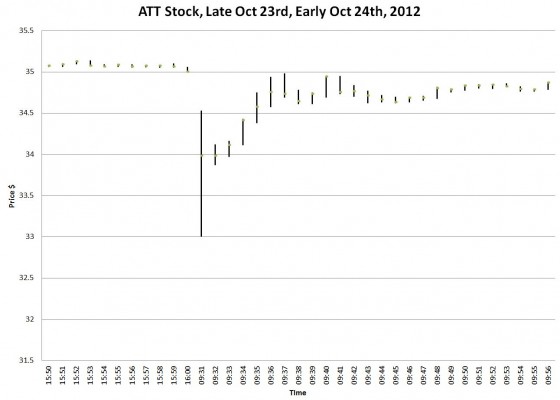

I’ve never liked stop loss orders. I’ve seen too many people get blown out of their positions by short term price fluctuations. A glitch October 24th, at ATT’s opening shows the typical pattern.

I think we need improved stop lost orders to help retail investors avoid being stopped out during events like these—often at the worst possible prices.

In the past most gaps were triggered by news or fat finger trades, but now software problems associated with High Frequency Trading (HFT), dark pools, and a plethora of interconnected exchanges cause most of these disruptions. In the aftermath of the May 2010 Flash Crash some additional protective measures including circuit breakers on individual stocks have been put in place, but nothing fundamental has changed and significant short term disruptions happen all the time.

There are 4 typical phases to a flash crash:

- Disruption

- Something significant happens that disturbs the normal flow of trading. For the 2010 Flash Crash it was the sale of 75K e-mini futures (worth ~$4 billion) in 20 minutes.

- Stop loss orders are triggered—exacerbating the fall

- Existing buy book orders are cleared out, spreads widen

- Disengagement (in a major crash)

- Futures’ range limits are hit, circuit breakers kick in, non-primary market makers withdraw from the market, HFT firms disengage because of abnormal market conditions. Liquidity plummets.

- Bargain hunting

- As the price bottoms out greed kicks in. Once buyers establish nothing fundamental has happened they step in to take advantage of the bargain prices

- Recovery

- Non-primary market makers, HFT firms re-engage. As the price recovers there’s a rush to participate in the bounce.

If the retail investor participates at all in these phases, it is getting hammered during phase one. In this WSJ article the investor had a $49.17 trigger set on a stop loss order—placed when the his Vanguard VTI position was trading around $59. The Flash Crash caused VTI to plunge through the limit price and trigger his stop loss-market order. The order filled at the market price—which averaged out to $41.15, a nearly instantaneous 30% loss. VTI finished the day at 59.71, down 2.9%. The investor had lost about 10% of his net worth in 30 minutes—trying to protect his portfolio.

This person wanted to take the “emotion out of selling”, his words, but the tools at his disposal suck. If he had used a stop-loss limit order, with the same trigger and the limit at $49 he would have still been down 17.5% for the day.

It’s time to recognize that flash crashes are going to be around for the foreseeable future.

If brokers added an optional delay parameter to stock loss orders (or conditional orders) investors would have a fighting chance. An execution delay of 30 minutes after the trigger, for example, would mitigate the vast majority of flash events. They still might get stopped out, but at least it would happen in the recovery phase, not at the worst of the disruption.

As always a new feature would have a few wrinkles. For example, what if the crash happened near the end of trading? Would the delay carry over until the next trading day? In cases like this simple is usually best. I would expect a GTC order with this feature to execute at open the next day—assuming the price was still below the trigger point. The investor could always cancel the order before open if they didn’t want that to happen.

This isn’t rocket science. It is already available in FX trading. It’s time for brokers to do something about flash crashes.

Setting a stoploss like the one you describe sounds profoundly stupid. Never set an order you don’t want to be filled.

Hi Andrew,

For an active investor I agree with you, but the vast majority of people out there are not monitoring their accounts. For them something that gets them out with the majority of their profits surely beats riding the bear all the way down again.

— Vance

Markets don’t often move that fast. Better to set an alert where you would have placed a stop loss and make a judgement call.

Not to say your proposal is a bad idea. I just dislike stoploss orders. They get investors into trouble.

Hi Andrew,

Good point about the alerts. Much better solution than today’s stop loss orders. It is hard to believe, but Schwab still doesn’t have email alerts.

— Vance