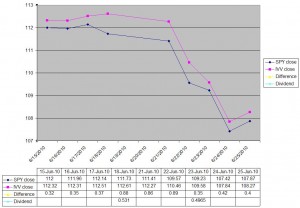

If your devious dividend capture plan involves you hedging against SPY’s price movements by selling IVV short until after SPY goes ex-dividend you can forget about it. The IVV (Barclays Global) price doesn’t drop by SPY’s dividend amount on SPY’s ex-dividend date. It continues to track the S&P 500 until it goes ex-dividend a few days later. Your master plan will net out with you down by at least your commission costs.

For IVV and SPY ex-dividend and distribution dates and lots of others see here.

If you are interested of an overview of dividend strategies—some of which actually work, see this post.

Thanks to Jeff in the comments below for pointing out to me that IVV management doesn’t have to do anything in order for this to play out this way.

Hi Jeff, Thanks for pointing out the error in my logic regarding IVV’s price. If I had looked a little closer at my own graph it would have been obvious! If anything it is SPY’s price that is being manipulated–after all the S&P500 index doesn’t care when SPY goes ex-dividend.

— Vance