Nearly four years ago Barclays introduced VXX, the first volatility Exchange Traded Product (ETP). Since that time 5 other companies in addition to Barclays have entered the volatility business. All together they have introduced 35 volatility funds.

It hasn’t been pretty. Of those 35 funds, 15 have been discontinued/terminated and almost half of the remaining 19 are either below critical mass with less than $10 million in assets, or not recommended. VXX has reverse split 4:1 twice, declining from a split-adjusted $1600 inception price to $33 in October 2012, a decline of 97.9%—earning it numerous nominations as the top ETF wealth destroyer. And VelocityShares’ TVIX (2X short term volatility) generated monumental amounts of bad press in early 2012 when its price rose almost 100% over its indicative value when Credit Suisse, TVIX’s issuer, suspended share creation, only to plunge 50% when Credit Suisse resumed partial creations a month later—vaporizing at least $270 million in capital in less than a day.

Other than that business has been good.

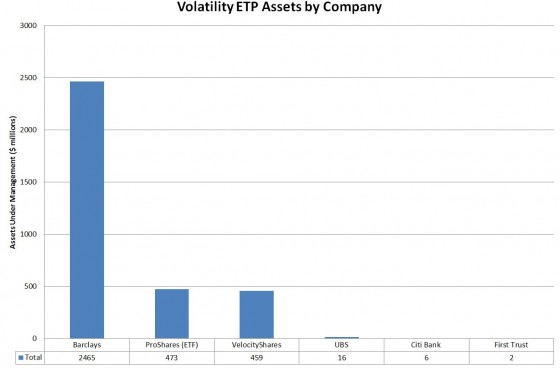

The chart below shows assets under management (AUM) for the 6 players in the market as of the 14th of October, 2012:

The overall AUM has grown to $3.4 billion, with Barclays holding $2.4 billion and ProShares and VelocityShares tied for second with almost $500 million each.

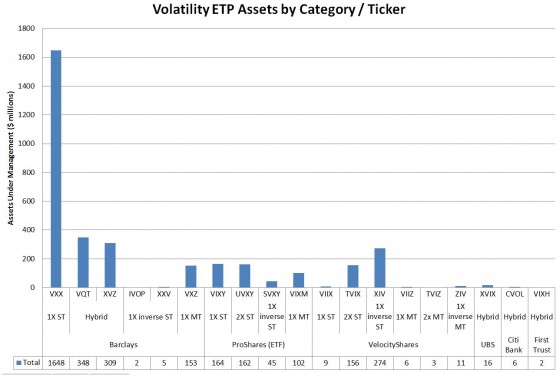

Looking at the AUM breakout at the fund level yields some surprises:

- The hybrids. I define hybrids as being composed of two or more different fund / securities types. VQT for example has the S&P 500 + a variable allocation of 1X short term volatility (essentially VXX), XVZ has variable allocations of 1X short term long & short and 1X medium-term volatility. Hybrid funds now comprise 20% ($681 million) of the volatility fund market even though they have only been around for two years or less.

- Barclays strikes out in the inverse and leveraged category. Evidently Barclays does not believe in daily reset inverse or leveraged funds. Instead, they have offered a series of funds that offer 1X inverse or 2X leverage at inception, but don’t maintain that same leverage factor as the underlying volatility futures move. These funds behave this way because they aren’t rebalanced. Barclay doesn’t have to commit any additional capital to adjust the leverage factor. This is convenient/safe for Barclays, but not so much for customers. The leverage factor increases when the market is moving against a fund and decreases when the market moves for a fund. The increased leverage tends to slam funds against their termination values, killing Barclays’ IVO, VZZ, and VZZB funds, and strands other funds, XXV and IVOP in sluggo land, with awful leverage factors (or “participation” as they call it). Currently IVOP‘s participation is 0.12, XXV‘s is 0.04.

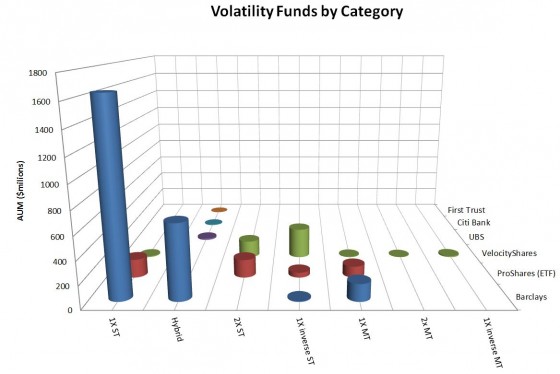

This next chart maps volatility fund categories against company.

Looking forward:

- As a company, ProShares seems to focus on leveraged funds for existing indexes. I doubt they will enter the volatility hybrid category.

- The dramatic increases in mid-term volatility contango will damage Barclays’ XVZ performance and make VelocityShares’ ZIV inverse mid-term fund more attractive. We may see new funds that attempt to capitalize on mid-term contango by investing in inverse volatility during non-panicky market conditions.

- New dynamic volatility funds may move away from using fixed parameters (e.g., VQT, XVZ), established by backtesting to allocating by recent behavior (e.g., last year’s volatility/term structures). The parameters established by backtesting can’t adapt to changing market conditions.

I’m curious what the total net fund flow into VXX has been. Ie, just how much capital has been lost since inception.

Hi Andrew, I had wondered the same thing. I looked it up on http://www.indexuniverse.com/data/etf-fund-flows-tool.html?task=showETFFlowsData — answer $5.7B, so $4B has been lost…

— Vance

Vance,

Excellent summary. It really is amazing how much innovation–and loss of value–this space has seen in such a short period of time.

Have you looked into the CBOE’s new VSTRPS? It may effectively replicate direct VIX exposure using the underlying options directly, rather than relying on futures markets.

http://blog.slcg.com/2012/10/two-new-exotic-products-from-cboe.html

Do you think these will find their way into ETF or ETN form?

Hi Tim,

Thanks for the feedback! I looked up the inflow of VXX since the beginning — $5.7B, so about $4B has been lost on VXX alone.

Regarding the VSTRPs, I have been waiting to see if they get any volume. If the CBOE website is any indication there is no open interest, so not working so far. My understanding is that VSTRPs would replicate the same process that market makers use to hedge VIX futures. If so I don’t think they would open up a new retail market–at least for customers with access to VIX futures. What bothers me is that if these strips are used for hedging VIX futures it seems like there would be arb opportunities when VIX drops due to holiday effects (Friday droop, Monday recovery). Since those moves haven’t been arb’d out it must be more complicated than that.

— Vance