Update

VXUP and VXDN were terminated on September 8th, 2016. They never accumulated enough assets to be financially viable. The naysayers on these funds were right—there was no way these funds could perform the way their prospectus or marketing materials suggested. They didn’t understand (and didn’t bother to learn once it was pointed out) how their funds would be arbitraged against VIX futures in such a way that would drag them far away from their indicative values, and their corrective distribution mechanism not only didn’t work but further complicated an already nightmarish system of monthly stock splits.

AccuShares’ VX UP and VX Down funds started trading on May 19th,2015. There was a lot of interest in these Exchange Traded Products (ETPs) because they were the first funds to attempt a direct linkage to the CBOE’s VIX index. An investable VIX has been the Holy Grail of volatility investment.

At this point it’s clear that these funds are a failure. The UP shares are often trading way above (10% or more) where the fund’s indicative value (IV) is, and the Down shares are trading way below (10% or more) their IV. It appears that the scenario pointed out this comment to the SEC regarding the funds is playing out—arbitrage opportunities with VIX futures are dragging their values away from their intended operating model. Right now their prices are behaving more like VIX Futures than the VIX index—not even close to what the investor is led to expect from the marketing materials and the prospectus.

I have spent some time reviewing the prospectus. As usual, it is a confusing and frustrating exercise. I don’t know what it is about prospectuses, they seem to give some information eight different times and if you are lucky other apparently critical things are only described once.

AccuShares states that these funds are intended only for sophisticated investors—I can second that.

The items below seemed important to me:

-

- The VIX Up and VIX Down Exchange Traded Notes (tickers VXUP & VXDN) trade in a monthly cycle. The cycle starts on the 16th calendar day of the month if it’s a business day or the first business day after.

-

- At the end of the monthly cycle, the fund with gains distributes a Regular Distribution of a cash dividend or stock grant of equal numbers of VXUP / VXDN shares of equivalent cash value to holders of record. Accushares believes that these distributions will be taxed as qualified dividends (pg 127). Usual disclaimers about tax advice apply.

-

- At the beginning of the monthly cycle the value of the two funds is set to the same value—the value of the lower of the two funds at the end of the previous cycle.

-

- The funds are intended to follow the percentage moves of the VIX (or the opposite), not the absolute value of the VIX. There will usually be a 0.15% daily adjustment that will be discussed later. The theoretical values of the fund’s shares are called the Share Class or the IV values. The fund’s initial Share Value was $25 per share.

-

- The fund issuer does not make any investments in volatility related securities. All assets are kept in cash or highly secure investments like treasuries or fully collateralized repos. Earnings from these investments may be distributed as part of the regular monthly distributions.

-

- If the VIX index at the beginning of the period is less than or equal to 30 the Up fund’s value is decreased by 0.15% of the cycle’s beginning Share Class value every calendar day (cumulative 4.6% per month). This factor is derived from the typical losses that long volatility products like near month VIX futures or VXX experience in a typical month of trading (a month with no volatility spikes). The Down shares are boosted by the same amount. This tweak is intended to prevent disruptive trading by individuals or institutions using VXDN or VXUP to hedge other volatility investments. Time will tell how well this works.

-

- The Regular Distributions at the end of the period are a bit tricky. The winning fund will do a dividend distribution that will take its Share Class value down to the losing fund’s value. The income from that dividend distribution will be partially offset by the capital loss from the winning shares’ value dropping all the way to the losing share’s value. For example, at the beginning of a period let’s assume the VIX is at 40, and the VXDN/VXUP shares are worth $10, if the VIX goes up 10% during the period the value of the VXUP shares before the Regular Distribution would be 10+ 1/4* (44-40) = 11 and VXDN would be 10 – (1/4)*(44-40) =9. The distribution for VXUP shares would be $2 per share (cash or share equivalents) and the new VXUP value after the distribution would be $9. Net gain to the VXUP shareholders pre-tax would be +$2/share dividend – $1/share capital loss = + $1 net, which is a 10% gain from the starting value. Expect confused shareholders at this point.

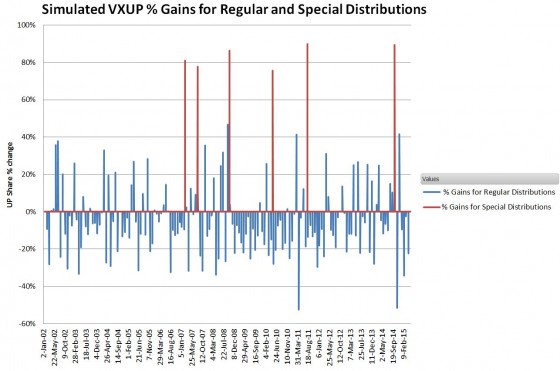

- The funds do a Special Distribution if either experiences more than a 75% gain in the Share Class from the start of the monthly cycle. The maximum gain is capped at 90%. This prevents the losing side from losing more than their initial investment. The Special Distribution dividend for the winning fund is essentially the difference between the ending values of the opposing share classes on the Special Distribution date. The next trading day the Up and Down Class Share value will be set to the value of the losing side. My rough simulation results below suggest that there would have been six such events since 2002, the last one (surprisingly) being on October 13th, 2014.

-

- The Share Class value of the funds is published every 15 seconds during market hours as the indicative value (tickers ^VXDN-IV & ^VXUP-IV on Yahoo Finance). If the funds are working well (which they aren’t) the IV prices should be close to, or within the market bid / ask spread. The difference between the IV value and the traded value of the funds is called the tracking error.

-

- If the tracking error of day end trades vs IV values exceeds 10% for 3 consecutive days a Corrective Distribution (CD) will be scheduled to be implemented as part of the next Special or Regular Distribution (the first 60 days of operation are exempt). A Corrective Distribution is a hard reset on the funds, where Accushares doubles the number of outstanding shares and distributes them in such a way to put every shareholder into a risk neutral position with equal numbers of Up and Down Shares. Since the asset value of the fund won’t change at that point the NAV and Share Class value of the shares will have to drop by a factor of two (unless they do a simultaneous 2:1 reverse stock split). The way the process works the premium / deficit due to tracking error will be removed from shareholder’s accounts at distribution time—it’s a very clever approach. Since the market knows the CD is approaching, the tracking error will drop to zero right before the regular distributions. However people will get burned if a Special Distribution occurs once the monthly CD threshold is reached. There’s no way to predict when a Special Distribution will occur. Before introduction AccuShares did not think Corrective Distributions would be necessary, but it’s looking like they could be an every month thing after the startup period. It also looks like they will only reduce tracking errors for a day. For the detailed workings of a Corrective Distribution see this post.

- The best case scenario for AccuShares would have been heavy demand for both Up and Down shares. This would result in increasing assets under management and fee/investment income. The worst case would be heavy buy demand for one share type and heavy selling on the other. In this situation, a key difference between VXUP and VXDN vs other Exchange Trade Products comes into play. Accushares requires that APs bundle equal numbers of Up and Down shares when transacting share creations / redemptions. This is unprecedented to my knowledge. Every one of the other 1600+ ETPs has just a single fund involved in the creation / redemption process. If there is a buy / sell imbalance between these two funds it may become unprofitable for the APs to do the arbitrage transactions that they typically execute that pull trading values closer to IV values. If this occurs trading and IV values of the funds might become uncoupled from each other—which is a bad thing in the ETP world.

Many a volatility investor has cursed their screens when they have called a VIX move correctly and see their volatility positions barely move, or even go in the opposite direction. If AccuShares had really delivered what they claimed with VXUP and VXDN a flood of money would have come their way. Given their actual horrendous performance, they are a complicated mess that should be terminated as soon as possible.

Hi Vance

I bought 67 VXUP at $2.0375 on August 23, now I see I have only two but I didn’t sell anything. Do you know hat happened or why it went down?

Hi Leticia,

Since you bought your shares VXUP has effectively a 2:1 reverse split due to a corrective distribution, a 10:1 reverse split that Accushares used to bring the price back up to prices above $10 and several dividends. You should also have 2 shares of VXDN in your account as the result of a corrective distribution. I talk about these various corporate actions in the post. Ironically the price has dropped so much because the VIX went up a lot in late August. Each month Accushares sets the share values of both VXUP and VXDN to the lower of the two and issues a dividend to compensate the fund that drops in value.

As you have seen these funds are very complex. They are

also not working very well. I don’t think that ordinary investors should use them.

Best Regards,

Vance

No one should use them!

Hi Vance,

I bought VXUP some 20 days back when it crashed from 23 to 3

My avg price is $3.06 and I see today it is $0.54.

I did not realize it is this complicated mess, poor judgment on my part we all make mistakes.

I know it is for an individual to judge, but do you see any chance of it going closer to 3 so that I get rid of it.

Or you more probably see them shutting shop in which case I just get out of it with whatever I can.

Hi, Things aren’t quite as bad as they look, the stock split 2:1 because of a corrective distribution and you now own some VXDN (same number of shares as your VXUP.). My opinion is to exit VXUP at least now, don’t see VIX going up in the short term.

— Vance

I bought my VXUP shares through Etrade at around $2.60 on 8/24. I’ve yet to see any VXDN shares added to my portfolio. Am I missing something? I’m new to this type of fund and really don’t know what to expect.

HI Dave,

Distributions take 3 days I believe. You should see some VXDN shares in your account by the end of the week.

— Vance

Thank you Vance. Much appreciated.

Thanks for explaining this in detail, the information outside is confusing and non existent.

One last question. Would it be worth holding on to the new VXDN shares, I think they would show on on 9/22. And what would be a good date to sell them one day before the month lock ?

My crystal ball is always pretty cloudy. Unless the market really tanks in the near term I would look to exit VXDN when VIX drops into the 17 / 18 range. At that point the VIX futures (the securities that really matter in all this) will have dropped about as much as they’re going to in the next month or two.

— Vance

What is the projected share price tomorrow?

I’m assuming they will do the reverse split immediately and since I don’t know the multiplier, don’t know the final price. Looks like the new value before the split will be around 1.34. A 20X reverse split would be reasonable…

Hi, Vance, Did VXUP blow up today? Down $21.52 or -90.54%

VXUP/VXDN did a special distribution (SD) because the movement in VIX since the start of their monthly reset exceeded 75%. I assume this was put in place to prevent VXDN from going negative. The new reset value is 1.73.

— Vance

Hi Vance

Incredibly interesting article, you have helped me understand this…however I still don’t understand how the Corrective Distribution is supposed to reset the market values to Class Values? I understand that the investors is not better or worse off from an intrinsic value basis, but how does this mechanism guarantee that the market values will sit where they should and that the tracking error becomes 0.

From what I understand, arbitrage prevents this product from ever trading at Class Value because of the term structure in the futures market.

Hi Steven,

The Corrective Distribution (CD) is actually quite impressive. It penalizes those that are holding the funds at levels higher than the NAV values when the distribution occurs. An example, let’s say you are holding 1000 shares of VXUP at $28 per share ($28K worth) , and its NAV value is $25 per share. Also let’s assume VXDN NAV is at $22. If the CD occurred then the holder of VXUP gets a $3/share dividend. As part of the CD Accushares issues a share of VXDN held in accounts for every VXUP share, and a share of VXUP for every VXDN share held in accounts. Since Accushares can’t change the asset level of the fund and they have doubled the number of shares outstanding the new NAV would be VXDN’s NAV level divided by 2, so $11 (or they might reverse split the stock). When the smoke clears the next day you have a $3k dividend, 1000 shares of VXUP, and 1000 shares of VXDN. When VXUP/VXDN opens the next market day your account has taken a $3K hit, down to $25K. It doesn’t matter what premium / discount the VXDN/VXUP opens trading at, it will be symmetrical around the new $11 NAV value. So for example if there is a 10% tracking error, VXUP would be at 12.1 and VXDN would be at 9.9. 1000*12.1+1000*9.9 = 22K + the 3K dividend = $25K. Pretty clever.

So, no one should hold VXUP or VXDN at a premium to its NAV value right before it goes into a CD.

— Vance

I’m equally confused. Let’s say they did a corrective distribution this month at this moment (VXUP is off by 20%, VXDN by 12% right now). As a person who got in early for the winning side, I don’t see any benefit. The prices will start to approach the VIX’s value as it approaches the 15th of next month, and when it does a distribution, they should be at the correct prices. Then what? They inconvenience all the shareholders who held on by forcing them to incur additional transaction fees. Behaviorally, at this point in time relative to the next standard distribution, it doesn’t seem like anything is affected if the corrective distribution didn’t occur at all.

Hi Seven, I have done a detailed example on the CD in this post: https://www.sixfigureinvesting.com/2015/06/how-does-vxup-vxdn-corrective-distribution-work/ It should answer your CD question. Yes, you are correct, I believe arbitrage will cause large tracking errors in VXUP/VXDN whenever the VIX and the front month futures have different values.

— Vance

Great analysis, as usual. I have a couple questions/comments.

-Did you determine in your backtesting how often the 90% drop limit would have been hit?

-Have you been able to pull up the indicative values, I couldn’t get them to display on yahoo finance.

-I read through the corrective distribution section in the prospectus several times. It seems rather innovative, since you could just cross-sell between the two securities for a risk free arb if the clause is triggered, which should erase differences between NAV and traded value. I’m curious why you aren’t bullish on this, except for the insane complexity which I agree can be a bit much.

Hi CG95,

Regarding the 90% drop, there weren’t any in the 2002 to present time frame with my analysis. Not surprising because the upside volatility of volatility is much higher than the down side, where mean reversion takes its time getting back to the mean.

I have generated 20 minute delayed IVs here: ( https://www.sixfigureinvesting.com/2015/05/vxup-vxdn-iv-tracking-futures-tracking/ ). Surprising it’s not being distributed in the normal channels.

Regarding the corrective distribution I suspect the cross-sell strategy would not work because the prices would be offsetting and far from the IV price. Certainly possible that Accushares screwed this up. Looks like we will see one of these happen at some point. It will be at least 90 days from now.

— Vance

Doesn’t look like they are doing well in early trading…darn, I really want there to be an actual Spot CBOE VIX trading opportunity!

Based on your description of these products, Vance, I am not optimistic about how well they will work. I will watch with curiosity from the sidelines.