For a security doomed to decrease in value over time, ProShares’ VIXY does amazingly well. Its volume averages over 8 million shares per day and its assets under management are currently around $270 million, not bad for a product that has averaged a 52% annual loss since its inception in October 2011. This works out to an average loss of almost 6% per month. See “Volatility Fund Monthly and Year Decay Rates” for a chart showing how these losses have varied over time.

According to its prospectus, ProShares can reverse split VIXY at any time. Historically the reverse splits have been 1:4 or 1:5, with the 1:4 ratio being used during the last 6 years.

History of VIXY Reverse Splits

| Event | Dates | Split Ratio | Inception / close price right before reverse split (split-adjusted initial share price) | Months since inception /last split |

| Inception | 3-Oct-2011 | $80 ($32,000 ) | ||

| 1st Rev. Split | 10-Jun-2013 | 1:5 | 10.32 | 21 |

| 2nd Rev. Split | 25-July-2016 | 1:5 | 11.54 | 37 |

| 3rd Rev. Split | 17-July-2017 | 1:4 | 9.90 | 12 |

| 4th Rev. Split | 26-May-2021 | 1:4 | 7.32 | 46 |

| 5th Rev. Split | 23-June-2023 | 1:5 | 5.00 (est) | 25 |

The first reverse split of VIXY occurred 21 months after its inception, but the second didn’t occur for 37 more months. The high contango of 2016 and 2017 forced a 3rd reverse split after only 12 months, but the up-and-down market from 2018 to 2021 avoided a 4th split until 2021.

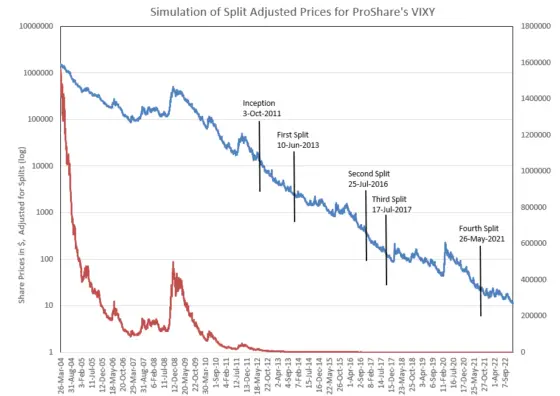

The chart below, with both log and linear scales, shows VIXY’s sordid split-adjusted price history.

Given its horrid track record, it’s fair to ask why people keep investing in VIXY. Some are just trying to profit from volatility spikes, hoping to catch the next big crash that somebody is always predicting to happen soon. Others are trying to hedge their equity holdings with VIXY because it is one of the few securities that reliably goes up when the market is panicking. Unfortunately, this strategy rarely works well. Unless your timing is very good owning enough VIXY to effectively hedge your portfolio is prohibitively expensive.

Specifics of the Split

If you hold shares of VIXY there isn’t anything to worry about when it reverse splits. The value of your investment stays the same through the reverse split process. You just have 4X or 5X fewer shares that are worth 4X or 5X more each. If your shareholdings are not a multiple of the split ratio, say 215 shares for a 1:4 reverse split, you will get 53 reverse adjusted shares and a cash payout for the 3 remaining pre-split shares.

If you are short VIXY, same story, no material impact.

If you were holding VIXY options (long or short) when the reverse split occurred there’s theoretically no material impact, however, the option chains are going to hurt your head for a while. This example VXX Options Clearing Corporation reverse split memo describes the adjustments for its March 2023 reverse split. It adjusts the number of VXX shares per option on the pre-split contract from the usual 100 to 25. The option strikes are not adjusted and the underlying symbol that the options trade against is VXX1, a new symbol—which is set at 25% of VXX’s price. These contortions are required so that holders aren’t left with fractional contracts–something the options clearinghouse doesn’t want to deal with.

So, as an example, let’s say you hold ten pre-split call options on VIXY with an expiration date of September 15th and a strike price of $10. Each contract was worth around 2.81 ($281) at the close on August 21st (VIXY’s closing price was 12.77) so your overall position value is around $2891. After the reverse split, your contracts are adjusted so each contract has 25 shares of the new reverse split VIXY as its deliverable. The strike price, $10 stays the same, and the effective price of the underlying that the option is priced against is the current VIXY value divided by 4. So, if on August 24th, right after the reverse split VIXY’s price is $51.08 and VIXY2’s price is 12.77. Your options will continue to be worth about $281 each, and you still own 10 contracts so your position is still worth around $2891. The only difference is that if you exercise all your contracts you won’t get 1000 shares of VIXY, you’ll get 250 shares. If you do exercise your shares the price you pay per share will be the reverse split value of the strike price, in the example above you would pay $40 per share (4*10) if you exercised.

New options created after the split will be generated with VIXY as the underlying, but the old adjusted options will hang around until they expire. Typically the spreads on the adjusted options are not good and sometimes margin calculations are disrupted by reverse splits, so if you are planning on exiting your options, rather than just letting them expire you should consider closing out your positions and re-establishing them after the split. For more on this topic see the end of my UVXY reverse split post.

For regular, forward splits things are more straightforward —the strike price of the options is divided by the split ratio, and the number of contracts is multiplied by the split ratio. See the OCC memo on SVXY’s 2017 2:1 split for an example. This basic approach can’t be used on reverse splits (multiply the strike price and divide the number of contacts by the split ratio) because depending on the number of contracts held some customers would end up with fractional contracts—which is a no-go.

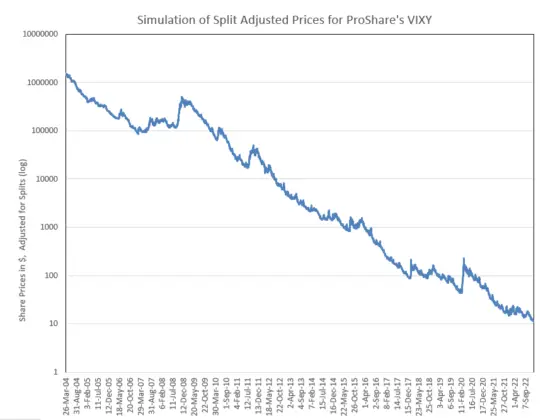

The chart below uses my simulated data plus actuals to show VIXY’s price history since 2004

Updated June 7, 2023

For more see:

Click here to leave a comment