On June 4th, 2024, Volatility Shares introduced ETHU, an Exchange Traded Fund (ETF) offering 2X leverage on the daily percentage moves of the ether cryptocurrency. This post will review ETHU’s architecture, operational characteristics, likely risks, possible rewards, and potential trading strategies. A simulation of ETHU back to 2017 provides some insight on how this Exchange Traded Fund (ETF) might perform in the future.

Before we get into the specifics of how ETHU works, I’m disclosing that I hold a small, minority share in Volatility Shares LLC, the issuer of ETHU. Volatility Shares has also issued BITX, ZIVB, SVIX, and UVIX ETFs. I do not hold management, executive, or operational roles in Volatility Shares LLC, nor do I give recommendations or investment advice to their clients. My analysis of these funds and their associated indexes is my own, is not investment advice, and is based on publicly-available information.

ETHU is a 2X Leveraged ETF

Architecturally, ETHU is structured as a 2X leveraged, daily-resetting ETF. Volatility Shares, the issuer of ETHU, seeks for it to deliver twice the daily percentage movements of the ether cryptocurrency. Typically, a 2X leveraged ETF uses margin borrowing to purchase enough of the underlying security to achieve the 2X leverage. In contrast, ETHU uses Ether futures that trade on the CME exchange rather than the ether cryptocurrency to achieve the desired leverage. I believe this was a wise choice, both for pragmatic reasons and for long-term stability and security. From a practical standpoint, the decision to use Ether futures instead holding ether directly may have been a key feature in Volatility Shares’ proposal for ETHU, which ultimately led to its approval by the U.S. Securities and Exchange Commission (SEC). For quite some time, the SEC had rejected all applications for Exchange Traded Funds that proposed to directly hold ether.

Cryptocurrencies like ether are traded on geographically diverse exchanges, most of which are not based in the U.S. and therefore not subject to U.S. securities laws or the SEC. While the Coinbase exchange, where most USA institutional trading of cryptocurrencies occurs, is based in the U.S., it is relatively new and lacks many of the safeguards that have been time-tested in U.S.-based futures exchanges. The Ether futures held by Volatility Shares for ETHU are traded on the CME Futures exchange, a U.S.-based exchange that has been operating for over a century. The CME runs a time-tested process that includes a clearinghouse intermediary, which protects the interests of those holding Ether futures, even when counterparties fail to meet their obligations.

In my opinion, using a regulated futures exchange with established clearinghouse processes is a significantly safer approach than holding ether directly and trading on exchanges with much shorter track records, minimal insurance, and relatively untested processes for managing inevitable stresses like counterparty bankruptcies.

Many people equate futures with speculative, widely varying price levels—which is true in some cases, but not with ether. Ether futures don’t have significant seasonality, storage, or supply/demand issues, so their prices tend to closely track the current “spot” price of ether. The main difference between the two is interest rate expenses and the cost of periodically rolling futures to longer-dated ones before they expire.

Unlike their other ETFs, Volatility Shares does not specify an index to determine the mix of Ether futures that should be held at any given time. ETHU is actively managed, meaning the specific mix of Ether futures held by the fund at any given time will be determined by its managers. This active management approach reduces the amount of information available to external traders (minimizing front-running opportunities) and gives the fund’s managers flexibility in selecting which assets to trade. For example, if longer-term futures are favorably priced, the fund’s managers can increase their allocation of those futures. Unlike exchange traded notes (such as Barclays’ VXX), where the net asset value (NAV) is determined by the value of an index, the NAV of an ETF is determined by the value of its underlying assets.

Dividends

Since its inception, ETHU has been paying a small monthly dividend. I’ve not been able to determine the algorithm used to establish the dividend amounts, but the dividends seem to average around 0.08% of the share price right before the dividend is declared. At current levels, the dividends are not economically significant. Perhaps these small dividends are a placeholder in case Volatility Shares decides to increase them later. For, example, Volatility Shares’ 2X Bitcoin ETF, BITX is distributing about 2% of its share price each month.

Since Inception

ETHU gained assets rapidly after inception and is currently (as of Oct 2024) holding around $100 million in assets under management. Its average volume is a very respectable 2.5 million a day, and its bid/ask spread is a penny. Options are available on ETHU. Clearly, a successful launch.

A ETHU Simulation

The long-term performance characteristics of an ETF seeking to deliver 2X the percentage moves of the notoriously volatile ether cryptocurrency is not something easy to predict. We can improve our intuition on this by simulating how ETHU would have performed in the past. Of course, there is no guarantee that ETHU will behave similarly going forward. My backtest uses the end of standard NYSE trading hours closing value of ether, starting November 17th, 2017, to drive the simulation.

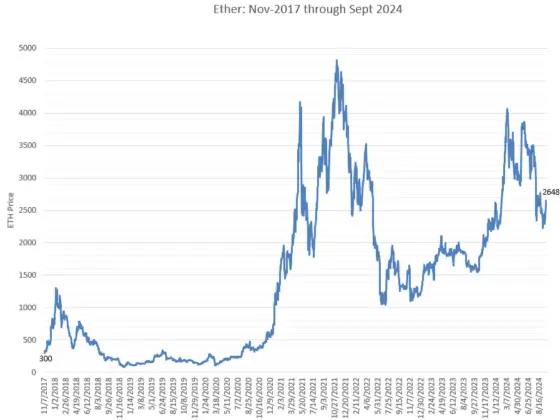

Before looking at the results of the ETHU simulation, it’s worthwhile to look at ether’s historic moves, the chart below covers its price moves from its 11-November 2017 value of 300 through its 23-September 2024 value of 2648.

Ether’s run up from 360 to 2648 (7.3X) over these 7 years has had three major peaks, one in 2018, one in 2020/2021, and one in 2024. To compare ether’s performance against simulated ETHU, I calculate two portfolios, both starting with $100, one holding ether and the other holding ETHU. The range of values is so large I use logarithmic scaling for the vertical portfolio value axis.

The simulated ETHU portfolio spikes up 10X to over $1K in 2018, but then dramatically erodes during the subsequent downswing in ether in 2018 and 2019. After 7 years, the ETHU-based portfolio is at $10, down 10X from its $100 starting point. A dreary performance, but objectively a significantly less bad performance than what the leveraged long volatility ETFs delivered over that same period. See How Does UVIX Work? for more on this subject.

It’s well known that leveraged ETPs are rarely good buy-and-hold style investments, but what if a skilled and/or lucky trader bought ETHU a month before the start of ether’s massive 2020/2021 rally? The chart below compares the performance of $100 invested in ether vs ETHU starting on 15-Apr-2020.

The results in this case are eyepopping, with a 21X run-up in ether, and a 280X (!) increase in ETHU. How is this even possible with a fund advertised as being a 2X leveraged fund? The answer is that in trending markets, without significant pullbacks, a leveraged fund can significantly outperform its leverage factor. For example, if ether had 3 consecutive days of +20% moves, after 3 days it would have increased by a factor of 1.2^3 =1.728, a 72% increase. ETHU on the other hand, would have ideally gone up 40% each day, so 1.4^3 = 2.744, a 174% gain rather than the 2 x 72 = 144% you might have expected from a 2X fund.

Of course, trends like this are rare. When the price action is more random, with more up and down, a dark side of leveraged ETF emerges—it’s called volatility drag. For ETHU, volatility drag is a significant factor that will often erode performance as will be discussed later in this post.

Summarizing, the simulation shows that for the past performance of ether, a long term position in ETHU will likely lose most of its value, but if you catch a rally you can do very well.

This ETHU backtest simulation spreadsheet is available for free here.

Some Observations on the simulated ETHU Backtest

The following table summarizes the best and worst-case percentage moves over various periods for simulated ETHU starting November 2017

| Topic | 1 Day | 5 Day (Week) | 21 Day (Month) | 93 Day (Quarter) | 252 Day (Year) |

| ETHU Worst Loss | -85% (11-Mar-2020) | -89% | -93% | -97.5% | -99.7% |

| ETHU Best Gain | 82% (2-Jan-2021) | 157% (~2.57X) | 622% (~7.2X) | 2670% (~27.7X) | 20300% (~204X) |

ETHU risks:

Not surprisingly, the ETHU backtest simulation suggests that a 2X leveraged ETF tied to the notoriously volatile ether cryptocurrency will have a lot of price volatility. Some less obvious risk factors associated with leveraged ETFs are detailed below.

- Volatility Drag

All leveraged ETFs have a loss mechanism called volatility drag, sometimes called Beta Slippage that reduces returns below what a trader might expect over the long run. Volatility drag in leveraged ETFs occurs when daily security prices follow a noisy, up-and-down path. Leveraged ETFs must rebalance their assets at the end of every day to achieve their leverage goals. If the day-to-day price action is noisy, that rebalancing activity generates losses.

Conceptually, a leveraged ETF uses a momentum strategy, assuming that the market will continue in the direction of today’s closing value relative to the previous close. To achieve its goal of matching its leverage factor in percentage moves of the underlying, it must rebalance its assets at the end of the day to be ready for the next day’s move. However if, instead of a continued trend, the next day’s movement reverses and the price goes the other direction, the ETF will lose some value. The extent of this loss depends on the magnitude of the reversal. For a 2X leveraged product, the average daily volatility drag will be approximately the daily volatility of the underlying index squared. The daily volatility of ether is ~5.6%, so ETHU’s volatility drag will be around (.056)^2 ~0.3% per day. This might not seem like a lot, but over a year, with approximately 250 trading days, the cumulative loss would be (1-.003)^250 -1 = -0.45, or 45% per year. See this link for more information on volatility drag.

- Big Down Days and Essentially Unrecoverable Losses

Big down days are treacherous for 2X leveraged ETFs. If the underlying index or reference security of a 2X leveraged ETF drops 50% or more within a single trading day, the ETF’s price will likely drop to zero, or near zero. It is important to note that despite the large drawdown potential for ETHU, its price cannot go below zero, ensuring that investors can’t lose more than their initial investment. This characteristic contrasts with the situation where a trader buys a security and then borrows via margin loans to buy an equal amount of the security to achieve 2X leverage. In that case, the trader can lose significantly more than their initial investment if the security drops more than 50%.

If ETHU’s value were to drop to near zero intra-day, the fund’s operators would likely act to dramatically reduce the number of Ether futures it holds. A 2X fund uses leverage to effectively hold $2 of the underlying asset for every $1 invested, so if the futures held by the ETF drop in value by 50% or more during a single day, the losses could equal or exceed the asset value of the fund, leading to an end-of-day share price at or near zero. In this scenario, the ETF issuer is exposed to huge losses if the underlying continues to drop in price. To protect itself, the fund would likely sell assets, and/or have hedges in place, to reduce its effective leverage. Somewhat smaller daily losses, e.g., 45% in the underlying, would probably not trigger deleveraging of the fund, but could still inflict grievous (e.g., ~90%) decreases in the 2X ETF’s price.

A less obvious risk is that there’s no realistic way to recover from a dramatic full-day drawdown on a 2X ETF, even if the market recovers spectacularly the following day. If ETHU is down 90% at market close, a 30% recovery in Ether futures the next day will not help much; it would only bring the fund’s value back to 16% of what it was two days prior.

A trader positioned for 2X leverage via margin loans rather than a 2X leveraged ETF would do much better in the two-day “down then up” scenario. With the futures down 45% one day and then 30% up the next day scenario, the margin-based trader would only be down 28.5%. However, in the “down then down more” scenario they could lose up to twice their investment, whereas losses in a 2X ETF are limited to the amount invested.

The CME exchange does have general market circuit breakers which are coordinated with the stock markets and in addition, the CME’s cryptocurrency futures have their own dynamic circuit breakers. - Is the Ether Adventure Over?

Ether has had an incredible run-up in price since its inception 7-August-2015. Often the past is a good predictor of the future, but there are no guarantees that ether’s long-term upward trend will continue. If it doesn’t, that’s bad news for long-term holders of ETHU.

Ether Opportunities

- Ether’s Price Goes on Another Run-Up

The ETHU backtest shows there’s potential for spectacular gains if ether goes on a bull run. The ETHU simulation shows three periods with huge gains in the last five years, 2017 (10X), 2020/2021 (230X), and 2024 (5X).

- Multi-day Upward Trends in Ether

Some of ETHU’s periodic spectacular simulated performance is due to the flip side of the volatility drag phenomenon that was described in the risks section. As mentioned earlier, a leveraged ETF effectively implements a momentum strategy, and if the underlying does go up for multiple days in a row, then the ETF can outperform relative to its leverage factor. For more on this, see When Leveraged Funds Outperform Their Leverage.

Fees, Regulatory Status, and Taxes

ETHU’s effective annual fee is 0.94%, which is deducted daily (~0.0026%) by Volatility Shares from the fund’s assets. ETHU is registered under the US Investment Company Act of 1940. My understanding is that ETHU will report gains/losses via IRS 1099 forms, will not issue K-1s, and that ETHU is not subject to non-resident withholding on publicly traded partnerships (PTPs). Please consult with your tax advisor regarding your specific tax obligations.

Trading Notes on ETHU’s Positions in Ether futures

- Each trading day the fund will likely roll some of its soonest-to-expire futures to futures with more time until expiration,

- Futures will be bought/sold to adjust for share creations/redemptions in the fund,

- To position ETHU to deliver 2X leverage the next day. The number of futures held by the ETF will be increased or decreased depending on the current day’s ending percentage move from the previous trading day.

Trading Strategies

Although most holders of ETHU will likely be short term traders, some will try to capture a future sustained run-up of Ether prices by just buying and holding. However, even if that strategy is successful, any windfall gains will likely fade quickly away if ETHU is held for a long time.

- In practice, identifying the peak value of an ether rally is virtually impossible, so strategies that take profits as they occur, for example selling shares to cash out ten percent of the profit every week, are attractive approaches that don’t require the trader to pick the peak.

- Those long ETHU should consider mitigating potential losses from big down days by holding options that go up in value if ETHU drops dramatically in value. Options are available on ether, Ether futures, and on ETHU.

- Traders who believe Ether is going to drop in value can short ETHU. If their forecast is correct, they will benefit from ETHU’s leverage, volatility drag, and fees. Buying out-of-the-money calls to limit the maximum loss if their forecast is wrong is a best practice. Holding these calls will also likely reduce upfront margin requirements.

Conclusion

ETHU is not intended to be a buy-and-hold investment. Even if ether goes on to set new all-time highs, investors that buy ETHU and never sell will very likely end up disappointed. On the other hand, ETHU offers an aggressive trader a product that’s able to significantly compound ether gains, without the need for additional capital, or risking more than they invested.

Resources

Click here to leave a comment