I recently posted a paper, “Transforming Stock Market Forecasts with Variable Expected Returns,” on the SSRN online repository. This paper resolves an issue that has been bugging me for years. The link is: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=495384

This paper is not about making money, but rather about a fundamental theoretical error regarding stock market forecasts that has been present for many years. The flawed methodology generates overoptimistic multi-period forecasts. Practitioners and academics have developed workarounds for the problems created by the error, but they never identified the root problem. This paper does that and presents an alternate approach that resolves anomalies that financial analysts, Blume, Jacquier, and Blitz identified years ago. The reason this error has gone undetected for so long is likely because there was more than one error. One error masked the other.

The errors:

- The Expected Value (EV), the probability-weighted sum of the values of a random variable, is a fundamental measure in statistical analysis, but it is not perfect. It suffers from the same issue as the arithmetic average, that for positive only, fat-tailed distributions like lotteries and stock markets returns, large outlier values bias the measure away from the typical central tendency value. In other words, in the case of the stock market, as an investor you shouldn’t expect the Expected Value.

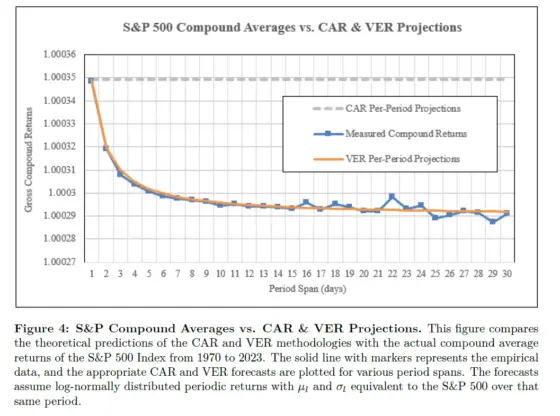

- When researchers, long ago, evaluated the forecasts based on the incorrect EV measure, their validation passed. What they didn’t realize is that both the incorrect measure (EV) and the correct measure give the same result for a one-period test. Discrepancies become apparent only when examining more than one period (see chart from the paper below)

This research aims to shed light on these overlooked errors and provide a more robust framework for market forecasts. By addressing the root issue, it offers a pathway for more accurate and reliable financial analyses.

Click here to leave a comment