One of the persistent characteristics of the CBOE‘s VIX® index is the Christmas Effect—the tendency for VIX to drop down to relatively low levels during the Christmas holidays. The CBOE’s VIX volatility December futures predict this drop for months in advance, and it has come to pass again this year. I am aware of at least three possible explanations for this:

- Option market makers and others short options reduce their prices before the holidays so that they don’t get stuck with time decay (theta) during the multiple days off

- Traders in general go on vacation the end of December, volume drops, and the market becomes lethargic, reducing volatility

- People expect volatility to decrease, trade accordingly, and it becomes a self-fulfilling prophecy

I am skeptical about calendar based trading strategies (e.g., “crash prone” October was +8.5%, -1.8%, +4% 2011 through 2013) but the Christmas effect has been persistent— perhaps because it’s not easy to profit from it. The VIX index itself is not investable, and the December VIX futures already discount the effect.

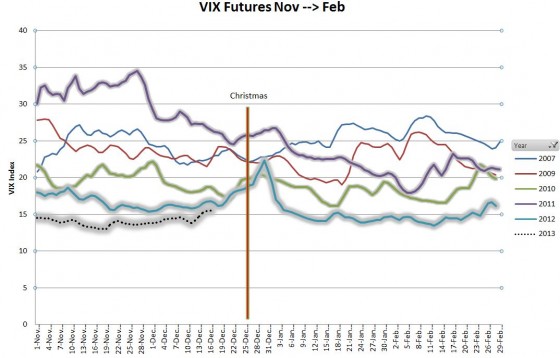

I was curious how the VIX behaved over the last few years in December and January, so I generated the chart below using VIX historical data from the CBOE.

To make the chart more readable I carried over closing values over weekends/holidays and used a 3-day moving average. I excluded 2008, even though it shows the Christmas effect because the market that year was clearly in an unusual state.

There does seem to be a fairly consistent low around the 23rd of December and the VIX has consistently increased right after that—at least for a few days. By mid-January things seem to have settled back into their random ways.

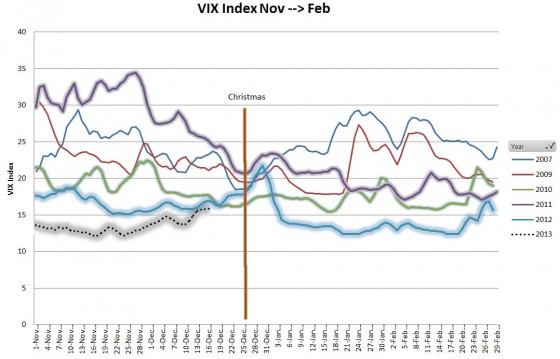

I also wondered how VIX futures behaved around the holidays. I used my VIX futures master spreadsheet to generate the chart below showing the behavior of the front month VIX futures, the next ones to expire.

With the VIX futures the December dip comes a few days earlier.

In my experience, the future is often uncooperative in repeating the past, but this VIX Yet to Come, looks like a reasonable bet for a post-Christmas boost.

is it vix then usually rising biginning of the year

Hi Olav,

That’s what the historical data suggests, that in the 2nd half of January volatility usually goes up. This trend looks hard to profit from. I looked at VXX and backtestested XVZ and neither one showed any corresponding move (contango probably cancelled it out). VIX February options are probably the best way to bet on that move, but I have not backtested that.

— Vance