarter of 2017, outperforming all other 23,788 funds, with a 35% gain.

- While VMIN is an Exchange Traded Fund (ETF) like SVXY, its tax reporting is the same as an ordinary equity investment with your short and long-term capital gains reported via 1099 forms. Because SVXY holds VIX futures directly tax laws require that it be treated as a partnership, reporting gains/losses via Schedule K-1 forms. While not a huge deal; K-1 forms are complicated and always seem to arrive very late in the spring.

- VMIN will make distributions of any realized securities gains at least once a year. In a good year this special dividend will likely be substantial (for FY 2016 it was $9.92/share). Neither XIV nor SVXY distributes capital gains this way—they have different legal structures (Exchange Traded Note and an ETF structured under the Securities act of 1933 respectively). Special dividends from VMIN or VMAX will be taxed as ordinary income.

How Is VMIN Different From a Structural Standpoint?

- For regulatory and performance reasons VMIN and VMAX are registered as actively managed funds. This was a first in the volatility ETP space; the rest of the volatility ETPs are passive funds that track a predefined index. These predefined indexes are inflexible in their investment strategies in that the index methodology specifies what securities to utilize and in what proportion.

- Being an active fund is key to VMIN meeting its performance It needs to utilize the CBOE’s relatively new Weekly VIX futures —a set of VIX futures expiring every week (more on this later). While they are improving, the weekly futures do not always have acceptable prices/liquidity so management discretion on trading strategies is required to make cost-effective investments.

- Active (rather than passive) management was also required for VMIN to avoid partnership style tax treatment. As a Registered Investment Company (RIC) adhering to the requirements of the Investment Company Act of 1940 VMIN can hold up to 25% of its assets in a private entity. In VMAX’s case, this entity is a wholly-owned subsidiary incorporated in the Cayman Islands. By utilizing the subsidiary to hold the VIX futures VMIN can benefit from the short VIX futures positions without holding them directly.

- The remainder of VMIN’s assets are invested in other volatility ETPs or cash. According to IRS rules for RICs no more than 25% of the fund’s total assets can be invested in the securities of any one issuer, so VMIN spreads out the rest of its holdings, typically by being short Barclays’ VXX, long Proshares’ SVXY, and long VelocityShares’ XIV. You can view VMIN’s holdings every day on their website. The image below shows a typical report on holdings.

What does VMIN track?

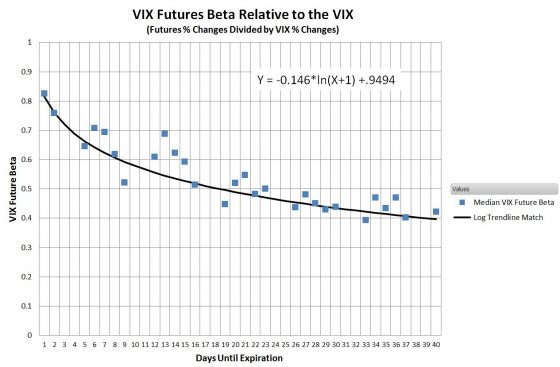

- VMIN and VMAX are unique amongst VIX futures based volatility ETPs in that they don’t track an analytical index—instead, it’s up to the fund manager to trade the fund’s holdings to achieve the desired performance. VMIN’s goal stated in the prospectus is: “the weighted average of time to expiry of the VIX Futures Contracts to be less than one month at all times.” The following chart illustrates the implications of that goal.

- This chart shows the statistical relationship of the ratio (called beta) between the percentage moves in VIX futures divided by the percentage moves of the VIX. This relationship tightens as the future approaches expiration. For example with one day until expiration, the median percentage move of a VIX future is a factor of about 0.85 compared to the VIX’s move. In comparison, a VIX future with 40 days until expiration will only move about 40% of the VIX’s daily moves. On any given day this multiplier might vary quite a lot (the standard deviation runs around 9), but over time the values center over these values.

- All the short term volatility ETPs except VMIN and VMAX track indexes that algorithmically roll contracts daily from the nearest to expiration standard monthly VIX Future to the next standard 30-day future such that the effective days until expiration of the combination stays right around 30 days.

- Before the introduction of the CBOE’s VIX WeeklysSM Futures this 30-day average was the best you could do with a volatility ETP that offered a consistent average time until expiration. Now, there are always futures available with at most 7 days until expiration, so theoretically an ETP could have an average time until expiration of 7 days. This theoretical ETP would have a beta of around 0.64 with respect to the VIX with compares to 0.45 for the 30-day average time till expiration of SVXY and XIV.

- Currently, the Weekly VIX futures don’t always have enough liquidity to support a passive ETP with a duration of 7 days, but the market is deep enough for the actively managed VMIN and VMAX to use Weekly VIX futures to achieve an average time till expiration of 20 days—delivering a beta of around 0.52. A 15% advantage doesn’t seem like a big deal, but with the sort of movement you get with the VIX it can make a significant difference.

Putting a Microscope on Beta

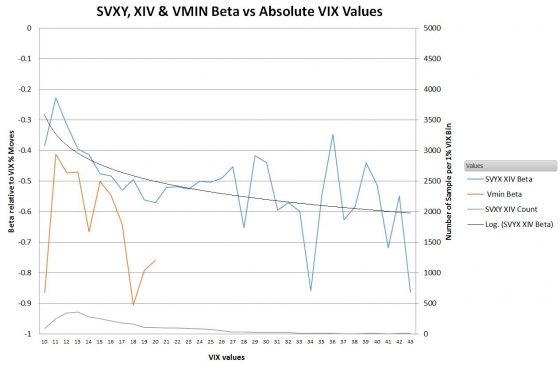

- While the overall historic median beta of SVXY & XIV is 0.45, and VMIN’s is 0.52 it is interesting to look at how beta varies depending on the absolute value of the VIX. The chart below shows that relationship.

- This beta curve shows that VIX futures, and ultimately the volatility ETPs are less sensitive to VIX percentage moves when the absolute value of the VIX is at low levels (e.g., 10 to 13). I suspect this is because at lower VIX levels the gains due to contango drag become larger relative to the VIX related moves. For example, when the VIX is at 10 a 1% move is +-0.1 points and the futures’ percentage move would be around half of that. The daily contango gain at that point might be a consistent +0.1 points (and tends to increase at lower VIX levels), so the combination would significantly dampen the beta factor compared to higher VIX levels where a 1% move would entail a larger point move.

- For VIX values above 25 the amount of SVXY / XIV data starts getting pretty thin, hence the noisiness in the chart, but the beta values for lower VIX levels are pretty solid. The curve at the bottom of the chart (which uses the scale on the right) shows how many data points there are for each 1 point wide VIX bin.

- Since VMIN has been operating for a much shorter time we don’t have nearly as much beta data for it, but as expected it exhibits a higher beta than the 30-day average funds.

Options are Available

- Options are available for VMIN and VMAX. Currently, the bid/ask spreads for the options are quite wide and the volume / open interest is tiny, but I wouldn’t be surprised if the underlying liquidity is reasonable for limit orders close to the mid-point between the bid and ask.

What are the Risks?

- Along with their impressive upsides, inverse volatility funds like VMIN, XIV, and SVXY carry considerable risks. The risks include the inevitability of volatility spiking up during a correction or bear market. Since its inception in 2010, XIV has experienced three major drawdowns, one over 70% and two greater than 50%. Because VMIN has a higher beta than XIV or SXVY it will likely suffer proportionally more. Buying and holding these securities is not for the faint of heart.

- Another risk is termination. If the VIX futures prices underlying these funds double intraday these funds will essentially be wiped out. You can’t lose more than your initial investment because they won’t go negative (unlike a true short position) but if things get bad enough these funds will receive margin calls on their short positions they can’t meet and the accounts will be liquidated. I’m guessing there may be somewhere between zero and 20% of the previous day’s assets remaining after such a scenario. VIX futures lag the VIX’s percentage moves in extreme situations but it’s not outrageous to imagine VIX futures jumping from a previous close of 14 to close at 28 given a bad enough financial or geopolitical event.

- Ironically, termination risk is higher when the market has been complacent. We are much more likely to see a daily 100% move in the VIX from 12 to 24 than a VIX jump from 24 to 48. We’ve never had a jump in VIX futures prices of the required magnitude, but it can happen, and probably will happen at some point. Be aware that multiple day volatility increases are not as destructive because these funds rebalance at the end of every day—effectively reducing their exposure. Three consecutive days of -35% would leave the fund down 73% overall, but the fund would never have been close to terminating.

How Have VMIN and VMAX Performed?

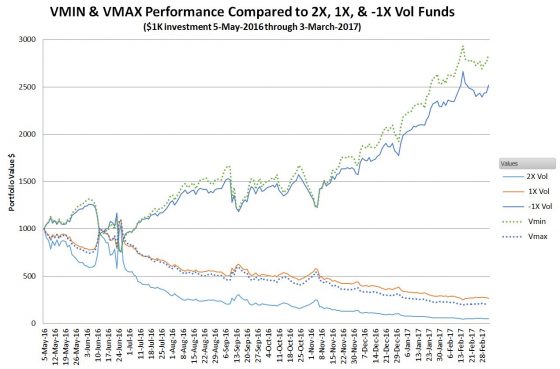

- With an active fund you might expect the managers to try and time investments to boost each fund’s performance, but VMIN and VMAX don’t play that game—volatility moves are notoriously hard to predict—instead they are totally focused on delivering a consistently higher beta. The chart below shows VMIN’s and VMAX’s performance relative to the existing 30 days till expiration volatility funds starting on their inception date of May 5th, 2016.

- VMIN’s performance over this period was exceptional, almost tripling in value, and not surprisingly VMAX suffered heavy losses. These new funds have demonstrated that they have created new performance choices. They offer higher beta’s and as a result, they will outperform the other 1X funds in favorable conditions (VXX, VIXY, VVVV, XIV, SVXY), while not decaying as badly as the 2X long offerings (TVIX, UVXY) during periods of high contango.

Always a Winner?

VMIN’s exceptional performance since inception won’t continue forever. Eventually, volatility will spike up again and end the party, but VMIN has demonstrated that its innovative structure can deliver superior results in the right circumstances.

Updated Dec 18, 2019

Vance, I’ve been searching the prospectus in VMIN for a while, but cannot find any termination/liquidation event like there was for the most recent disaster of XIV. SVXY doesn’t have one, and like proshares announced this week, SVXY will continue to operate in light of the historically disproportionate /vx move on 2/5/18. are you aware of anything in VMIN that would lead to termination?

I’m aware in the prospectus it says it could happen if it cannot cover the shorts, but we’re 2 days after apocalypse, and VMIN is still operating (on a lifeline, yes). However, VMIN on 2/6 and 2/7 is following the price trend of XIV (going down while /vx and vix go down), while at the same time SVXY is going up with the drop in /vx.

Hi Vance, thanks for all your much appreciated content, which I follow regularly. A question: do you know where the sudden huge drop in VMIN on December 26 came from? It fell from about 45$ to about 35$ and has stayed there so far.

Hi Patricio,

VMIN had a special dividend or around 10.32 / share. https://www.volmaxx.com/Data/Sites/9/media/docs/VMIN_Distribution_PR.pdf They are obligated by the way they are structured to distribute net profits to their shareholders.

Great, thanks. I also understand the drop on Apr 12 now, was ex-dividend, too

Hi Vance, I tried estimating the Beta of VIX to VIX Futures via regression on number of days to expiry but could not come up with the same curve as shown here. What was your methodology?

Thanks.

Joel

HI Joel, Sorry for the late response. My methodology was to take the daily percentage move for all active futures since March 2004 divided by the VIX move for that day. This data was indexed by the number of days the futures had until expiration. For example all the data points where the future has 3 days until expiration were grouped together and then I took the median value of those measurements. I also made a small adjustment to the VIX percentage value on Mondays because there is a significant negative bias (around 1.5% I believe) due to the way the CBOE does annualization on the VIX calculation.

Hi Vance, which data source did you use? I am using Quandl front month futures, settle price. Also did you have to manually index the days to expiry? Thanks.

Hi Vance,

Your site is great and I love reading it.

For last dividend of VMIN, the Declaration Date was 4/10/2017 and last Ex/Eff Date was 4/12/2017. Basically investors just have around one day to find this out and decide if they want to sell VMIN on 4/11/2017.

Do you think there is specific reason why VMIN creator has this plan and basically forces most of the investors to accept the big % of dividend? I don’t live in US so this is a big deal for me, since I would need to pay a very big % as tax if I accept dividend, but I don’t need to pay profit tax by buy low sell high.

Thank you.

Benjamin

Hi Benjamin, It turns out that REX ETF did issue a press release on 4-April-16 detailing the special dividend http://www.prnewswire.com/news-releases/rex-shares-announces-rex-volmaxx-short-volatility-fund-vmin-special-distribution-date-and-outstanding-performance-since-inception-in-may-2016-300434649.html I’d suggest setting up a google alerts search with the key words: special dividend VMIN to let you know when this is going to happen. I would also expect that they would post the press release on their website so in April you could start checking that daily.

Vance

Dear Vance,

Thanks and I just created a google alert. By the way do you think having special dividend would let potential investors buy Vmin at lower price? SVXY and XIV seem like would be just higher and higher forever.

-Benjamin

Hi Benjamin, Other than tax implications I don’t really see that there is an advantage one way or the other. VMIN effectively has higher leverage which can cut both ways.

Vance

Thanks. I read the 80% or more vix future raises would force the reverse vix etf issuer closes the etf. If there is another 1987 or 2008 kind of crash then how can the issuer pay the lose? Vix future would raise like 500% or more but etf investors only max lose 100%, who would pay the rest?

-Benjamin

Hi Benjamin,

The issue here is large one day moves of the VIX futures. For the inverse funds if there was more than a 100% up move in the index that VXX follows (a mix of the M1 & M2 futures) then the fund value would start to go negative. The issuer would terminate at that point or before so they are not out any money.

I understand the idea. It should be a safe method for the issuer since the biggest single day raise in vix history should be around 65% in 2007. But 1987 biggest single day raise should be around 300% to 600% then I think the issuer would be too late to cut. Well that is like one day record in 50 years.

Hi Benjamin, The issuer can terminate the fund any time during the day. They don’t have to wait for the end of the day.

Hi Vance,

I have enjoyed reading your site and learned a lot of invaluable information on trading VIX instruments. I was curious if you had any thoughts on the recent volatility spike and how VMIN behaved. It would appear that it dropped further than SVXY/XIV on the spike and recovered a smaller percentage after the spike. With a higher beta I would have expected a larger move down but I was a bit surprised by the lack of recovery.

Thanks!

Hi Eric,

This looks to me like a classic case of volatility drag. Compared to a straight long position an inverse, daily resetting fund like XIV or VMIN will lose value if it goes through an up/down or up/down sequence. For example if VXX goes up 10% and then down 9.091% it will end up unchanged and XIV will lose 1.8%. The greater the leverage the greater the losses in a move like this, so since VMIN had effectively higher leverage it lost more ground than XIV through the Aug 9, 2017 to Aug 15, 2017 sequence.

Hey Vance, I hope all is well.

Another random question, when you have time. Are VMIN and VMAX true inverses such that I can run a double short? I have double shorts on a variety of pairs that are more or less flat day to day but decay over the months. Is this possible with VMIN/VMAX? The charts suggest it might be but the splits are a little wonky on my software.

Thanks in advance for your time and have a nice evening.

Justin

Hi Justin,

Everything I’ve seen (including looking at the daily holdings) supports the true daily inverse assertion.

Hey Vance. Love the blog, long time vol shorter…. I read this comments thread and got down to the one about the 40/60 hedge and your response. Along the same lines I have a question. If you look at the short interest on vxx it is scary. I worry that the bubble out there right now is the short vol trade. If there is a large short squeeze in vxx could it de-couple from the vix? And I mean large… like something worse than August 2015… Did any of these vol etf’s exist in 2008? This has been the “best” trade since inception but I do worry about tail risk. I currently maintain a constant short position with a tail hedge using options and accept the return drag as simply risk management. But I do wonder if the etf’s could de-couple under severe conditions… thoughts?

Thank you for your time,

Justin

Hi Justin, In normal markets ETP’s like VXX by their nature are not subject to a true short squeeze. Unlike equities, creation of new shares by the issuer is a routine operation and the authorized participants are financially incentivised (via risk free arbitrage) to short overpriced ETP shares, buy the underlying VIX Futures and cover their short with new shares from the issuers at end of day. In a extreme market condition (e.g., VIX up 150%, front month VIX futures up 100%) I think we would likely see complicating factors like trading halts, spreads getting really wide, APs backing off from the market due to uncertainty, and overloaded software taking the APs or the exchanges off line. Given time these things can be sorted out, but a few things, like the inverse funds terminating with VXX moves >80% intraday would not get better with time. Ironically if there was a subsequent >50% collapse in VIX futures the 2X long funds (UVXY & TVIX) could also terminate. My simulations suggest this would have happened in the aftermath of the ’87 crash. VXX, the first volatility ETF started in January 2009, so we don’t have any real data during extreme volatility events. Bottom line, I think that the system over the course of a day or two will stay rational, but intraday those that have to move (e.g., because of margin calls) will likely get wipe out. If your tail hedge options keep you out of margin call territory then I suspect you would ride out the storm alright. Options have some nice alignment issues with the underlying–they won’t trade if the underlying is halted and their IVs will predictably skyrocket if the underlying volatilty goes crazy. Good news for a tail hedge position.

lol. Thank you for the clear response Vance, I apprecaite it. Hilarious timing on my part. Maybe the short vol trade will not “de-couple” as I asked last night but simply have out-sized moves versus the S&P. Enter today… it looks like at the low today the S&P was down around 1.5% but at the same time the vix had rocketed about 50%! At yes, at that time my tail risk options were actually solidly in the money. I was oblivious to it being in a meeting but was amused when I got back to my desk. Today is also a good example of why I pay for options instead of using buy stops… What an interesting day.

Hi Justin, It was an interesting day of vol watching. The VIX move was astonishing–reinforces my intuition that high percentage VIX moves are much more likely in low vol environments (VIX closed at 10.03 yesterday). VIX futures / ETPs were much more restrained–no signs of stress that I could see. Cool that your hedges worked well. Good data for you to see if you’re positions are sized appropriately. Big boosts in IV are helpful.

Hello Vance, Thank you for all your knowledge sharing articles and answers. if its not too much trouble, can you please advice: I am seeking a neutral position on UVXY/SVXY (1:2) and sell covered weekly calls at @5% higher strike price on svxy and @50% strike price on UVXY. can you please advice what could go wrong with this. and any ideas on picking the strike prices of SVXY (or the days to pick in a week). Thank you as always for all your inputs.

Hi Sunil, I didn’t do a detailed analysis, but a few observations: Your UVXY position will likely decay significantly faster than your SVXY position will increase. Your covered calls help that, but I doubt they will generate enough premium to make things profitable. The 2nd observation is that UVXY can increase more than 50% very easily which opens you up to large losses on your SVXY position where your calls will do very little to cover the large losses you would take on the short vol position if volatility really spikes.

Thank you for your answers Vance….

1. To handle the uvxy decay I am thinking a weekly rebalance or if something spikes to rebalance…atleast to contain. I will start observing this.

2. To handle the 50% or more spike in uvxy, a put at 25% of svxy is coming out to very reasonably.

How to chose svxy strike price has been tough call. Any advice on it please for a weekly call. Thank you for your time and have a great day

Hello Vance – Yet another informative article written very clearly! Thanks. I have a question about the capital distributions (or special dividend). What happens to the option prices right after such an event? In case of call option holders, it would be clearly a massive loss in value. But should I assume that the distribution would have been priced into the option premiums already?

Hi Vance – many thanks for all your amazing articles. I have a question which you have considered many times – regarding hedging inverse volatility position. What is your opinion on doing it by either (a) selling far out, deep OTM UVXY puts when the IV is high, or (b) similarly by selling SVXY calls deep OTM and far out, say to neutralize fraction of the delta? Of course they give only limited protection, but one does not have to go against theta decay. Hedging 50% of the inverse vix position might be more than sufficient. Eager for your comments!

I’ve been holding svxy for a few years now, and I hedge with svxy puts. (In hindsight I should have used xiv and hedged with svxy puts for k-1 reasons) anyway, what worries me is a termination event. Would svxy puts have value in a termination event? Or, would there be a cash payout to put holders? Just wondering if I should hedge with something else just in case

My expectation would be that the SVXY puts would reflect the final payout of SVXY if it terminated. The share price would be the remaining asset value of the fund divided by the number of shares outstanding. This would be an extraordinary event, so it’s possible there is some sort of escape clause buried in the legalese of the option contract, but I doubt it. It would defeat one of the primary attractions of options.

Vance

Thanks Vance, I kind of figured the same thing, plus I can’t see the put sellers getting a free pass either way. Still, I wonder what the official position is. I have limit orders to sell my puts at what would be a 60% or so drop in svxy to try to cash them in before the fund terminates, but in such a crazy scenario who knows what the liquidity would be. I might write to proshares to see what they say. I’ll post back if and when they reply. I’m sitting on an enormous gain with this and would hate to lose it.

Hi Vance, if I buy puts on SVXY do I suffer a double drag from the natural cost of contango and constant theta decay, in which case buying a 2x Long Vol fund maybe a more cost effective way to hedge as you’re only exposed to the cost of contango? In which case, I would greatly appreciate if you can help me understand why would someone buy puts on SVXY as opposed to buying a long vol fund or vice versa. Thank You 🙂

Hi Nicholas, SVXY does have both those drag factors, but the 2X longs have double the contango drag. Neither strikes me as a good way to hedge long term because of the ruinous decay factors. You might look at XVZ or BSWN, they have low enough drag factors that they are suitable for a long term hold.

Vance, would you use vxx or vmax to protect gains in XIV. Can a 40/60 vx to xiv type ratio keep one somewhat protected if they think the market is getting more volatile?

VXX and VMAX would both reliably move in the opposite direction of XIV. Doesn’t seem like there would be an advantage to do this vs just exiting the position other than tax treatment. Put options on SVXY would be another way to protect your investment that wouldn’t kill your upside.

Vance

My idea is that if XIV fells by 60% that VXX would likely go up over 100% and you’d still be profitable. In an extreme case would you expect VXX to go up 200%+ in the event that XIV terminates? I was thinking for tax reasons and timing reasons that a VXX hedge could make sense if one believes a XIV downdraft could come within months. Also seems easy to remove the VXX leg if XIV falls back into a lower range.

Hi Dph,

Normally, intraday XIV has just the same percentage move as VIX, but opposite sign, so I don’t see where your 60% / 100% numbers come from. If XIV dropped by 60% that’s not a termination level, so I would expect VXX to be up 60%. VXX is not leveraged so if XIV dropped -80% and terminated then VXX would be +80% at that point. If VIX futures kept going up after that VXX would keep increasing, but that would have already been an unprecedented day at that point.

Vance

Vance, I was under the assumption that in extreme events that VXX (and XIC) can trade beyond/below its underlying value. If there is enough buying/selling can it significantly depart from NAV (or equivalent)? What would happen if quant programs bought up VXX with aggression during a market swoon?

Hi dph,

Exchange traded funds have institutional partners, called authorized participants (APs) , that act to keep the funds trading close to their indexes. They do arbitrage operations that normally are essentially risk free when the funds trading values diverge from the indexes. The APs make a lot of money when the trading value diverges from the indexes–and their actions–buying and selling tends to diminish the tracking error. So bottom line, unless the underlying VIX futures are halted, or in a very chaotic situation VXX and XIV will likely track their indexes with not much error. Having said that, you are referring to extreme market situations so things could get unglued–but I think the more likely situation in that case is just trading halts (like occurred with XIV in August 2015).

Vance

Hello Dph, I am not an expert and I could be wrong. I try to do something similar 25/75 (uvxy/svxy).. The challenge is when to exit UVXY on the rise. Like in Aug 2015 episode, UVXY went up by 240%, while SVXY down by around 60%.. so only if we hold the position till that point, profits can’t be materalized. A month later UVXY is back to its previous lows while SVXY is still down by 40% or so from its previous high. As I said I am no expert and still learning and could be wrong. Just my analysis/observation. Thank you