Based on searches that lead people to Six Figure Investing, these are the top 10 questions people ask about volatility investing:

-

How can I buy/trade/invest in the CBOE’s VIX® index? The short answer is that you can’t. No one has figured out how to do this economically.

However, there are quite a few investment approaches that allow you to trade in volatility, including futures, options on futures, various Exchange Trade Products (ETPs), and options on ETPs.

- VIX Futures. The CBOE Futures Exchange offers VIX futures with expirations up to 9 months out. Most of the time they trade at a significant premium to the current VIX value—the only firm exception is when a contract expires. Even at expiration the VIX and the VIX futures can differ by a couple of percent. For more on VIX futures see VIX Futures—Crystal Ball or Insurance Policy?

- VIX options. These are options that track VIX Futures not the VIX index itself. They track specific futures (e.g., November options track November futures). They are European exercise and expire on different days than regular stock/ETP options. For more see Things You Should Know About VIX options.

- VIX related ETPs (Exchange Traded Funds / Exchange Traded Notes). All of these funds invest in VIX futures in some way or another in order to give the investor exposure to volatility. They offer long funds, short funds, long/short, option hedged fund, and combinations with various equities. For the complete list of USA volatility funds, associated websites, and volatility timeframes see Volatility Tickers.

- VIX related options on ETPs. Only 6 of the current 13 volatility funds have options available (VXX, VIXY, UVXY, SVXY, VXZ, VIXM). For more on ETP volatility options see VXX Options.

-

How can I go long on the VIX? For going long on VIX using Exchange Traded Products see this post.

-

How can I go short on the VIX? The post How to Short The VIX gives an general overview on shorting volatility. For VXX specific information see How to Short VXX.

-

How does the VIX index work? For an equation free explaination of how the index works see How does the CBOE’s VIX index work

-

What is the best ETF / ETP for tracking the VIX? All of them are pretty horrible at tracking the VIX index. TVIX is the least bad. For more see Tracking the VIX Index.

-

Why is the VIX moving with the S&P 500, instead of against it today? Normally the moves of the VIX are negatively correlated to the general market, but around 20% of the time it moves in the same direction.

The VIX index is based on the prices of options on the S&P 500 index (SPX), and sometimes the actions of those SPX option buyers/sellers are contrary to the general market mood. For example if a big event (e.g., Fed announcement) occurred that reassured the investment community then option premiums might drop dramatically— even if the market was somewhat down for the day. For more see How Much Should We Expect VIX to Move? and No, the VIX is not broken.

-

Why are VIX Futures not tracking the VIX today? The VIX futures market is independent from the S&P 500 options market. Sometimes these two markets have different opinions about what is going to happen. Generally the prices of the VIX futures tend to trade at a 3% to 9% premium over the equivalent VIX value computed from SPX option prices. For more see VIX Futures—Crystal Ball or Insurance Policy?

-

Why are VXX, TVIX, and UVXY not tracking the VIX today? VXX invests in the two nearest months of VIX futures, so it tracks the movements of the VIX futures not the VIX itself. The same goes for TVIX and UVXY except they are 2x leveraged versions using the same VIX futures.

For other, more nuanced reasons why there are apparent discrepancies in the volatility ETPs see If you think your ETF is broken.

-

Why do VXX, TVIX, always go down? They don’t go down all of the time— just 70% to 80% of the time. Their appalling erosion is due to the typical price structure of the VIX futures, where the prices you pay for the further out contracts are significantly higher than the short term futures. Because of this the value of the futures that these funds hold typically decline over time, much like option premiums decline. Of course, if volatility really spikes these funds will respond, but their moves will be muted compared to the VIX itself. For more see The Cost of Contango—It’s Not the Daily Roll.

-

When do VIX options and Futures expire? VIX options and VIX futures expire on the same day, the Wednesday immediately before or after the Friday expiration of regular options. See here for a yearly calendar of VIX expirations.

The CBOE selected this unusual date because it wanted the expiration for VIX futures to be exactly 30 days before the expiration of the next month’s SPX options. Since SPX options expire on the 3rd Friday of the month—which can be as early as the 15th or as late as the 21st, the VIX future’s date has to jump around to satisfy the 30-day requirement. For more see Calculating the VIX and VIX Timescape

-

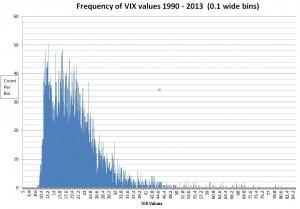

How low can the VIX go? The record low close for the index was 9.31 on December 22nd, 1993. It rarely drops below 10. The most recent close below 10 was 9.52 on January 8th, 2018.

|

More questions? Checkout the 40 volatility related posts I’ve indexed on the right side of this page. |

Click here to leave a comment