Update

On September 26, 2018 REX ETF shutdown VMIN. See this link for the newsrelease. The 2018 market was not friendly to short volatility products and VMIN never recovered its asset base after the 5-Feb-18 Volatility Tsunami.

March 2018 Update

As of March 7th, 2018 VMIN will shift its trading strategy to use longer-term VIX futures with 3 to 5 months until expiration in addition to it holdings of short term volatility Exchange Traded Funds. I’m estimating that this new strategy will result in a leverage factor of around -0.53X of the short term index futures index SPVXSTR that VXX is based on. This change was likely in response to the events of February 5th, 2018 when a massive VIX futures spike occurred in the last 30 minutes of trading. This change to VMIN will make it less susceptible to a termination event if VIX futures were to increase 100% or more from the previous day’s close. This leverage change will likely reduce VMIN’s performance when VIX futures are in contango and reduce its price decreases when VIX futures fall. I have not updated the content of the post below to reflect the strategy—I will when the details of the change become clearer. REX ETF Press Release

———————————————————————————————————————————————————————————

In May of 2016, REX Exchange Traded Funds introduced two volatility oriented products, VMIN and VMAX. One is a bet on market volatility staying the same or dropping (VMIN) and VMAX is essentially its mirror image—betting on short term volatility increases. VMIN has some important structural and performance related differences that distinguish it from the other short term inverse volatility funds—VelocityShares’ XIV and ProShares’ SVXY.

In this post I focus on VMIN’s differences from its competitors. If you are new to inverse volatility investing I suggest you review the fundamentals by reading How does SVXY Work?

For a good understanding of VMIN (full name: REX VolMAXX™ Short VIX Weekly Futures Strategy ETF) you need to know how it differs from other inverse volatility funds, what it tracks, its risks to the investor, and how well it has performed.

How Is VMIN Different From a Performance / Tax Standpoint?

- Far from being a “me-too” product, VMIN differs from its SVXY and ZIV competitors in a number of important ways. One key difference is that VMIN is designed to track the daily moves of the CBOE’s VIX® better than existing securities. VMIN is an inverse fund, so it generally moves in the opposite direction of the VIX.

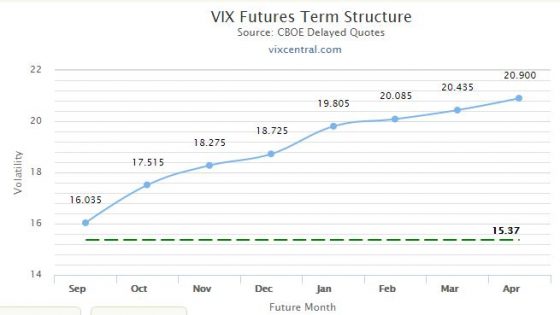

- In addition to this improved tracking, VMIN also outperforms its competitors in taking advantage of the structural drag of VIX futures when their term structure is in contango. Contango exists when longer-dated VIX futures are priced higher than VIX futures that have less time until expiration. The VIX futures that underlie the volatility Exchange Traded Products (ETPs) are in contango around 75% of the time. In the May 2016 to March 2017 time period, VMIN outperformed its completion by 28% due to this characteristic, more than tripling during that period. In fact, VMIN was the best performing fund in the ETP universe in the first quarter of 2017, outperforming all other 23,788 funds, with a 35% gain.

- While VMIN is an Exchange Traded Fund (ETF) like SVXY, its tax reporting is the same as an ordinary equity investment with your short and long-term capital gains reported via 1099 forms. Because SVXY holds VIX futures directly tax laws require that it be treated as a partnership, reporting gains/losses via Schedule K-1 forms. While not a huge deal; K-1 forms are complicated and always seem to arrive very late in the spring.

- VMIN will make distributions of any realized securities gains at least once a year. In a good year this special dividend will likely be substantial (for FY 2016 it was $9.92/share). Neither XIV nor SVXY distributes capital gains this way—they have different legal structures (Exchange Traded Note and an ETF structured under the Securities act of 1933 respectively). Special dividends from VMIN or VMAX will be taxed as ordinary income.