Exchange Trade Fund UVXY is a 1.5X leveraged fund that tracks short-term volatility. To have a good understanding of UVXY (full name: Ultra VIX Short-Term Futures ETF) you need to know how it trades, how its value is established, what it tracks, and how ProShares makes money running it. For the last year, UVXY has been the only leveraged long volatility Exchange Traded Fund (ETF) available, but recently the 2X leveraged UVIX ETF was introduced. For more on that newcomer see “How Does UVIX Work?”

How does UVXY trade?

- UVXY trades like a stock. It can be bought, sold, or sold short anytime the market is open, including pre-market and after-market time periods. With an average daily volume of 47 million shares its liquidity is excellent and bid/ask spreads are a penny.

- It has an active set of options available, with seven weeks’ worth of Weeklys and close to the money strikes every 0.5 points.

- Like a stock, UVXY’s shares can be split or reverse split. If fact, UVXY reverse split 5 times in its first four years of existence—which may be a record. See this post for more details on historical and predicted reverse stock splits.

- UVXY can be traded in most IRAs / Roth IRAs, although your broker will likely require you to electronically sign a waiver that documents the various risks with this security. Shorting of any security is not allowed in an IRA.

How is UVXY’s value established?

- Unlike stocks, owning UVXY does not give you a share of a corporation. There are no sales, no quarterly reports, no profit/loss, no PE ratio, and no prospect of ever getting dividends. Forget about doing fundamental style analysis on UVXY. While you’re at it forget about technical style analysis too, the price of UVXY is not driven by supply and demand—it’s a small tail on the medium-sized VIX futures dog, which itself is dominated by SPX options (notional value > $100 billion).

- According to its prospectus, the value of UVXY is closely tied to 1.5 times the daily return of the S&P VIX Short-Term Futurestm This index manages a hypothetical portfolio of the two nearest to expiration VIX futures contracts. Every day the index specifies a new mix of VIX futures in that portfolio. For more information on how the index itself works see this post or the UVXY prospectus.

- The index is maintained by S&P Dow Jones Indices. The theoretical value of UVXY if it were perfectly tracking 1.5X the daily returns of the short-term index is published every 15 seconds as the “intraday indicative” (IV) value. Yahoo Finance publishes this quote using the ^UVXY-IV ticker.

- Wholesalers called “Authorized Participants” (APs) will at times intervene in the market if the trading value of UVXY diverges too much from the IV value. If UVXY is trading enough below the IV value they start buying large blocks of UVXY—which tends to drive the price up, and if it’s trading above they will short UVXY. The APs have an agreement with ProShares that allows them to do these restorative maneuvers at a profit, so they are highly motivated to keep UVXY’s tracking in good shape.

What does UVXY track?

- Ideally, UVXY would exactly track the CBOE’s VIX® index—the market’s de facto volatility indicator. However, since there are no investments available that directly track the VIX ProShares chose to track the next best choice: VIX futures.

- VIX Futures are not as volatile as the VIX itself; solutions (e.g., like VXX) that hold unleveraged positions in VIX futures only move about 45% as much as the VIX. This shortfall leaves volatility junkies clamoring for more—hence the 1.5X leveraged UVXY and the new Volatility Shares 2X leveraged UVIX

- ProShares achieves the 1.5X daily return by taking advantage of the fact that VIX futures only require a small percentage (e.g. typically less than 25%) of their face value be deposited as margin to purchase the contract. By doubling up the number of contracts they own they can double the returns. To keep this leverage near a constant 1.5X they have to adjust the number of futures contracts held by the fund at the end of every trading day. This adjustment is essentially a compounding process.

- If you want to understand how leveraged funds work in detail you should read this post, but most importantly you should know that the 1.5X leverage only applies to daily percentage returns, not longer-term returns. For a leveraged fund, longer-term results depend on the volatility of the market and general trends. In UVXY’s case these factors usually (but not always) conspire to dramatically drag down its price when held for more than a few days.

- The leverage process isn’t the only drag on UVXY’s price. The VIX futures used as the underlying carry their own set of problems. The worst is horrific value decay over time. Most days both sets of VIX futures that UVXY tracks drift lower relative to the VIX—dragging down UVXY’s underlying non-leveraged index. This drag is called roll or contango loss.

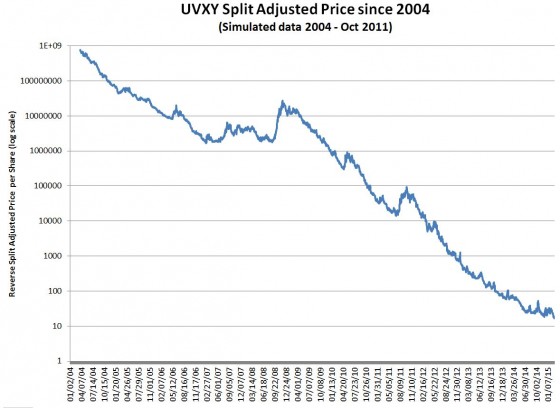

- The combination of losses due to the 1.5X structure and contango losses add up to typical UVXY losses of 10% per month (70% per year). This is not a buy and hold investment.

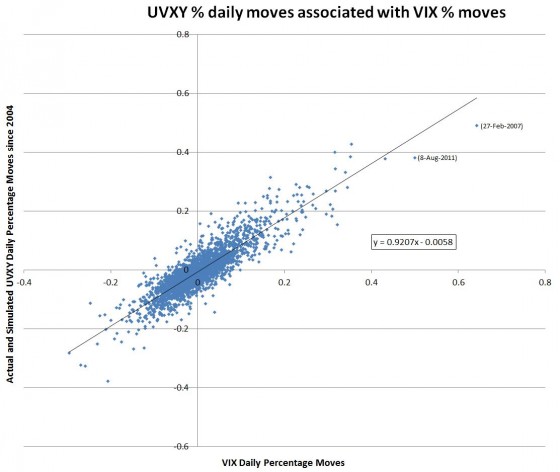

- On the other hand, UVXY does a good job of matching the short term percentage moves of the VIX. The chart below shows historical correlations with the linear best-fit approximation showing UVXY’s moves to be about 92% of the VIX’s. The data from before UVXY’s inception on October 3, 2011, comes from my simulation of UVXY based on the underlying VIX futures.

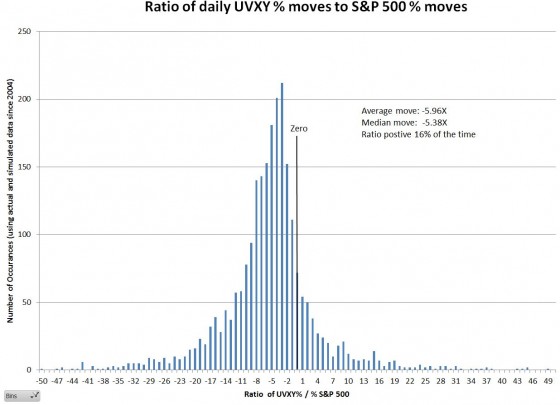

- Most people buy UVXY as a contrarian investment, expecting it to go up when the equities market goes down. It does a respectable job of this with UVXY’s percentage moves averaging -5.96 times the S&P 500’s percentage move. However, 16% of the time UVXY has moved in the same direction as the S&P 500. So please don’t say that UVXY is broken when it doesn’t happen to move the way you expect.

- The distribution of UVXY % moves relative to the S&P 500 is shown below:

- With erratic S&P 500 tracking and heavy price erosion over time, owning UVXY is usually a poor investment. Unless your timing is especially good you will lose money.

How does ProShares make money on UVXY?

- As an Exchange Traded Fund (ETF) UVXY must explicitly hold the appropriate securities or swaps matching the index it tracks. ProShares does a very nice job of providing visibility into those positions. The “Daily Holdings” tab of their website shows how many VIX futures contracts are being held. Because of the 1.5X nature of the fund, the face value of the VIX futures contracts will be very close to 1.5 times the net “Other asset/cash” value of the fund.

- ProShares collects a daily investor fee on UVXY’s assets—on an annualized basis it’s 0.95% per year. With current assets of $1.1 billion, this fee generates around $9.5 million per year. That should be enough to cover ProShares UVXY costs and be profitable, however, I suspect the ProShares’ business model includes revenue from more than just the investor fee.

- One clue on the ProShares’ business model might be contained in this sentence from UVXY’s prospectus:

“A portion of each VIX Fund’s assets may be held in cash and/or U.S. Treasury securities, agency securities, or other high credit quality short-term fixed-income or similar securities (such as shares of money market funds and collateralized repurchase agreements).” Agency securities are things like Fannie Mae bonds. The collateralized repurchase agreements category strikes me as a place where ProShares might be getting significantly better than money market rates. With UVXY currently able to invest around $350 million this could be a significant income stream. - According to ETF.com’s ETF Fund Flows tool, UVXY’s net inflows have been over $3 billion since its inception in 2011. It’s currently worth $1.1 billion, so ProShares has facilitated the destruction of around two billion dollars of customer money—so far. I’m confident the overall destruction trend will continue.

- UVXY has escaped the negative publicity that Barclays’ VXX and VelocityShares’ TVIX funds have generated, but as it continues to grow in size and continues to destroy shareholder value at eye-watering rates it’s probably a matter of time before UVXY starts getting vilified on its own merits or lack thereof.

Important Dates

- UVXY Inception 3-October-2011

- UVXY Leverage Reduction from 2X to 1.5X on 28-February-2018

- UVXY Reverse splits: See this post

UVXY is like a loaded gun, effective when used at the right time, but dangerous if you leave it lying around.

Hey there, I’m William! I’ve been diving into the exciting world of cryptocurrency predictions, exploring what’s in store not just for this year, but also for the coming years. I’d love to hear your thoughts on my articles! What are your predictions for the future of cryptocurrency? Let’s chat!

https://coinpedia.org/price-prediction/btt-bittorrent-price-prediction/

Hi Vance,

I’m wondering if you’d care to comment on what you expect the future to look like for UVXY, now that Barclays has stopped the creation of any additional VXX units (and thus potentially killing VXX much like TVIX was done away with).

Thanks for any insight you may have!

Barclays said in their press release “Barclays expects to reopen sales and issuances of the ETNs as soon as it can accommodate additional capacity for future issuances.” Unless they change their mind, I expect VXX to resume normal operations within a month. I don’t see any macro factors that are threatening the existence of the volatility ETFs. — Vance

With UVXY getting so cheap I’m starting to think the buy and hold strategy could actually start getting smart. Like it’s under $5 now. At a certain point it has limited downside but huge upside especially in a black swan event. For instance say it gets down to 2 bucks a share. It can literally only go down 2 bucks but at SOME point SOMETHING will cause shares to jump. Am I missing something or flawed in this thinking? Thanks for the detailed article it was very helpful.

Hi Colin,

What your missing is how much of move is required to even break even after UVXY declines as much as it normally does. While it would be possible for UVXY to get back to $5 after it declines to $2, it would take a 150% move up to just break even. Wait a bit longer, with UVXY at $1, now it takes a 400% move to break even. This is not a stock that’s in a trading range, it’s a stock that headed for zero with occasional interruptions.

Vance

Thank you Vance!

Hi Vance,

Thanks for the detailed explanation of UVXY. One question always lingers in my mind, if this ETF is made to decay, why doesn’t everyone short it? I examined 10 years worth of UVXY data and found that 60% of the time you will break even on a month long put at expiration and 50% of the time you can end up with a 30% gain at expiration on a month long put and that’s assuming you hold till expiration which if one is seeking 10-20% gain on a month long put then you would pull out as soon as you hit that milestone. Just wondering if I am missing some crucial piece of info here because the risk/reward ratio makes sense but maybe thats just my aggressive risk tolerance speaking. Also, I looked at longer term puts that give the investor even longer periods to break even (granted break even requires a slightly bigger dip) and some didn’t make too much sense for the big slash to the profits.

Hi Kareem, If you haven’t read it I suggest https://www.sixfigureinvesting.com/2016/10/is-shorting-uvxy-tvix-vxx-the-perfect-trade/ and look at UVXY’s chart for March 2020. Without a disciplined (always expensive) risk management strategy shorting UVXY is a risky proposition.

Vance

Hi all — i had a question. I bought and sold UVXY over a day or two and made thousands. now for tax year 2020 I will get a distribution K1 statement from proshares stating a loss or a gain — we will see. If it is a positive distribution, I think I’ll be responsible to pay taxes on those gains … but, my question is, will I get a check for that k1 profit from proshares? I understand that the amount I have Gained by trading on my brokerage platform will likely be different from the K1 statement.

Hi Vanarp, You definitely will not get a check from proshares on any profits. They only report what their calculations show. You are right, the K-1 statement (if you get one) will likely differ from your actual profits. You should be able to access your K-1, if you have one by signing up at https://taxpackagesupport.com/proshares They offer on-line access to K-1 forms. At least for me they are already available for 2020. One other note, you may be able to use what’s called 1256 reporting on your UVXY profits. This is a pretty big deal because the 1256 allows 60% of the profits to be taxed at long term rates and 40% at the short term rates. Your broker might not report this stuff correctly so it might be worth some money to have a tax savvy accountant to look at it. — Vance

Hi Vance, hope you’re still responding to this string. As it appears Q2 ’21 is closer to a big drop in the markets than when this string began, would long calls on UVXY be good at this point? I’m looking at UVXY and SQQQ as possible long calls for significant gains.

Frankly no idea. I wouldn’t be surprised if the market tanked or soared from this point.

Hi, must you have margin account to purchase UVXY?

To my knowledge no. However, you will likely be asked to sign a waiver stating that you understand that UVXY carries significantly more risk than normal securities.

Well, I just purchased 2 contracts of the $11, 21 January 2022 calls. I think the market exuberance is out of control and expect a volatility spike within the next year. I hope this pays off.

I day traded the UVXY today and gained $1888. It’s very difficult to time though. I was using 2k shares max.

UVXY at $10.40 is a very good buy with 3 month view.

That didn’t work out very well for you.

Nice

Hi Vance, first off thank you for your awesome website. I am looking to trade ETF that are holding short term futures and that are subject to important contango/backwardation. Apart from UVXY, would you have any suggestion?

Thank you.

Hi Vance,

Thank you for all your insights about uvxy. There is lots of sentiment that a bear market is due added to all the uncertainties in the world affairs. So what are the chances that this fund will spike significantly in case of a 2008 crash model and who buys its shares

at higher prices?

Thank you

Joe

Hi Joe,

One of the things that always impresses me is how hard it is to predict when major corrections and bear market will occur. Certainly, there will be a bear market eventually, but a lot ($ billions) have been lost, and will be lost trying to timing these volatility events. Chances are very good that UVXY will spike dramatically during the next market crash. The people that continue buying it during the spike are betting that the spike will continue / get worse. The rewards are large if you get it right.

Vance

Thank you. It might be worth going long with a minimum investment.

What are good options for betting against the market other than shorting?

UVXW and tvix are the two best shorts ever. even when the market corrects they only go up briefly before continueing downward. only wish i had found them sooner

In just the last year (after all the reverse splits) this dog has gone from over $800 to less than $20. Over the last 5 years it has gone from $1.2M to less than $20. So my question is, since it is optionable, why not just invest in puts a year or more out? Wouldn’t the fact that the thing is such a consistent loser be a goldmine even after fees and decay?

Buying puts is a reasonable strategy. You will likely make money, especially if you wait for a vol spike to initiate the position. The risks are a major correction, or a bear market. If one of those happens your options might not be long term enough for them to become profitable.

In the last 6 days UVXY went from $20 to 15 and change, even though the markets have had a rocky couple of weeks. Seems it would have been a fine near term naked put.

I’m confused. I believed UVXY tracked the ^VIX less cantango loss. I bought a small amount of UVXY on Friday 2/10 at 21.90 when the ^VIX was at about 10.80. As of now (Monday 2/13 just before noon) the ^VIX is up 4% at 11.28 while my UVXY is down 4% at 21.00.

Far from tracking the short term ^VIX, this performance is its perfect inverse. Is this an anomaly, or did I misunderstand the intent of the UVXY? I couldn’t find a single data point in the scatter plot in the article that had an 8 point spread around the axis.

I had only intended this as an experiment in buying what I think of as “very short term volatility insurance”. I got the volatility guess right… but my insurance broker seems to have taken my premium payment and denied my claim.

Hi GammaDog,

UVXY tracks a mix of VIX futures, not the VIX directly. While VIX futures eventually line up with the VIX on the day of their expiration they are free to go their own way before that–and often do. For more see: https://www.sixfigureinvesting.com/2015/03/how-does-uvxy-work/

Thanks, Vance. I went back and reread the article with particular focus on the scatter plot that shows the correlation between ^VIX and UVXY. In my post yesterday I said that the data did not show a prior occurrence of a day like yestday where the ^VIX was up 4% and UVXY down 4%. I now realize that I had misread the scale of the chart by one order of magnitude. In fact, that divergence (^VIX up,and UVXY down on a given day) is everything in the lower right quadrant from the origin. While there have been no occurrences of a +40/-40 divergence, there clearly is a history of divergence in the low single digits on either side of the origin on any given day.

Today is showing the same phenomenon (^VIX +2.4%, UVXY -1.5%). Fortunately, I bailed yesterday afternoon with a small loss which I’ll file under “investing college tuition payment”. I’m thinking that buying the UVXY as volatility insurance is like juggling lit Molotov cocktails… you can impress your friends if it works… or burn the crap out of yourself most of the time. Any investment where I get the fundamentals right and still lose money in the process seems like one to avoid for me.

In this aricle you said you are confident the overall destruction trend will continue. why this kind of product still allow to trade and open loot for customer’s / small investors ?

The documentation on these products is very clear, there is no deception on their likely behavior. They also have legitimate uses–in a volatility spike they are an impressive way to profit / hedge your other investments. Most brokers require investors to sign off extra waivers if they want to use these products.

We allow people to buy knives even though they can hurt themselves with them–what level of control to you want to assert on people? With freedom comes responsibility.

I get a very strong sense you’re horribly jaded. Did the author lose a small fortune of some1 else’s $$$ playing the VIX? If I wanted this much negativity…………..

Nope, didn’t lose $$$ playing my or someone else’s money on this. Have had been contacted over the years by multiple people that have lost hundreds of thousands. I do believe there are people that consistently make make money on this, but I think they have well above average sophistication and/or timing sense.

THis is not a sixfigure investing idea…..UVXY is crap

Hi Vance,

I am looking at the 2 year chart of UVXY – is it true that it traded about 200 back in September 2015 period, came back down for a few months and then traded/spiked close to 300 in January-February 2016 when the market correction of about 10% took place. And since it traded almost 300 in Jan/Feb 2016, it has now come down to about 18? Or is the chart skewed because of the reverse splits? It couldn’t be contango that would have caused the drop from almost 300 in January-Feb 2016 to about 18 as of 9/30/16? And if this is all true, could it be expected that if the market corrects again 10-15%, there would be another potential spike from these current levels to ____ ? Feel free to fill in your guestimmate….

Please enlighten me as to how this huge trading range from 300 to 18 took place…. Thanks for your expertise – loved reading all of your responses to the posters …. Dan

Hi Dan, The charts are reverse split adjusted. UVXY never traded at those levels. This chart https://www.sixfigureinvesting.com/wp-content/uploads/2016/10/Split-vs-Non-split.jpg shows VXX with the upper line being reverse split adjusted and the lower one showing the actual traded values over time. UVXY’s chart would look similar – only worse…

Yes, contango caused all this damage. A 95% drop in less than a year is on the high side, but pretty much typical. Hence all the reverse splits (see https://www.sixfigureinvesting.com/2016/06/monthly-yearly-decay-rates-contago-losses-vxx-uvxy-vxx-vixy/ and https://www.sixfigureinvesting.com/2014/01/uvxy-reverse-split/ )

A general market correction in the 10 to 15% range would probably cause UVXY to go up around 3 to 4 times its value right before the spike. Impressive, but only if your timing is great–otherwise contango eats your lunch.

Vance

Hi Vance,

As I am a newcomer to UVXY and it’s workings, what is the downside after a spike occurs, with perhaps UVXY spiking 3-4 times its current level to about 50-60, and then buying long term puts or even a straight purchase of SVXY and waiting for the etf to come back down to its long term average and also let contango do the heavy lifting for you ?

Thanks again for your expertise….Dan

Hi Dan,

The challenge to what you propose is knowing when the volatility spike is over. If you’re wrong and the VIX spikes again it can be painful. Not too much pain with the puts, but pretty bad with a SVXY position.

— Vance

Hi Vance or anyone that can enlighten me. My thoughts are we will get a 5-10% correction by 27th. I bought some SEP 30 19.50 calls on the 21st and averaged down with some more on the 22nd. Current position is down 64.12%. My question is where can we find a simulator for the price of UVXY if the S&P moves a certain percentage. Is there a simulator out there? I also was prepared to lose around 50% of my investment but it moved so quickly with the S&P not having a huge up move over the last few days and only a small fraction down today. Just trying to figure out how it will move given certain daily moves in the S&P and when is a good time to exit or reenter. Thanks again.

Hi Richard, There are a lot of moving parts between the S&P and the price of UVXY. Historically the average VIX % move is about -4.7X of the SPX, but there is a wide distribution https://www.sixfigureinvesting.com/2012/11/how-much-should-we-expect-the-vix-to-move/ . On average the VIX futures that comprise UVXY move about .45 of the VIX move, but again there is a wide distribution. Since UVXY is 2X leverages that gives an average .90 % move. If VIX futures are in contango that drags UVXY down around 20% per month https://www.sixfigureinvesting.com/2016/06/monthly-yearly-decay-rates-contago-losses-vxx-uvxy-vxx-vixy/ Finally the volatility of volatility impacts UVXY, dragging it down significantly if volatility is bouncing up and down.

Overall, I don’t see how this will help you with timing. You either are right calling the correction or you will likely have a total loss.

Hi Vance,

I think I understand the structure of these 2-3x leveraged funds, like UVXY, VXX, etc., that have built in contango effects that ultimately drive the value of the asset towards 0. So, why couldn’t I just go out say 1 to 2 years and buy a deep in the money put with very little premium and check my account a year or two from now and capture all the downside these assets have? if a split occurs, it should be accounted for on my options. To me, it seems like there is no way to lose over a long period of time. Am I missing something?

Thanks.

Hi Danny, This is a trade a lot of people like. The premium you pay for these puts is pretty high, so the price of the fund has to go significantly below the strike price before you even break even–and your profit is limited because the fund price can’t go below zero. Even with all that I think people have been profitable with this strategy. The main risk is a bear market. They aren’t short term situations and these funds will get a tremendous boost when that happens (and it will at some point). In that case these puts will likely expire worthless.

Hi Vance – Hope you are doing well. I have a general question about options calendar but will ask in the context of UVXY since it is more relevant that way. How exactly do I figure out when options for a particular expiration will become available to trade in the market? For example, as of 9/16/2016, UVXY has a Mar 2017 expiration contract but I’m interested in the Apr 2017 or May 2017 contracts. How do I find out when these options contracts will be ‘live’? Is such a calendar published on the CBOE website? I tried looking at a few places but had no luck. Thank you.

Hi rttrader, It looks like these two resources might be helpful: http://www.cboe.com/products/leaps.aspx

http://www.cboe.com/tradtool/strikepricecode.aspx

Vance

UVXY – Day trading success means moving your money back to cash each day. I made silly money last Christmas, went long, average down and ended up loosing 75% of my life savings during the last split. There is money to be made if you move to cash at the end of the trading day. I’ve made $2+ a share holding overnight before, but I’ve lost more. There is another name for holding UVXY overnight, it’s called gambling. SVXY is

a great option to always be in the money. When UVXY goes down SVXY goes up. Even after loosing so much, now I know what I’m doing it’s a happy trade. Oh, and it beats working for a living! 🙂

I am just getting into trading aND many have said to start with UVXY. But I have no idea what the company is, and I’ve been reading about it for over a hr now lol Can anyone explain what it sells or how it works for someone like myself ? Thanks much

Hi Steve, UVXY is not a company. They don’t make anything. People have lost a TON of money on it over the years. It’s an Exchange Traded Product that is a 2X leveaged tracker of VIX futures. In my opinion this is not a good place for anyone to start trading.

Thanks for the info. What are some good company for a beginner to start trading with in Canada ? Thanks for the reply Vance.

I read these post and people speak of purchasing UVXY for $10, $14 etc. Yet when I look at the UVXY chart, I never see a price lower than $16.80, which occurred September 7th, 2016. Are we talking about different products, what am I missing? I understand there have been 5 reverse splits that supposedly kept value the same, yet increased the unit price, do the charts show this? Somebody who only checks 10 day charts for bottoms, could be severely mislead, no?

Hi Joch, The charts are reverse split adjusted, so they don’t reflect the past values that the ETP actually traded at. You’re right, people that only look at short time frames can draw the wrong conclusions. With UVXY they will rapidly learn their lesson.

So let me see if I get this UVXY. 1.The chart can’t be used to predict future performance because it has been adjusted at least 5 times. 2. More likely than not, UVXY always goes to zero. 3.The many reverse splits are the only reason this is not now sitting zero.

Correct on all 3. For #1 your context is a short term chart, a longer term chart would show UVXY as a perennial loser.

I would argue he is incorrect on all three.

Nice discussion here, though. Thanks.

This is a great article to explain UVXY pitfalls- I used to buy and hold and watch it drift down. This year, I waited for a run up in the market, than bought it about 2 days before brexit. Made a buck a share and got out. I will also buy it when the market has had a great run but I expect a pullback. Just yesterday I bought in when it was at 19.65- (dow up 80 ish- then the market turned and went down in the afternoon. I had an auto sell set up at 22. It hit that briefly and I made $2.35 per share in about a 3 hour period. But if you do this, put in sell orders for the gain or loss you will accept, ( I had to because I was at work). Later in the day it went back to 21 pretty quickly- she moves like a butterfly and stings like a bee. If you carefully trade it, you can make some good fast gains. But if you hold it watch out.

Friday UVXY opened at $20.35- fell to $19.25 before noon- rose to $22.21 by 2pm- closed at $20.83. That’s a serious swing. – you have robe nimble! Trading at the wrong time would have lost a buck a share- buying at the low and selling at the high got you $3 per share- holding netted you 50 cents per share, which you’ll probably lose on Monday.

Hi Vance – I was doing some basic math on historical NAV for UVXY and was very surprised when I realized this: The NAVs per share on 10/3/2011 and 10/4/2011 were 2,016,650 and 2,400,000 respectively. I checked a few times to confirm these were ‘per share’ values. I don’t know if you have an opinion on this, but what was proshares thinking!?! What kind of a retail investor (or institutional) would want to buy shares at that price? Why would proshares price it this way, and preclude themselves from a majority of the prospective market?

Hi rttrader12, UVXY’s inception was a lot of reverse splits ago. It’s inception price was $40 per share. The NAV you came up for was the adjusted price that accounts for all the reverse split multiplers and applies it to the inception price. Another way to look at it is if Proshares had not reverse split UVXY it would now be trading at $ 0.0000167 per share.

Understood. Very simple answer. Thank you.

Hello Mr. Harwood, just like some other posts let me wish I had seen this article beforehand. I started buying few days after Brexit for $10.49 and every few days afterwards as well to average out when UVXY would go down more than 7-8%. Now I have over 9,000 shares and average cost is$8.14 (25% down as per friday closing). Would it be a good strategy, 1. to hold for say 6 months and hope for turn around; 2. Put more and bring the average down to say $7.50 and wait; 3. cut my loses and move on?

I understand Stock market at its highest may call for some kind of correction sooner or later and hence at least break me even in future. I don’t mind waiting even more if needed. While I understand I can’t hold you for it but what would be your suggestion? Appreciate that.

Typically UVXY goes down around 10% per month if there is not a volatility spike, that would leave you down another 50% from where you are now. I suggest you figure out the maximum losses you are willing to take–because if you stay long you stand a very good chance of losing all your investment. Of course if a volatility spike occurs soon you might recover and make some money–but what are the chances? Volatility spikes are notoriously hard to predict. One strategy is to sell some now, and then wait a bit before selling on the rest. That way there is some positive news either way–either you didn’t take as much loss as you would have, or at least you had some position if UVYX goes back up.

Thank you very much.. I will do as much reading on all these positions as I can before making another move. I’m gonna hold my position for a few weeks to see how it shakes out but If i can get a quick bump I may exit.

Mr. Harwood.. Now that i’ve purchased 6k shares yesterday without reading this article. How long would you say i give them to see if I can make a piece of change in a quick downturn. I have a stomach of steel and can accept the fact i’m an idiot without beating myself up when things go wrong… 🙂

Hi John,

My suggestion would be to decide now how much of a loss you are willing to take before you exit. You should plan on decay of at least 10% per month if your hoped for downturn does not materialize. Relatively minor corrections (e.g, 5 to 10%) tend to pump VUXY up by a factor of 1.5x to 3x, big corrections by a factor of 3x to 4.5x, financial crisis (2008-2009) factor of 12X. If you hold on for a year and a half with no downturns even another financial crisis will only get you back to break even.

Hi Vance, I purchased uvxy on June 29 @ $10 (250 units), felt that the brexit sell off might resume, however its a approx $7 today, looking to average just if there is a short term spike in the VIX so i can break even. Looking to pickup 200 units at $7. Or should i cut my losses which im down 30% 🙁

Hi Taha,

It’s always tough to take your losses because there’s always the fear that the market will reverse right after you sell. However holding onto (or adding to) a UVXY position for more than a couple of days is always a risky decision if the market is rallying.

Getting back to even is one of the worst goals in investing. It’s much better to ask the question of whether your position / planned positions are more or less likely to be profitable moving forward in the time frame you have in mind. Look for situations where you think the odds are in your favor.

Vance

I theory, if one worried the market would drop in a couple months along with an increase in VIX, would it be a better idea to by UVXY calls as opposed to buying UVXY shares? I know the calls would suffer from time decay, but seeing as UVXY isn’t a good buy and hold, are the options a better hedge on long bets?

The markets are pretty good at making these two approaches financially equivalent. Options have a built in kill switch when they expire, so emotionally they are generally easier to deal with than shares if you’re wrong. The counter example being UVXY spiking right after they expire.

hypothetically, lets say I could see the future and knew that over the next year or 2 we’d see an ’08 like crash in the markets, if not, worse. would UVXY be a good buy or is there a better option. I know it seems like a ridiculous question and ive read some of your posts about UVXY being bad in the long run. but would it work in this hypothetical scenario? if im looking to “win the lottery”. is there another option that could provide me with that level of return without the steady decrease in value?

My backtests show that UVXY would have climbed about 8X in the 2008 crash. UVXY typically declines around 10% per month (https://www.sixfigureinvesting.com/2016/06/monthly-yearly-decay-rates-contago-losses-vxx-uvxy-vxx-vixy/). If you invest now and the 2008 event happens two years from now you about break even. If it happens a year from now you might double your money. In my opinion XVZ would be a better choice, it would have increased about 2.5X in the 2008 crash, but it does not suffer as much from decay. Beware, it still decays plenty.

Vance

Hi Vance, just an amateur who has stumbled upon this post in the most recent correction, but I’m curious…if you bought UVXY calls/went long at the “right” time (let’s say the recession reaches its bottom 6 months from now and the DJI/S&P 500 bottoms from Feb 2020 highs by 20-50%), how much would UVXY increase by? And how much would you stand to make if you bought it right now?

Hi Han-Gwon,

A partial answer to your question. https://twitter.com/6_Figure_Invest/status/1236015815427686400 The answer to your full question would take quite a bit of time, so it would fall into the category of consulting for pay if you really wanted an answer, probably $300 worth. If you’re that interested send me an email at [email protected]

Perhaps this is a dumb question but I am not knowledgeable about this. Is UVXY a buy and hold candidate or must it be traded to receive a benefit?

Hi Mark, Definitely not buy & hold. Tends to lose 4% to 7% of its value per month.

Then it is a good candidate for short, steady income. Only thing need to look for is the spike. Or, you dont recommend shorting it.

Below is my day trading idea. ( not yet used). What do you think about it?

“If market is green and no bad news for the morning, and not expecting any report”, then TVIX /UVXY is expected to go down” – So, in that condition shorting is a good idea.If market is red, and expecting few reports, then buy them”

Another question is Does the Shorting TVIX is same as long in XIV”?

Volatility in Oil, Gas, Gold will affect VIX as well?

This is a great article to explain UVXY pitfalls- I used to buy and hold and watch it drift down. This year, I waited for a run up in the market, than bought it about 2 days before brexit. Made a buck a share and got out. I will also buy it when the market has had a great run but I expect a pullback. Just yesterday I bought in when it was at 19.65- (dow up 80 ish- then the market turned and went down in the afternoon. I had an auto sell set up at 22. It hit that briefly and I made $2.35 per share in about a 3 hour period. But if you do this, put in sell orders for the gain or loss you will accept, ( I had to because I was at work). Later in the day it went back to 21 pretty quickly- she moves like a butterfly and stings like a bee. If you carefully trade it, you can make some good fast gains. But if you hold it watch out.

Hello Vance,

what do you think about holding a short position in UVXY if you are able to find the shares to do so?

Hi Gregory, Danger, Danger. Honestly review how you’d feel if UVXY went up to $80. Not at all unreasonable if market goes into a correction. Small position size (keep margin for 6X+ rise) and stomach of steel required.

— Vance

Hello and thank you for the article – I’ve found this to be one of the better UVXY educational forums on the internet. I have a question regarding a holding of UVXY. Over the past month – I purchased 200 shares of UVXY at an average price of $14.44. To date I am down about 12% on this stock (which is average loss for contango) but can you help me understand how this will continue to go down over time – regardless of what happens in the general market. I guess my question is in viewing the 12M chart with a 52w high of $87 – will my 200 shares continue to diminish indefinitely even if the UVXY stock price returns to $87/share?

I have had about a month and have lost consistently with increasing value of stock market – but if I am planning on a pullback inside of 6 months is the best stock to have or should I be doing a general put options on DJIA futures?

Thanks again –

Brandon

Hi Brandon, Unless the market has a sharp correction or goes into a bear market it’s unlikely UVXY will ever see $87 per share again (unless reverse splits get it there). In my opinion being long UVXY for more than a few days in the hopes of a volatility spike is a bad idea–unless you’re actually in the midst of a volatility spike. Puts aren’t much better, they have heavy time decay and if your strikes are out of the money it can take a substantial correction before you even make a profit. If you feel you must take a long volatility position with the view that a pull back is coming you might consider VQT, VQTS, or XVZ. These are funds that don’t suffer contango losses anywhere near UVXY, but should spike up if volatility really does a sustained jump. On the downside–these funds won’t jump as much as UVXY either.

— Vance

Vance Thanks for the great Article I found things to good to be true I have been shorting The UVXY every day for the past month and I have been making a great return There is an average 7% rate for shorting the stock but it’s nothing compared with the contango loss on this stock,I have called 2 friends and advise them to do the same but there Brooker inform them there is no available stock to short on this security Imeasures I’m doing something wrong here or just lucky, what’s the downside of selling short and holding long term since the contango loss is huge I would like your advice .

Thank you

Hi John, Shorting UVXY is a crowded trade. Sometimes you can find shares to short by calling other brokers. Be carefully, especially with your position sizes, UVXY can reverse with a vengeance. Please read: https://www.sixfigureinvesting.com/2016/10/is-shorting-uvxy-tvix-vxx-the-perfect-trade/

Brandon, did you hold through June 24th/27th???

Dear Vance, I had sold naked puts on UVXY due to high premiums. The chart showed UVXY had not been below 25 for over 6 months and so I sold puts for $20. I am now assigned 2k shares which I have averaged down to $18 rate now. I did not completely understand how UVXY was tradeded until I saw this article now. I have sold few small Covered Calls but based on your analysis, UVXY prices continues to deteriorate (12.5%/yr) unless there is big crash. Do you have recommendation how I can fix my position as I may blow my whole account due to contango loss . Thank you for this article as it was a huge help as I won’t avg down anymore. I had no clue that this ETF was was not buy and hold type of instrument.

thanks again and looking forward to some advise,

New Investor – Kal 🙂

Hi Kal,

Sorry to hear about your pain with UVXY. As you have discovered being long UVXY can be a difficult situation. Regarding your position, it’s always possible the market will go into a correction and UVXY will recover temporarily, but unless this happens soon you will likely never get back to your original account value. Clearly continuing holding onto to UVXY over the long run is a very bad idea. Just selling will get the pain over quickly, but there is always the fear that you will sell right before a major volatility spike. Another approach would be sell some significant percentage now, and then wait a day or two before selling the rest. The advantage of this is that no matter which way the market goes you have a positive story (either you at least sold some before it dropped some more, or you waited a little until the price recovered a bit). Another approach would be to do more covered call writing–this collects a little premium at the risk of experiencing more principal loses. No good choices. Sorry.

Best Regards,

Vance

Hi Mr. Harwood, I am planning to sell a spread option call and take credit. As normally UVXY goes down, we potentially make money by expiration unless the markets crash, right? I know, we loose money in case of drastic down for markets, but that only happen rarely. Please advise me.

I am not Mr. Harwood but I have been selling the call spread. Yes, most likely it will expire worthless. I usually do 20% out of money with expiration date being at least 2 months out. In case your spread goes in-the-money, you can always roll the position to the next months. It will most likely expire worthless the following months unless we have like 2008 type of crash. Even in 2008 when entire year was bear market, there were more days with contango than backwardation.

Thank you Endoherodon. My plan is pretty close to yours! I would sell/ buy 20% out of money calls with $4 spread but with expiration in about a month for the credit of ~$0.50. For two months expiration the credit is little higher but too long, right?

Not only the credit is higher, but it is safer. The probability is much higher for your spread expire worthless if it is 2 months out than only one month out. Also, you can use laddering technique rather than put all your money in one spread. For instance, you can sell spread in May for options expiring in July and sell spread in June for options expiring in August and so forth. Also, you can have multiple spreads with different strike price if UVXY keeps moving upward. So any market downturn in one particular month has less impact on your entire account. It is just one way to reduce the risk that can blow up your account. Good Luck!

Great! perfectly makes sense and thank you for your response. Usually, how much leg spread wide (leg1-leg2 strike) do you prefer? Just checking whether my $4 wide with ~$0.50 credit makes sense.

I usually use $5 wide, like 20/25, 35/40, or 40/45. There are a lot more open interests at numbers ending with either 0 or 5. You have to look at the open interests numbers too.

Just learned about SVXY which is quite opposite to UVXY. Isn’t selling svxy naked puts 30% out of money a better idea rather?

UVXY is 2 times leveraged and SVXY is not leveraged. I’ve never traded SVXY but people going long on SVXY. I feel SVXY is not as predictable as UVXY.

Hi Guys , sorry for my english .. I was contemplating ( december 23 butterfly spread) , $1.5 out of the money both way’s) shorting 9 puts and covering with 8.5 and shorting 12 call’s and covering 12.5. When I notice that the call’s ( $1.5 out of the money) are exacly 2x more expensive then the put’s ! What im I not seing here ?? Robert

Hi Robert, The cause for this is a variant of what’s called the “volatility smile”. The standard Black & Scholes option pricing model assumes that every option strike price should consider the volatility of the underlying security is the same for all strikes. This assumed volatility shows up as the implied volatility on options chains, or “IV”. It turns out this Black & Scholes assumption is bad because as people found out in the 1987 crash stocks can drop a lot faster than they go up. For normal long equities, e.g., SPY, this smile shows up as higher IVs for options as you go lower in strikes. Since UVXY goes up when the market goes down its IV goes up with higher strike prices. For your trade the $12 calls have an IV of 115 and your $9 calls have an IV of 90. Higher IVs get reflected in higher premiums.

Vance

not understanding UVXY, i bought 50 shares at $25.70. Should I dump it or buy more at 13.07??

What were you expecting UVXY to do? It tends to drop rapidly unless market has major correction or bear market?

I guess I was expecting bear market without such a significant drop. The question is what to do now

Holding UVXY is brutal unless you call a volatility upswing perfectly. My opinion is that there is probably around a 80% chance of a continued market upswing the next two weeks.

— Vance

looks like you were right on this one 🙂

Never go long or average down on UVXY with a speculation of market crash. The market crash happens only rarely and the market tends to continue moving up or going sideway all the time. UVXY can crash even when the market goes sideway. You were already wrong on market crash. You will never get the market timing right. Even if you win lottery by timing the crash, you won’t win the lottery twice.

if the market crashes this year, will uvxy shoot up in value

i think you went the wrong way on log(x) of your values in the graph

You’ll have to say more. I don’t understand what you’re saying. The value of UVXY has declined dramatically over time. The chart shows what the split adjusted price would have been.

I have noticed recently that the left tails on the graph of the ratio of daily UVXY% to S&P 500% moves have been getting fatter. I’m assuming that you are using end of day data in your graph. Using today’s close, the correlation is -87! I haven’t actually plotted the data, but I’ve been acutely aware of the phenomenon. It would be interesting to do an overlay of the most current data with your graph. I know that UVXY is DESIGNED to decay over time, but the move since February and especially that past few months has even caught me by surprise. The contango has been very steep, but I feel that others factors may be at play. Any thoughts?

Yes, I do use end of day data for my charts. With regards to UVXY’s behaviour, I don’t think anything fundamental has changed. Contango if anything has been lower than normal. There have been some big overall shifts in the VIX futures term structure where whole curve moves up or down pretty much in unison. This drives big changes in UVXY.

— Vance

Maybe the slight flattening of the term structure is having a significant impact on the 2X long volatility products. Having the second month contract moving more in unison with front month will lead to faster decay initially rather than a delayed effect in steeper contango structures. This small change can be quite significant for daily leveraged ETPs. Plot the data for just this year and overlay it on your graph above. My guess is the distribution will be flatter with a more negative skew.

Mr. Hardwood…I know I’m probably in over my head here as a pretty basic investor (I usually just write various options on stocks like TWTR, YELP, etc.), but I recently started looking into ETF options trading and it looked pretty lucrative especially with the 7 ot 14 day premiums offered for call sales. However, after reading through your article and the comments below, it’s quickly becoming (seemingly) too complicated.

If you could lay it out in lamens terms for me, I would greatly appreciate it. Basically, I’m trying to figure out how much it will actually cost me to sell a call on the ETF. Let’s say I buy 100 UVXY at $36 and sell a call for $38 7 days from now for a premium of $1.5 per share. In 7 days, the price of UVXY is above $38 and my shares are taken from me. So I’ve made $200 plus $150 on the premium for a total of $350. Will I still be charged the management fee, and the other expense ratio fee, as well as any other fees? Are there any other weird costs involved? What are the main risks of this simple transaction? Just trying to wrap my head around this process and keep it as simple as possible. Like I said, I’m a pretty basic investor. Please advise on this issue and provide any recommendations….thank you!

I apologize for “Mr. Hardwood”…phone aurocorrected. Meant Mr. Harwood!

Hi Kyle, No problem with the autocorrection, funny..

Regarding covered calls on UVXY the main risk factor is not fees, they are quite small. The main risk is that UVXY usually drops in value. It the market is not going down pretty sharply then UVXY loses value rapidly. For example if drops to 34.5, you haven’t made any money–and if you try this trade that will often be the case.

— Vance

Hi, thanks for your analysis. However, you mentioned that the “contango” effect represents a loss of 7,5% in the NAV of UVXY. I checked the futures differential for May and June and, without considering the leverage, you have a weighted average differential of about 18 – 20% per month (36% – 40% more or less considering leverage). Maybe I´m wrong but can you comment on these figures please?

Hi Sergio, The 7.5% number was low, it should have been 12.5%. I had intended to add the 5% number and the 7.5%, but didn’t. I’ve corrected the post to use 12.5%. Thanks! I used actual UVXY results over the last 2 years and figured the compounded losses from that.

I don’t see where you get your 18% to 20% numbers. If you provide more detail I’ll take a look.

VIXCentral.com shows the daily short term contango, and it rarely goes above 10%. I think VIXCentral uses the formula M2/M1-1 (where M1 is the near month). for their calculation. Since the decrease in futures value is not linear (more like square root of time) and compounding losses the resultant UVXY losses are less than 2X the VIXcentral numbers.

— Vance

Thanks Vance. I hope this sleeping dog lays low for a long time. Short strategies pay handsomely.

Question to premiumRox, What strategy do you use on UVXY?

Thanks

UVXY has not been below 24.34 for during the past two years. Why not sell put credit spreads with the short put strike around delta -.20 and ~ 3:1 risk/reward?

That is good news because I am currently selling puts and calls on UVXY at the strike price of around $26-27 because of the above average premium. Does anyone else do this and can anyone tell me the pros and cons. Thanks

Mr Harwood, will we have notice before UVXY splits? And what if we are in a call or put obligation position. what happens?

Thank you very much for your help on this.

Proshares will announce the reverse split a week or two before the event. I use Google alerts to flag those for me. For information on the impact of the reverse split on options see https://www.sixfigureinvesting.com/2014/01/uvxy-reverse-split/

— Vance

Mr Harwood, can you share with us your take on the recent SEC ruling that may cause them to shut down the ETF, UVXY? Thank you

Hi Jim,

Just took a quick look at it. A lot of material there to sort through. Just guessing it looks to me like it might impact the ETNs (e.g, TVIX) more than the ETFs. UVXY’s exposure is likely concentrated on their rebalancing requirements. If there is a big up day then ProShares has to buy a lot more VIX futures to keep the leverage at 2X. Unless they change the margin requirements for VIX futures I suspect they will be ok.

— Vance

Can UVXY be cancelled at any moment during a trading day without any notice and traders can lose all their position regardless if the position is a winning or losing position?

It’s my understanding that if UVXY was terminated that the assets held by the fund would be liquidated and the resultant funds distributed to the shareholders. That payout would be close to the NAV of the fund, which is typically close to the currently traded prices.

— Vance

Merry Christmas to you all and let’s hope for a great and prosperous new year for us all.

“Happy New Years to you all” Mr Harwood, am I missing something or does the ETF “UVXY” still have the best option premium of any ETF ?

And do you think it’s still ok to sell options on it going into the new year?

Hi Jim, UVXY’s premiums are high for a reason. There’s a lot of risk there. Take a look at UVXY in Aug/Sept 2015 and ask yourself how much money you would have lost if you were short the calls starting in early August. Any short volatility position must include a exit plan to limit losses.

— Vance

Mr Harwood, on UVXY, I don’t mind it going low but if the market keeps going up and UVXY keeps going down, just how far could it go?

Thank you so much for your support on our questions.

Hi Jim, Over time UVXY will continue dropping, its structure guarantees that. The only thing keeping it in a reasonable trading range is reverse splits. A share of UVXY bought 4-Oct-11 for $40 would now be worth $0.0033.

— Vance

Hi Vance,

do you think short-selling the UVXY is a secure investment, provided you keep your positions low and can sit out spikes to the upside in times of crashes? Maybe there is something I don’t see, but could short-selling the UVXY be a ” free lunch”? I know there shouldn’t be any Free Lunches, so what’s the catch here? Interesting would be a back-test to see how the UVXY would have reacted in the financial crisis 2008/09. Thanks, Pat

Mr Harwood, hello and happy new year to you all. Question, are there more ETF’s that work like, UVXY & VXX? If so can you pease list some of them or tell us where we can go find them. Thank you so much for expertise on all of this.

Hi Jim, I have a list of all US ETFs/ETNs that somehow use VIX futures here: https://www.sixfigureinvesting.com/2010/12/volatility-tickers/

— Vance

Mr Harwood, can you please tell me the difference between tickers, VXX and VIX and why do the weekly options on VIX expire in the middle of the weeks vs on fridays?

Also do they both have semilar functions?

I want to trade weekly options on both and need to know the difference.

Thank you very much

Hi Jim, I suggestion you read these posts: https://www.sixfigureinvesting.com/2014/07/how-does-the-vix-index-work/ https://www.sixfigureinvesting.com/2013/04/how-does-vxx-work/ and https://www.sixfigureinvesting.com/2010/01/trading-vix-options/

VIX and VXX options are both volatility options. VXX tracks the VIX’s moves at around 50% (a 1% move in VIX will give approximately a 0.5% move on VXX). VIX options track the VIX in a time variable fashion. If they have many months to expiration the tracking will be in the 20% to 30% range. This tracking becomes much closer to the VIX index’s moves as the options approach expiration.

— Vance

Dear Vance, I’m thinking to buy just 1,000 dollar of UVXY. My question is: how much can I loose at all? 1000 dollar? right? they cannot ask me more? thanks a lot for your reply! really appreciated! Concetto

Hi Concetto, If you are buying your maximum loss is your initial investment, so yes $1000 is the most you can lose.

Best Regards, Vance

Hi Jay, UVXY has had two big reverse splits in the last two years. Checkout the unadjusted history on Yahoo. Traded at $8 in May 2015. Figure UVXY declining at least 4% per month. For more https://www.sixfigureinvesting.com/2014/01/uvxy-reverse-split/

— Vance