Volatility Shares BITX (2X Bitcoin Futures) & ETHU (2X Ether) ETF Backtests (free)

$0.00

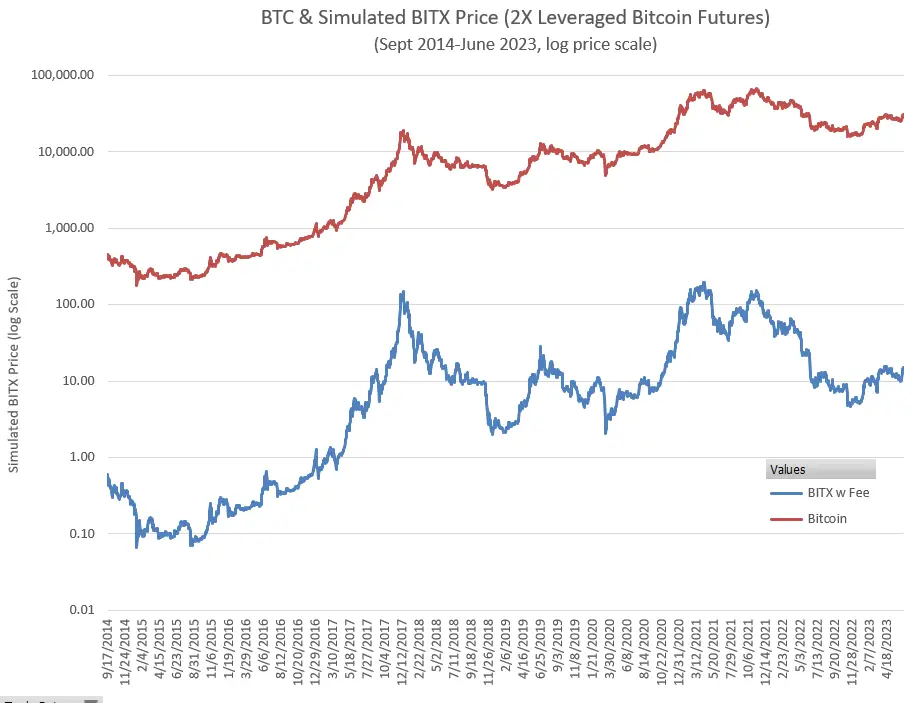

Simulated prices for BITX starting 17-Sept-2014. The data included typically goes up to the end of the last calendar quarter. Includes its underlying SPBTFDUE index and historical Bitcoin prices.

Description

This free spreadsheet includes backtest simulations for Volatility Shares 2X Bitcoin (BITX) and 2X Ether (ETHU) exchange-traded funds along with supporting historical data for BTC and ether.

The 2X leveraged BITX is an Exchange Traded Product (ETF) offered by Volatility Shares that holds a dynamic mix of the front two months of CME Bitcoin futures as its underlying securities. BITX uses the S&P Global S&P CME Bitcoin Futures Daily Roll Excess Return Index (ticker SPBTFDUE) as its underlying index. BITX seeks to deliver twice the daily percentage move of SPBTFDUE. BITX started trading on June 27, 2023, so there is no market price data available before that. This simulation provides SPBTFEU historical prices and BITX simulated end-of-day closing prices starting September 17th, 2014 through the most recent quarter (See this table for specific dates). For more on BITX see How Does BITX Work?

The 2X leveraged ETHU is an Exchange Traded Product (ETF) offered by Volatility Shares that holds CME Ether futures as its underlying securities. ETHU seeks to deliver twice the daily percentage move of the ether cyber currency by holding Ether Futures. EHTU started trading on June 4th, 2024, so there is no market price data available before that. This simulation provides ether historical prices and ETHU simulated end-of-day closing prices starting November 9th, 2017 through the most recent quarter (See this table for specific dates). For more on ETHU see How Does ETHU Work?

The BITX & EHTU simulations may provide some insight into their likely behaviors, but of course, Bitcoin & ether’s price action is unpredictable and may perform dramatically differently going forward.