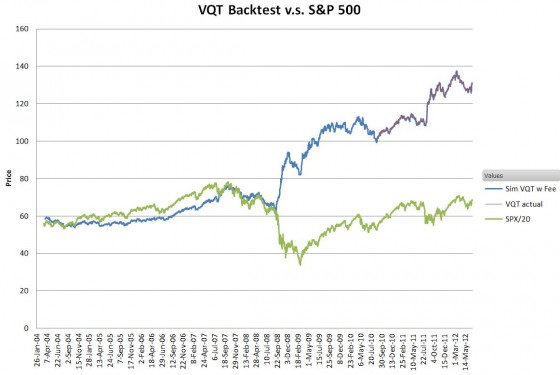

I have backtested Barclays’ VQT ETN back to when VIX volatility futures first started to trade in March 2004. I have made two versions of the spreadsheet available for purchase below. One with results data only and the other version with formulas and required indexes included. I have included the simulated daily closing values including the 0.95% annual fee from March 29, 2004, until June 30th, 2014. I have included the reported IV values from Barclays through January 2017. The results of the simulated values compared to actual values are shown in the chart below. My results match samples from the published SPVQDTR underlying index within 0.35%.

VQT is a way to have exposure to the general market and profit from major market panics. For details on VQT see:

- A Covered Call Position That’s Long Volatility

- For a detailed analysis of the inner workings of XVZ see Under the Hood of Barclays” VQT

- VQT prospectus

For more information on the spreadsheets, I have for sale see this readme.

If you purchase the spreadsheet you will be directed to paypal where you can pay via your paypal account or a credit card. Please email me at [email protected] if you have problems, questions, or requests.

Vance,

VQT seems like it will protect someone from sharp falls in a 3 to 4+ year time frame compared to SPX. But should we assume that over longer periods (5+ years) that it will lag a bull market so much that the protection isn’t worth the cost of the missed upside? Maybe suited for those who are near retirement or in retirement and maybe not for those who expect to be in the market for the next decade?

VQT is going to terminate in October 2020 I think, so it is sort of a moot question, although PHDG may still be around for a while. This strategy has shown that it does not do well during rising markets. The only time I’d consider it is during a major correction / bear market and you want to belong volatility without having much risk, and without having to manage your exposure on a daily level.

Best Regards,

Vance

Really, very good information. By the way where can I get VQT Historical Prices from 2004 in excel format o similar in order to backtest my portfolio. Many thanks for your help

Hi, I offer the VQT simulation data from March 2004 on for sale, but I have not put the info for sale yet on my website. For the data only (dates & prices) I charge $40. If you want the full spreadsheet with all formulas and indexes required to compute VQT’s value I charge $200. If you are interested in either send me an email at [email protected] letting me know which one you would like to buy. I’ll email the spreadsheet and you can pay me via paypal. Please let me know if you have any questions.

Best Regards, Vance

HI Vance,

I am curious to see what maximum drawdown your backtest gives for the VQT since 2004 ?

Charles

Hi Charles, The top 3 drawdowns were 18% on 15-Sept-08, 13% on 27-Feb-09, and 11% on 24-Aug-10.

– Vance

hi Vance,

do you notice what happened to XVZ today?

about an hour after market open, it doesn’t move anymore and locked at 57.25

do you have any idea about this?

Hi Hendra, I looked at the charts and didn’t see anything unusual. XVZ is lightly traded, so it can be a long time between trades. I’m expecting XVZ to bottom soon and start back up.

— Vance

yes Vance, you’re correct

it’s because XVZ’s volume

thanks for your respond

keep posting useful articles as usual!!

I wonder if VQT was optimized for the 2008 downturn/VIX explosion. We won’t really know until a major out-of-sample VIX spike and market correction occurs.

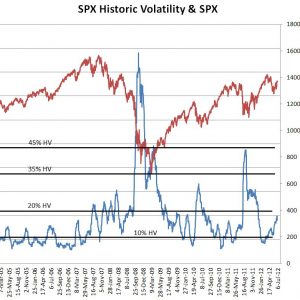

Hi Andrew, I expect it was. But it did handle the 2nd half 2011 troubles nicely. I like the way it tracks 20 day vs 5 day volatility. Feels like a more general and robust approach compared to XVZ’s hard coded VIX/VXV ratios triggers.

— Vance