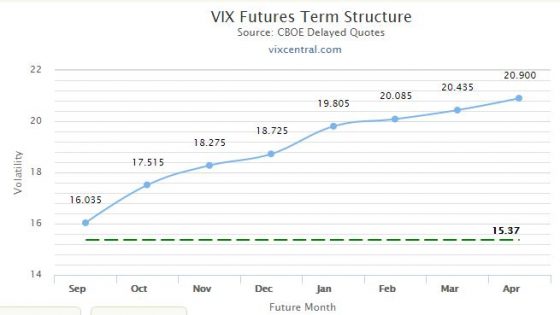

It’s well known that long volatility Exchange Traded Products (ETPs) like VXX, UVXY, and UVIX often experience devastating losses during market quiet spells—even when the value of the VIX is staying relatively stable. These heavy losses occur when the VIX futures that underlie these funds are in a price/time arrangement called contango. The chart below shows an example of VIX futures in a contango configuration.

The blue dots show the prices of various futures and the horizontal scale indicates the month of expiration. The horizontal green line shows the current VIX price— also known as the “spot” price. You can’t tell it from the chart, but in this example, the leftmost future has 4 days until expiration. At expiration, a VIX future’s value will be very close to the VIX spot price.

When futures are in contango the longer the future has until expiration the higher its price.

If you were to take a time-lapse video of this chart over time with a stable VIX you would see the blue dots moving down the blue line, eventually intersecting with the green VIX line at expiration.