If you want to trade options on fear I’ve listed some things below that you should know. If you are interested in other volatility investments besides options see “10 Top Questions About Volatility“. Regarding VIX options:

- Your brokerage account needs to be a margin account, and you need to sign up for options trading. There are various levels of option trading available (e.g., the first level allows covered calls). My experience is that to trade VIX options you will need to be authorized to trade at the second level. These levels vary from brokerage to brokerage, so you will have to ask what is required to be long VIX options. If you are just getting into options trading this is as high as you want to go anyway. Selling naked calls for example, is not something for a rookie to try.

- No special permissions are required from your broker for VIX options. In general, the same sort of restrictions (e.g., selling naked calls) that apply to your equity option trading will apply here.

- Calendar spreads aren’t allowed (at least within my account, with my level of trading). The software didn’t prevent my entering the order, but the order was canceled once I entered it and I got a call from the broker—ok, what did I do now? The reason for this restriction is because VIX options with different expirations don’t track each other well. More on that later.

- The option greeks for VIX options (e.g. Implied Volatility, Delta, Gamma) shown by most brokers are wrong (LIVEVOL and Schwab are notable exceptions). Most options chains that brokers provide assume the VIX index is the underlying security for the options, in reality, the appropriate volatility future contract should be used as the underlying. (e.g., for May options the May VIX futures are the underlying). To compute reasonably accurate greeks yourself go to this post.

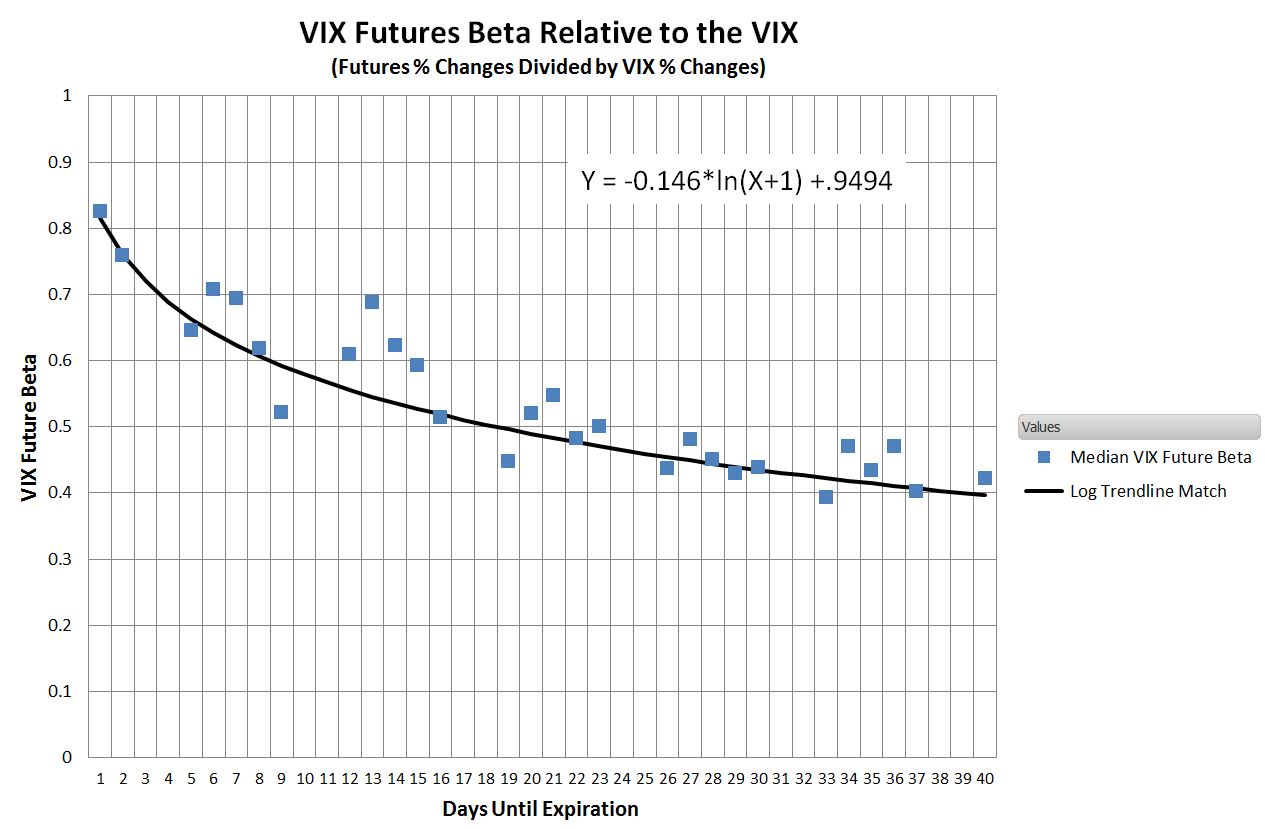

- While technically not the actual underlying, VIX futures act as if they were the underlying for VIX options—the options prices do not closely track the VIX. A big VIX spike will be underrepresented, and likewise, a big drop probably will not be closely tracked. This is a huge deal. It is very frustrating to predict the behavior of the market, and not be able to cash in on it. The only time the VIX options and VIX are guaranteed to sort-of match is on the morning of expiration—and even then they can be different by a couple of percent. The closer the VIX future and the associated VIX option are to expiration, the closer they will track the VIX. With the CBOE’s introduction of VIX weekly options there should always be options available with less than a week to expiration. The following chart that I generated from VIX and VIX futures historical data shows the typical relationship.

- The VIX options are European exercise. That means you can’t exercise them until the day they expire. It is common for these options to be trading at levels much different than you would expect for American style, early exercise capable options. The prices only start relating closely to the VIX spot price on the expirations day.

- Expiring In-the-Money VIX options give a cash payout. The payout is determined by the difference between the strike price and the VRO quotation on the expiration day. For example, the payout would be $1.42 if the strike price of your call option was $15 and the VRO was $16.42.

- The expiration or “print” amount when VIX options expire is given under the ^VRO symbol (Yahoo) or $VRO (Schwab). This is the expiration value, not the opening cash VIX on the Wednesday morning of expiration. VIX options expire at market open on expiration day, so expiring options are not tradeable during regular hours on that day.

- VIX options do not expire on the same days as equity options. It is almost always on a Wednesday. This odd timing is driven by the needs of a straightforward settlement process. On the expiration Wednesday the only SPX options used in the VIX calculation are the ones that expire in exactly 30 days. For more on this process see Calculating the VIX—the easy part.

- The bid-ask spreads on VIX options tend to be wide. I have always been able to do better than the published bid / ask prices–always use limit orders. If you have time start halfway between the bid-ask and increment your way towards the more expensive side for you.

- I don’t recommend you start trading options on VIX if you aren’t an experienced options trader. If you are a newbie trade something sane like SPY options first…

- The VIX is not like a stock, it naturally declines from peaks. This means its IV will tend to decline over time. As a result, VIX options will often have lower IVs for longer-term options—not something you see often with equities.

- The CBOE reports that trading hours are: 9:30am to 4:15pm Eastern time, but in reality, the options do not trade until after the first VIX “print”-when the VIX value in calculated from the first SPX options transactions. The first VIX quote of the day is usually at least a minute after opening.

Updated Dec 18, 2019

Hi, I’m trying to find some answers for my boss. #7- Expiring In-the-Money VIX options give a cash payout. My question is- what happens when it expires and it is NOT in the money? He is set up in a fund, so will it automatically enter into a new option where he will need to make up the difference? Hope that question makes sense.

When a VIX option expires out of the money it is has no value and just goes away. You have to explicitly enter into a new trade for a later dated option if you want to continue with that strategy.

I bought 300 shares of uvxy what should I expect? I keep seeing ppl say I’m going to owe money if the sp500 goes down. I’m confused. I heard if so 500 goes down then uvxy goes up. Should I be nervous or excited?

Hi Damon, If you haven’t read it you should read https://www.sixfigureinvesting.com/2015/03/how-does-uvxy-work/ If the market goes down significantly then UVXY will go up but when the market is going up or flat UVXY’s value will erode (not stay stay the same) rapidly–maybe 10% a month. This is not a buy and hold investment.

Are you talking about VIX index options or VIX futures options?

There’s no direct link between VIX options and VIX futures (e.g., you can’t exercise a VIX option and get VIX futures) but from a pricing standpoint VIX options for a given expiration month will closely follow the equivalent expiration VIX future. To my knowledge there are no VIX futures options.

Vance,

Are you saying that if I buy /VX (The VIX Futures Contract), that I could use the puts on the VIX as a quality direct hedge?

Yes, the VIX options for the same month (e.g, March) closely track the VX future that expires that same month. Those futures & options settle to the same VRO quote and track each other well before expiration.

Thank you Vance!

I really appreciate your insights and response.

To clarify my question below…

I will hold the option til expiration and just buy another one when it expires. I don’t really care about settlement it is just a hedge so I can buy the leveraged futures contract.

If it is not going to act right I will just go ahead and buy calls on the VIX.

Thanks in advance.

Vance, I have been reading your blog for some time and I find it one of the most interesting source of information on volatility products.

I hope your read the comments to older posts, because I have a question. You mentioned often that the true underlying of VIX option is the corresponding future contract instead of the index itself; while I intuitively agree with you, I could not find any technical discussion of the point (besides your considerations on put-call parity). Did I miss something? Is there anything I can read to get a better understanding of the issue?

Hi Andrea, Technically VIX futures are not the underlying of VIX options–but using the appropriate VIX future you do get a much more accurate picture of the greeks and the option’s premium. Since VIX options do not allow early exercise and are cash settled the whole concept of an underlying is not really necessary. To be really technical, the pricing bedrock for VIX options and futures is a 30 day variance forward variance priced in volatility points. That’s probably not useful, but it’s my best shot at accuracy. These variance forwards / swaps consist of “strips”, lots of SPX options at different strikes that together give a variance that’s not very sensitive to the absolute value of their underlying (the SPX). The square root of variance is volatility. There’s some more subtleties, but I doubt they would be helpful.

Hi Vance, thanks for your prompt reply. I used to trade interest rate and equity derivatives (actually, I was in charge of financial product engineering at a major Italian bank) around 20 years ago, but I never had the opportunity to trade volatility products.

In regards to point #10…the bid/ask spread: how often would you say that you got filled better? For example, as I am typing this, calls for next month at the 15 strike are quoted at 1.00 x 1.10. If I joined the bid, what are the chances that someone hits me there…and if I placed a limit order at say 1.05, what are the chances I would get filled there? I understand its not an absolute science but any experience you could relay would be great.

“Because the underlying for VIX options is the futures contract, the options prices do not track the VIX particularly well”

Techinally this isn’t correct. The underlying for the options IS is the vix index and the SOQ calculated based on the same SPX options that are used to calculate the VIX index also.

The reason the options seem to track the futures and not the index, is the european style exercise – the options behave as they were american style options with the futures as the underlying, but they actually are european style options with the index as the underlying. In practise this doesn’t make much difference because on settlement date the values are the same, but if for some impossible reason the index and futures would differ on settlement, the official options exercise price would be the SOQ of the Index, not the price of the futures contract.

Hi Markus, I agree that VIX futures are not the actual underlying of VIX options and I have modifed the post to that effect. However, I don’t agree that the VIX is the underlying. As you mention, the actual settlement uses the SOQ calculation on a set of SPX options. These options form a 30 day forward log contract variance swap priced in volatility points. If VIX options settled to the spot VIX there wouldn’t be a typical difference, sometimes of several percentage points with the VIX opening price. The reality is that VIX Futures act as if they were the underlying of the appropriate vix options series (e.g, satisfying put /call parity) and VIX futures are key enablers for the existence of VIX options because the market makers use VIX futures to hedge their VIX options positions. Explaining everyday VIX option pricing with respect to VIX futures is straightforward–trying to explain it in terms of the VIX spot is impossible.

— Vance

To clarify in regards to exercising the options, once you go long a call, the only time you can get out of it is at expiration? You couldn’t sell the call prior to expiration?

Hi Felix, You can always sell the call whenever the market is open, exercising is restricted to only happen at expiration. In practice I don’t see any benefit to exercising VIX options, the option is either in or out of the money at expiration and if in the money the holder will get the cash difference from the strike price.

With American style options there is the ability to exercise early and there are sometimes times when it makes economic sense to do that, primarily associated with dividends, or possibly with mis-pricing.

— Vance

You sir have answered many of my questions with that single post. Thank you very much.

I was wondering the same thing..

Great post. You might also find this interesting – Top 6 Reasons to Trade Volatility http://www.vixstrategies.com/top-6-reasons-to-trade-volatility-2/

Hey wow I really like your article because it explains everything in great detail. I’ve been dying to invest in trading options but I was scared since I’m just new to all this. I’ve been searching the web for some helpful tips and advice such as on http://www.amazon.com/dp/B00JFB3V7O/ie=UTF8?m=ADE61CS5ZCK11&keywords=&tag=cfx02-20. Well but when I came across your blog I felt so much more confident because your article seems so simple and easy. Thanks a lot for sharing.